Question

16.Campbell Computing Inc. currently has sales of $1,000,000, and its days sales outstanding is 30 days. The financial manager estimates that offering longer credit

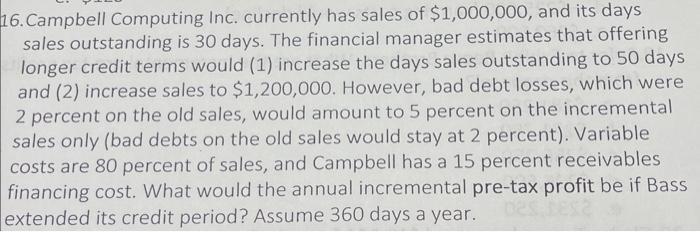

16.Campbell Computing Inc. currently has sales of $1,000,000, and its days sales outstanding is 30 days. The financial manager estimates that offering longer credit terms would (1) increase the days sales outstanding to 50 days and (2) increase sales to $1,200,000. However, bad debt losses, which were 2 percent on the old sales, would amount to 5 percent on the incremental sales only (bad debts on the old sales would stay at 2 percent). Variable costs are 80 percent of sales, and Campbell has a 15 percent receivables financing cost. What would the annual incremental pre-tax profit be if Bass extended its credit period? Assume 360 days a year.

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Calculate the change in accounts receivable due to extended credit terms Change in accounts r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App