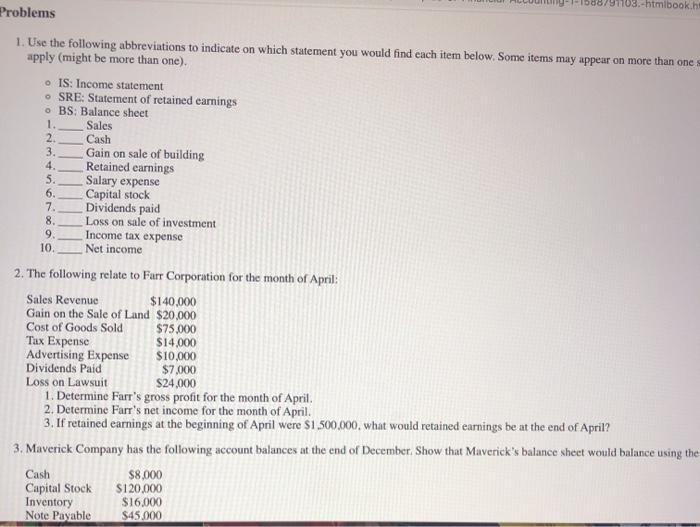

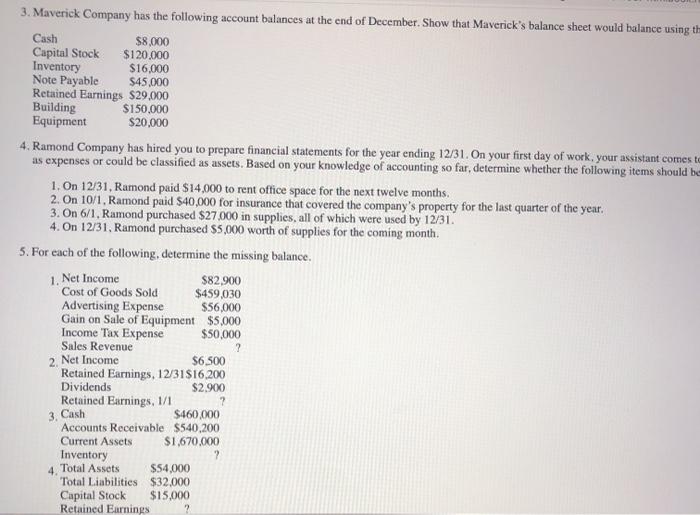

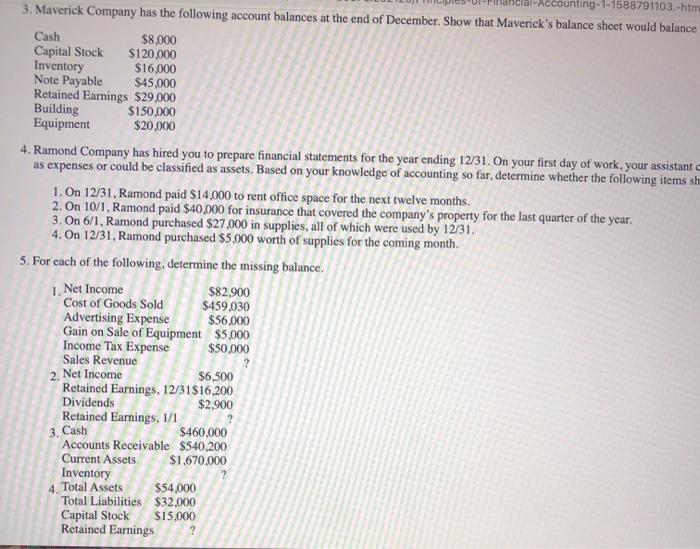

16887970s.-htmibook.hu 2. 3 4. Problems 1. Use the following abbreviations to indicate on which statement you would find cach item below. Some items may appear on more than one apply (might be more than one). IS: Income statement SRE: Statement of retained earnings BS: Balance sheet 1. Sales Cash Gain on sale of building Retained earnings 5. Salary expense 6. Capital stock 7. Dividends paid 8. Loss on sale of investment 9. Income tax expense 10. Net income 2. The following relate to Farr Corporation for the month of April: Sales Revenue $140,000 Gain on the Sale of Land $20,000 Cost of Goods Sold $75,000 Tax Expense $14,000 Advertising Expense $10,000 Dividends Paid $7,000 Loss on Lawsuit $24,000 1. Determine Farr's gross profit for the month of April 2. Determine Farr's net income for the month of April. 3. If retained earnings at the beginning of April were $1.500.000, what would retained earnings be at the end of April? 3. Maverick Company has the following account balances at the end of December. Show that Maverick's balance sheet would balance using the Cash $8,000 Capital Stock S120.000 Inventory $16.000 Note Payable $45.000 3. Maverick Company has the following account balances at the end of December. Show that Maverick's balance sheet would balance using the Cash $8,000 Capital Stock $120,000 Inventory $16,000 Note Payable $45.000 Retained Earnings $29.000 Building $150,000 Equipment $20,000 4. Ramond Company has hired you to prepare financial statements for the year ending 12/31. On your first day of work, your assistant comes te as expenses or could be classified as assets. Based on your knowledge of accounting so far, determine whether the following items should be 1. On 12/31, Ramond paid $14,000 to rent office space for the next twelve months. 2.On 10/1, Ramond paid $40,000 for insurance that covered the company's property for the last quarter of the year. 3. On 6/1, Ramond purchased $27.000 in supplies, all of which were used by 12/31 4. On 12/31, Ramond purchased $5,000 worth of supplies for the coming month 5. For each of the following, determine the missing balance. 1. Net Income $82,900 Cost of Goods Sold $459,030 Advertising Expense $56,000 Gain on Sale of Equipment $5.000 Income Tax Expense $50,000 Sales Revenue ? 2. Net Income $6,500 Retained Earnings, 12/31916,200 Dividends $2.900 Retained Earnings, 1/1 $460,000 Accounts Receivable $540,200 Current Assets $1,670.000 Inventory 4. Total Assets $54,000 Total Liabilities $32,000 Capital Stock $15,000 Retained Earnings 3. Cash Accounting-1-1588791103.-htm 3. Maverick Company has the following account balances at the end of December. Show that Maverick's balance sheet would balance Cash $8,000 Capital Stock $120,000 Inventory $16,000 Note Payable $45,000 Retained Earnings $29,000 Building $150,000 Equipment $20,000 4. Ramond Company has hired you to prepare financial statements for the year ending 12/31. On your first day of work, your assistant as expenses or could be classified as assets. Based on your knowledge of accounting so far, determine whether the following items sh 1. On 12/31, Ramond paid $14,000 to rent office space for the next twelve months. 2. On 10/1, Ramond paid $40,000 for insurance that covered the company's property for the last quarter of the year. 3. On 6/1, Ramond purchased $27,000 in supplies, all of which were used by 12/31 4. On 12/31, Ramond purchased $5,000 worth of supplies for the coming month. 5. For each of the following, determine the missing balance. 1. Net Income $82.900 Cost of Goods Sold $459,030 Advertising Expense $56,000 Gain on Sale of Equipment $5.000 Income Tax Expense $50,000 Sales Revenue 2. Net Income $6,500 Retained Earnings, 12/31516,200 Dividends $2,900 Retained Earnings, 1/1 3. Cash $460,000 Accounts Receivable $540,200 Current Assets $1.670,000 Inventory 4. Total Assets $54,000 Total Liabilities $32,000 Capital Stock $15,000 Retained Earnings