Answered step by step

Verified Expert Solution

Question

1 Approved Answer

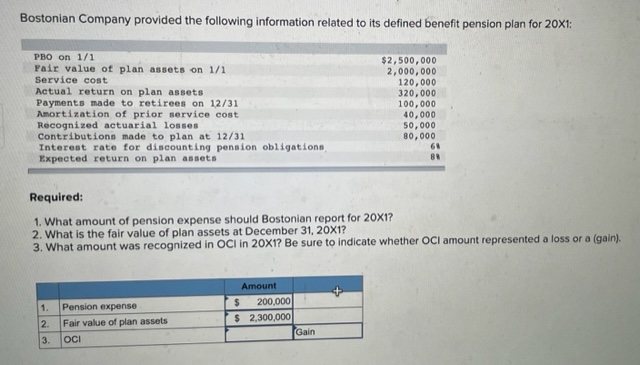

Bostonian Company provided the following information related to its defined benefit pension plan for 201: PBO on 1/1 Pair value of plan assets on

Bostonian Company provided the following information related to its defined benefit pension plan for 201: PBO on 1/1 Pair value of plan assets on 1/1 Service cost Actual return on plan assets Payments made to retirees on 12/31 $2,500,000 2,000,000 120,000 320,000 100,000 Amortization of prior service cost Recognized actuarial losses. 40,000 50,000 Contributions made to plan at 12/31 80,000 Interest rate for discounting pension obligations, Expected return on plan assets 68 88 Required: 1. What amount of pension expense should Bostonian report for 20X1? 2. What is the fair value of plan assets at December 31, 20X1? 3. What amount was recognized in OCI in 20X1? Be sure to indicate whether OCI amount represented a loss or a (gain). Amount 1. Pension expense $ 200,000 2. Fair value of plan assets $ 2,300,000 3. OCI Gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the pension expense for 20X1 we need to consider several components such as the servi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started