Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#17 & #18 Ms. Kona owns a 12 percent interest in Cariton LLC. This year, the LLC generated $68,800 ordinary income. Ms. Kona's marginal tax

#17 & #18

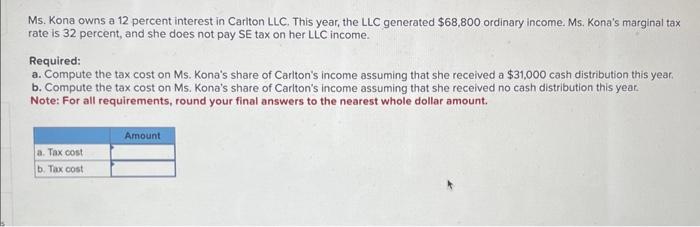

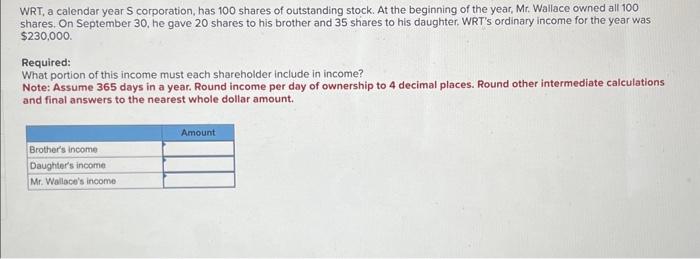

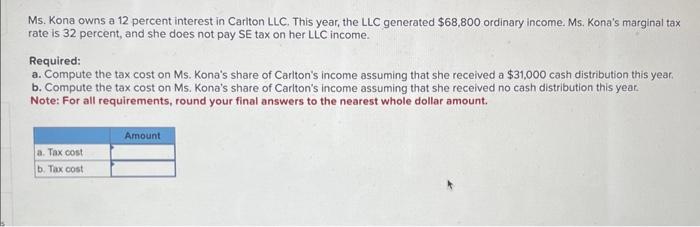

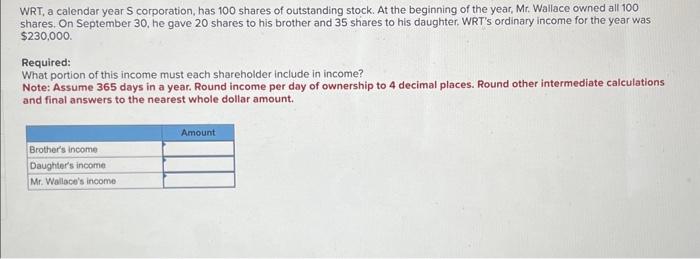

Ms. Kona owns a 12 percent interest in Cariton LLC. This year, the LLC generated $68,800 ordinary income. Ms. Kona's marginal tax rate is 32 percent, and she does not pay SE tax on her LLC income. Required: a. Compute the tax cost on Ms. Kona's share of Cariton's income assuming that she received a $31,000 cash distribution this year. b. Compute the tax cost on Ms. Kona's share of Cariton's income assuming that she received no cash distribution this year. Note: For all requirements, round your final answers to the nearest whole dollar amount. WRT, a calendar year S corporation, has 100 shares of outstanding stock. At the beginning of the year, Mr. Wallace owned all 100 shares. On September 30 , he gave 20 shares to his brother and 35 shares to his daughter. WRT's ordinary income for the year was 5230,000 Required: What portion of this income must each shareholder include in income? Note: Assume 365 days in a year. Round income per day of ownership to 4 decimal places. Round other intermediate calculations and final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started