Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#17 2,3 & 5 Question 2 Which of the following are used to value projects? Selected Answer: Answers: Sales revenue which only includes projected sales

#17 2,3 & 5

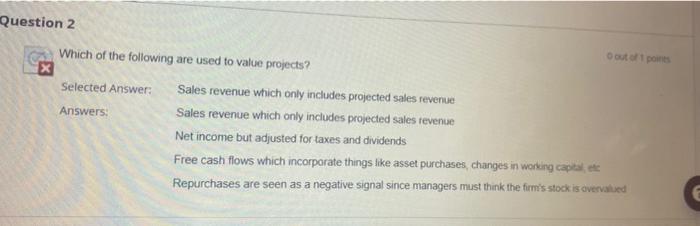

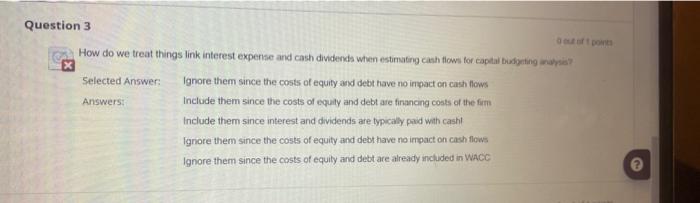

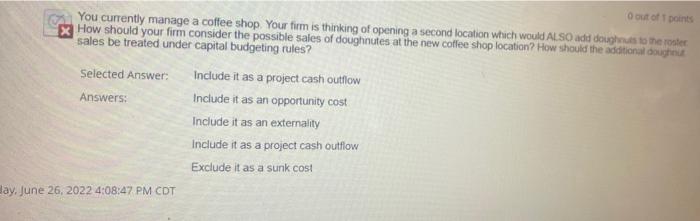

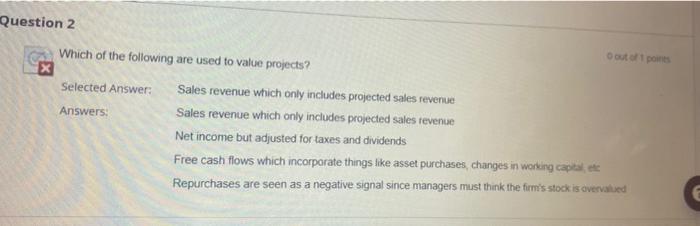

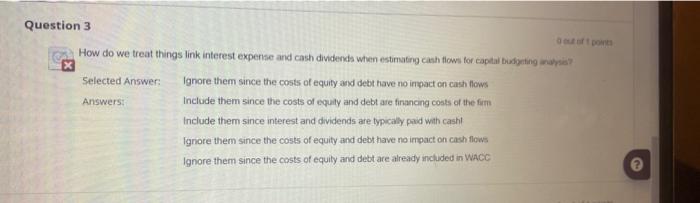

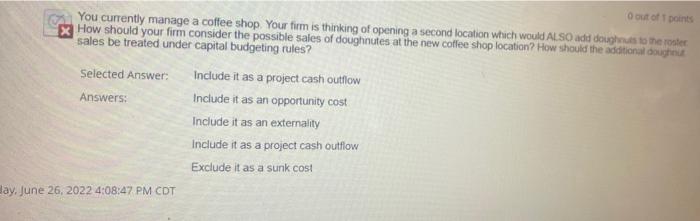

Question 2 Which of the following are used to value projects? Selected Answer: Answers: Sales revenue which only includes projected sales revenue Sales revenue which only includes projected sales revenue Net income but adjusted for taxes and dividends 0 out of 1 points Free cash flows which incorporate things like asset purchases, changes in working capital, etc Repurchases are seen as a negative signal since managers must think the firm's stock is overvalued Question 3 How do we treat things link interest expense and cash dividends when estimating cash flows for capital budgeting analysis? x Ignore them since the costs of equity and debt have no impact on cash flows Include them since the costs of equity and debt are financing costs of the firm Include them since interest and dividends are typically paid with cash! Ignore them since the costs of equity and debt have no impact on cash flows Ignore them since the costs of equity and debt are already included in WACC Selected Answer: Answers: 0 out of 1 points You currently manage a coffee shop. Your firm is thinking of opening a second location which would ALSO add doughnuts to the roster How should your firm consider the possible sales of doughnutes at the new coffee shop location? How should the additional doughnut sales be treated under capital budgeting rules? Selected Answer: Answers: lay, June 26, 2022 4:08:47 PM CDT Include it as a project cash outflow Include it as an opportunity cost Include it as an externality Include it as a project cash outflow Exclude it as a sunk cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started