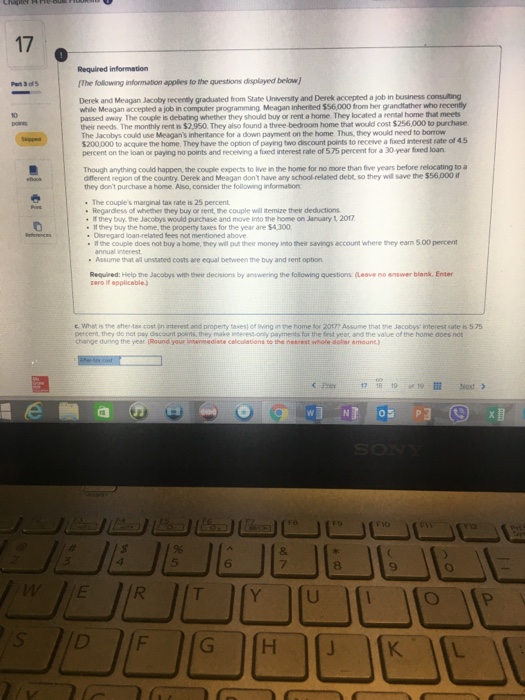

17 0 Required information The following information applies to the questions displayed below Derek and Meagan Jacoby recenty graduated from State University and Derek accepted a job in business consuting while Meagan accepted a job in computer programming Meagan inherited $56,000 from her grandfather who recently passed away The couple is debating whether they should buy or rent a home They located a rental home that meets their needs. The monthly rent s $2,950. They also found a three-bedroom home that would cost $256,000 to purchase The Jacobys could use Meagans inhentance for a down payment on the home Thus, they would need to borroww $200000 to acquire the home. They have the option of paying two discount points to receive a fixed interest rate of 45 percent on the loan or payling no points and receiving a fued interest rate of 575 percent for a 30 year fixed loan Though anything could happen, the couple expects to live in the home for no more than five years before relocating to a dofferent region of the country. Derek and Meagan don't have any school related debt, so they will save the $56,000 if they don't purchase a home. Also, consider the following information The couple's marginal tax rate is 25 percent Regardless of whether they buy or cent, the couple will itemize their deductions If they buy, the Jacobys would purchase and move into the home on January 1, 2017 Ifthey buy the home, the property taxes for the year are $4300 Disregard loan-related fees not mentioned above if the couple does not buy a home, they will put their money into their savings account where they earn 500 percent Assume that all unstated costs are equal beween the buy and rent option Required: Help the Jacobys with their decisions by answering the following questions (Leave no answer blenk. Enter zero if applicable c What is the ahetax cost in interest and property taxes) of living in the home for 20177 Assume that the Jacobys interest rate is 5.75 percent they do not pay discount poknsthey make ieresny payments for the first yeer and the value of the home does not change duning the year lRound your intenmediete celiculiations to the nebrest whole dollar amount C Phe 17 18 19 19 Next 5 6 7 8 9 O IP K IL