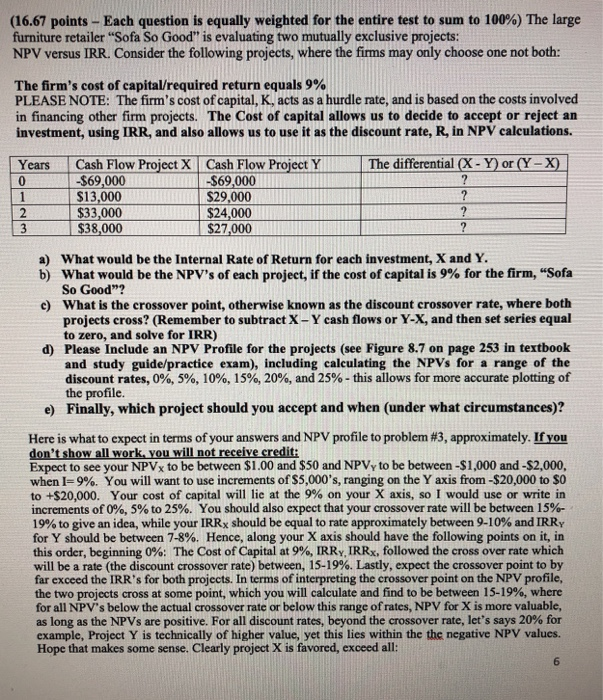

(16.67 points-Each question is equally weighted for the entire test to sum to 100%) The large furniture retailer "Sofa So Good" is evaluating two mutually exclusive projects: NPV versus IRR. Consider the following projects, where the firms may only choose one not both: The firm's cost of capital/required return equals 9% PLEASE NOTE: The firm's cost of capital, K, acts as a hurdle rate, and is based on the costs involved in financing other firm projects. The Cost of capital allows us to decide to accept or reject an investment, using IRR, and also allows us to use it as the discount rate, R, in NPV calculations. Years Cash Flow Project X Cash Flow Project YThe differential X- $69,000 $29,000 $24,000 $27,000 or (Y-X) $69,000 $13,000 S33,000 $38,000 a) What would be the Internal Rate of Return for each investment, X and Y b) what would be the NPV's of each project, if the cost of capital is 9% for the firm, "Sofa So Good"? e) What is the crossover point, otherwise known as the discount crossover rate, where both projects cross? (Remember to subtract X-Y cash flows or Y-X, and then set series equal to zero, and solve for IRR) d) Please Include an NPV Profile for the projects (see Figure 8.7 on page 253 in textboolk and study guide/practice exam), including calculating the NPVs for a range of the discount rates, 0%, 5%, 10%, 15%, 20%, and 25%-this allows for more accurate plotting of the profile. e) Finally, which project should you accept and when (under what circumstances)? Here is what to expect in terms of your answers and NPV profile to problem #3, approximately. If you don't show all work, you will not receive credit: Expect to see your NPVx to be between $1.00 and $50 and NPVy to be between-$1,000 and-$2,000 when 1-9%. You will want to use increments of $5,000's, ranging on the Y axis from-$20,000 to $0 to +$20,000. Your cost of capital will lie at the 9% on your X axis, so I would use or write increments of 096, 5% to 25%. You should also expect that your crossover rate will be between 15%- 19% to give an idea, while your IRRx should be equal to rate approximately between 9-10% and IRR for Y should be between 7-8%. Hence, along your X axis should have the following points on it, in this order, beginning 096: The Cost of Capital at 9%, IRRYIRRx, followed the cross over rate which will be a rate (the discount crossover rate) between, 15-19%. Lastly, expect the crossover point to by far exceed the IRR's for both projects. In terms of interpreting the crossover point on the NPV profile the two projects cross at some point, which you will calculate and find to be between 15-19%, where for all NPV's below the actual crossover rate or below this range of rates, NPV for X is more valuable, s the NPVs are positive. For all discount rates, beyond the crossover rate, let's says 20% for example, Project Y is technically of higher value, yet this lies within the the negative NPV values. Hope that makes some sense. Clearly project X is favored, exceed all: 6 (16.67 points-Each question is equally weighted for the entire test to sum to 100%) The large furniture retailer "Sofa So Good" is evaluating two mutually exclusive projects: NPV versus IRR. Consider the following projects, where the firms may only choose one not both: The firm's cost of capital/required return equals 9% PLEASE NOTE: The firm's cost of capital, K, acts as a hurdle rate, and is based on the costs involved in financing other firm projects. The Cost of capital allows us to decide to accept or reject an investment, using IRR, and also allows us to use it as the discount rate, R, in NPV calculations. Years Cash Flow Project X Cash Flow Project YThe differential X- $69,000 $29,000 $24,000 $27,000 or (Y-X) $69,000 $13,000 S33,000 $38,000 a) What would be the Internal Rate of Return for each investment, X and Y b) what would be the NPV's of each project, if the cost of capital is 9% for the firm, "Sofa So Good"? e) What is the crossover point, otherwise known as the discount crossover rate, where both projects cross? (Remember to subtract X-Y cash flows or Y-X, and then set series equal to zero, and solve for IRR) d) Please Include an NPV Profile for the projects (see Figure 8.7 on page 253 in textboolk and study guide/practice exam), including calculating the NPVs for a range of the discount rates, 0%, 5%, 10%, 15%, 20%, and 25%-this allows for more accurate plotting of the profile. e) Finally, which project should you accept and when (under what circumstances)? Here is what to expect in terms of your answers and NPV profile to problem #3, approximately. If you don't show all work, you will not receive credit: Expect to see your NPVx to be between $1.00 and $50 and NPVy to be between-$1,000 and-$2,000 when 1-9%. You will want to use increments of $5,000's, ranging on the Y axis from-$20,000 to $0 to +$20,000. Your cost of capital will lie at the 9% on your X axis, so I would use or write increments of 096, 5% to 25%. You should also expect that your crossover rate will be between 15%- 19% to give an idea, while your IRRx should be equal to rate approximately between 9-10% and IRR for Y should be between 7-8%. Hence, along your X axis should have the following points on it, in this order, beginning 096: The Cost of Capital at 9%, IRRYIRRx, followed the cross over rate which will be a rate (the discount crossover rate) between, 15-19%. Lastly, expect the crossover point to by far exceed the IRR's for both projects. In terms of interpreting the crossover point on the NPV profile the two projects cross at some point, which you will calculate and find to be between 15-19%, where for all NPV's below the actual crossover rate or below this range of rates, NPV for X is more valuable, s the NPVs are positive. For all discount rates, beyond the crossover rate, let's says 20% for example, Project Y is technically of higher value, yet this lies within the the negative NPV values. Hope that makes some sense. Clearly project X is favored, exceed all: 6