Answered step by step

Verified Expert Solution

Question

1 Approved Answer

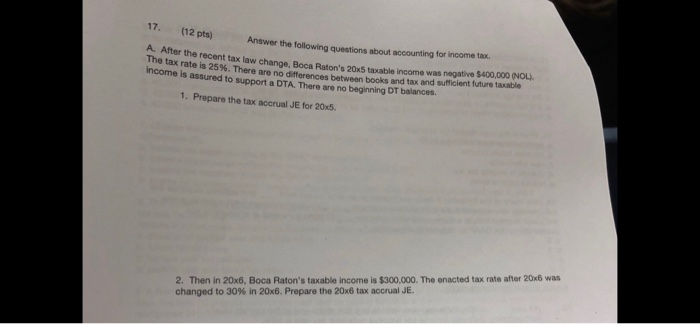

17. (12 pts) Answer the following questions about accounting for income tax. A. After the recent tax law change, Boca Raton's 20x5 taxable income was

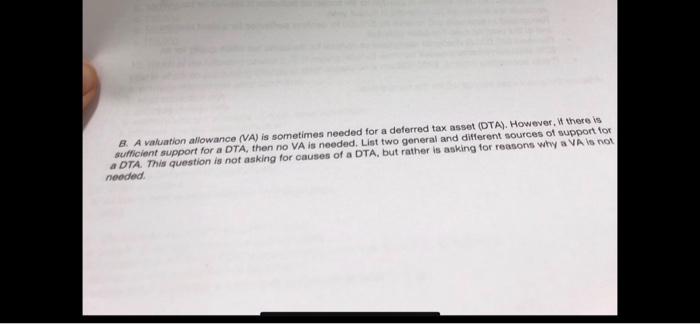

17. (12 pts) Answer the following questions about accounting for income tax. A. After the recent tax law change, Boca Raton's 20x5 taxable income was negve The tax rate is 25%. There are no differences between books and tax and sufficient income is assured to support a DTA. There are no beginning DT balances. 1. Prepare the tax accrual JE for 20x5. 2. Then in 20x6, Boca Raton's taxable income is $300,000. The enacted tax rate after 20x6 was changed to 30% in 20x6. Prepare the 20x6 tax accrual JE. B.. A valuation allowance (VA) is sometimes needed for a deferred tax assetOTA. However, wthere is sufficient support for a DTA, then no VA is needed. List two general and different sources of support tor DTA This question is not asking for causes of a DTA, but rather is asking for reasons why a VA Is not needed

17. (12 pts) Answer the following questions about accounting for income tax. A. After the recent tax law change, Boca Raton's 20x5 taxable income was negve The tax rate is 25%. There are no differences between books and tax and sufficient income is assured to support a DTA. There are no beginning DT balances. 1. Prepare the tax accrual JE for 20x5. 2. Then in 20x6, Boca Raton's taxable income is $300,000. The enacted tax rate after 20x6 was changed to 30% in 20x6. Prepare the 20x6 tax accrual JE. B.. A valuation allowance (VA) is sometimes needed for a deferred tax assetOTA. However, wthere is sufficient support for a DTA, then no VA is needed. List two general and different sources of support tor DTA This question is not asking for causes of a DTA, but rather is asking for reasons why a VA Is not needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started