Answered step by step

Verified Expert Solution

Question

1 Approved Answer

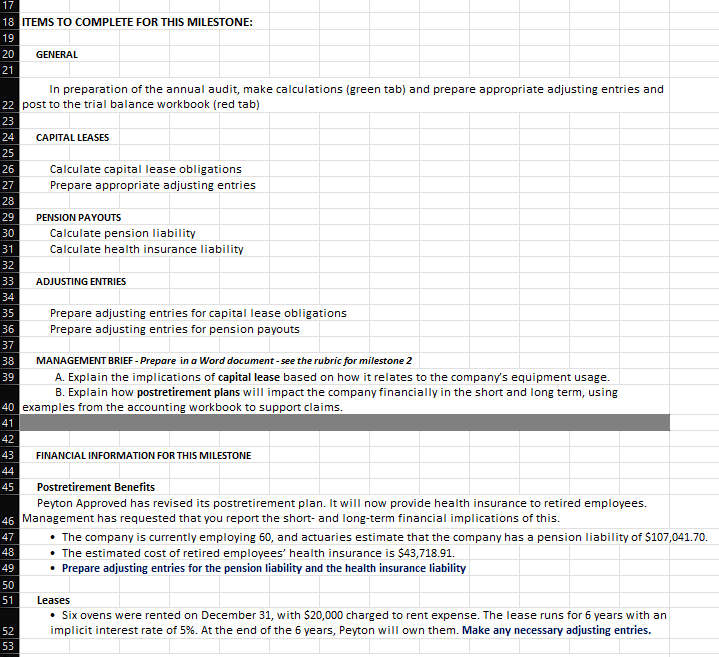

17 18 ITEMS TO COMPLETE FOR THIS MILESTONE: 19 20 GENERAL 21 In preparation of the annual audit, make calculations (green tab) and prepare

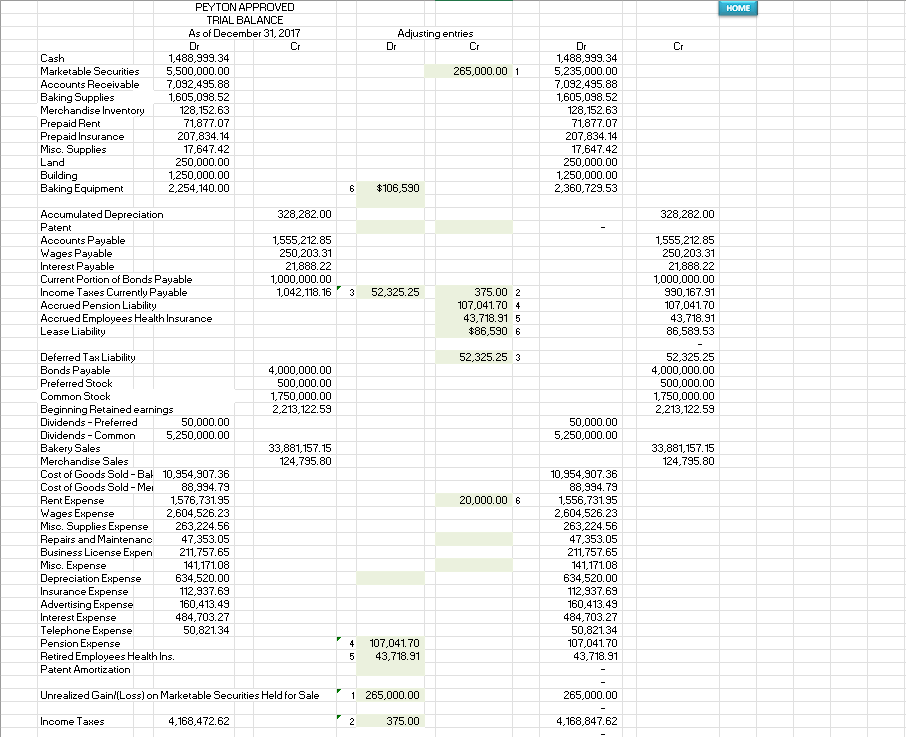

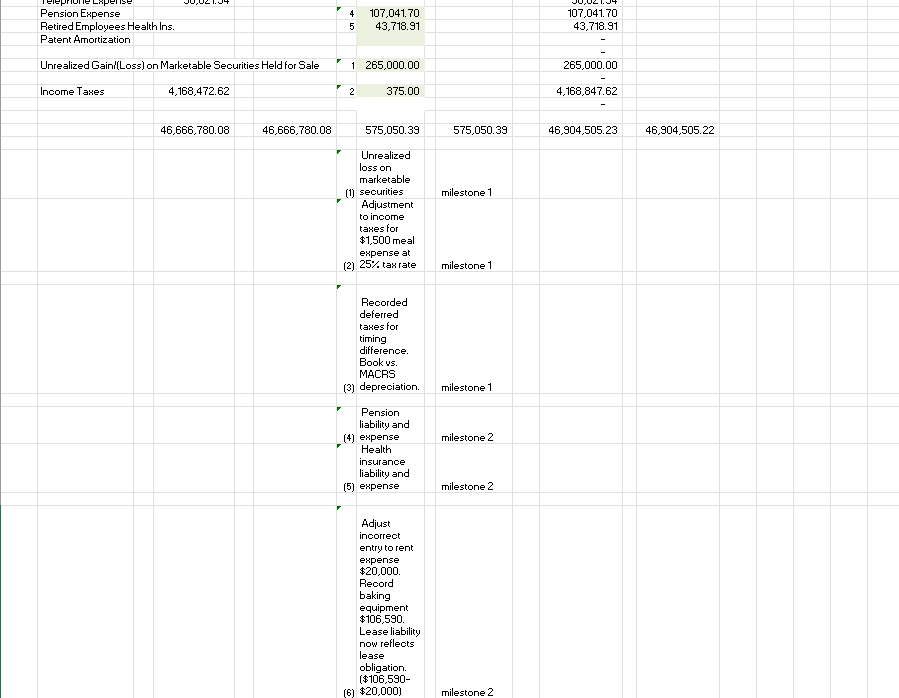

17 18 ITEMS TO COMPLETE FOR THIS MILESTONE: 19 20 GENERAL 21 In preparation of the annual audit, make calculations (green tab) and prepare appropriate adjusting entries and 22 post to the trial balance workbook (red tab) 26 27 28 29 30 PENSION PAYOUTS Calculate pension liability 22222222 23 24 CAPITAL LEASES 25 Calculate capital lease obligations Prepare appropriate adjusting entries 31 Calculate health insurance liability 32 33 ADJUSTING ENTRIES 34 35 Prepare adjusting entries for capital lease obligations 36 Prepare adjusting entries for pension payouts 37 38 39 MANAGEMENT BRIEF-Prepare in a Word document-see the rubric for milestone 2 A. Explain the implications of capital lease based on how it relates to the company's equipment usage. B. Explain how postretirement plans will impact the company financially in the short and long term, using 40 examples from the accounting workbook to support claims. 41 42 43 FINANCIAL INFORMATION FOR THIS MILESTONE 44 45 Postretirement Benefits Peyton Approved has revised its postretirement plan. It will now provide health insurance to retired employees. 46 Management has requested that you report the short- and long-term financial implications of this. 47 48 485 The company is currently employing 60, and actuaries estimate that the company has a pension liability of $107,041.70. The estimated cost of retired employees' health insurance is $43,718.91. 49 Prepare adjusting entries for the pension liability and the health insurance liability 50 51 Leases 52 Six ovens were rented on December 31, with $20,000 charged to rent expense. The lease runs for 6 years with an implicit interest rate of 5%. At the end of the 6 years, Peyton will own them. Make any necessary adjusting entries. 53 PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 Cash Marketable Securities Dr 1,488,999.34 5,500,000.00 Accounts Receivable 7,092,495.88 Baking Supplies 1,605,098.52 Adjusting entries Cr Dr Cr Dr 1,488,999.34 Cr 265,000.00 1 5,235,000.00 7,092,495.88 1,605,098.52 Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies 128,152.63 71,877.07 207,834.14 17,647.42 128,152.63 71,877.07 207,834.14 17,647.42 Land 250,000.00 Building 1,250,000.00 250,000.00 1,250,000.00 Baking Equipment 2,254,140.00 6 $106,590 2,360,729.53 Accumulated Depreciation 328,282.00 328,282.00 Patent Accounts Payable 1,555,212.85 Wages Payable 250,203.31 Interest Payable 21,888.22 Current Portion of Bonds Payable 1,000,000.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 Income Taxes Currently Payable 1,042,118.16 3 52,325.25 Accrued Pension Liability 375.00 2 107,041.70 4 990,167.91 107,041.70 Accrued Employees Health Insurance 43,718.91 5 43,718.91 Lease Liability $86,590 6 86,589.53 Deferred Tax Liability 52,325.25 3 Bonds Payable 4,000,000.00 Preferred Stock 500,000.00 52,325.25 4,000,000.00 500,000.00 Common Stock 1,750,000.00 1,750,000.00 Beginning Retained earnings 2,213,122.59 2,213,122.59 Dividends - Preferred 50,000.00 Dividends - Common 5,250,000.00 Bakery Sales Merchandise Sales 33,881,157.15 124,795.80 50,000.00 5,250,000.00 33,881,157.15 124,795.80 Cost of Goods Sold - Bal 10,954,907.36 10,954,907.36 88,994.79 Cost of Goods Sold - Mer Rent Expense 1,576,731.95 Wages Expense 2,604,526.23 Misc. Supplies Expense 20,000.00 6 88,994.79 1,556,731.95 2,604,526.23 263,224.56 Repairs and Maintenanc Business License Expen Misc. Expense Depreciation Expense 263,224.56 47,353.05 211,757.65 141,171.08 47,353.05 211,757.65 634,520.00 Insurance Expense 112,937.69 Advertising Expense 160,413.49 Interest Expense 484,703.27 Telephone Expense 50,821.34 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 Pension Expense 4 107,041.70 Retired Employees Health Ins. 5 43,718.91 107,041.70 43,718.91 Patent Amortization - Unrealized Gain/(Loss) on Marketable Securities Held for Sale 1 265,000.00 265,000.00 Income Taxes 4,168,472.62 2 375.00 4,168,847.62 HOME Telephone Expe Pension Expense 4 107,041.70 Retired Employees Health Ins. 5 43,718.91 Patent Amortization Unrealized Gain/(Loss) on Marketable Securities Held for Sale 1 265,000.00 Income Taxes 4,168,472.62 2 375.00 46,666,780.08 46,666,780.08 107,041.70 43,718.91 265,000.00 4,168,847.62 575,050.39 575,050.39 46,904,505.23 46,904,505.22 Unrealized loss on marketable (1) securities milestone 1 Adjustment to income taxes for $1,500 meal expense at (2) 25% tax rate Recorded deferred taxes for timing difference. Book vs. MACRS (3) depreciation. Pension liability and (4) expense Health insurance liability and (5) expense Adjust incorrect entry to rent expense $20,000. Record baking equipment $106,590. Lease liability now reflects lease obligation. ($106,590- (6) $20,000) milestone 1 milestone 1 milestone 2 milestone 2 milestone 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started