Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17, A 15-year semiannual corporate bond was issued 3 years ago. Its coupon rate is 8%, and your required rate of return is 10% for

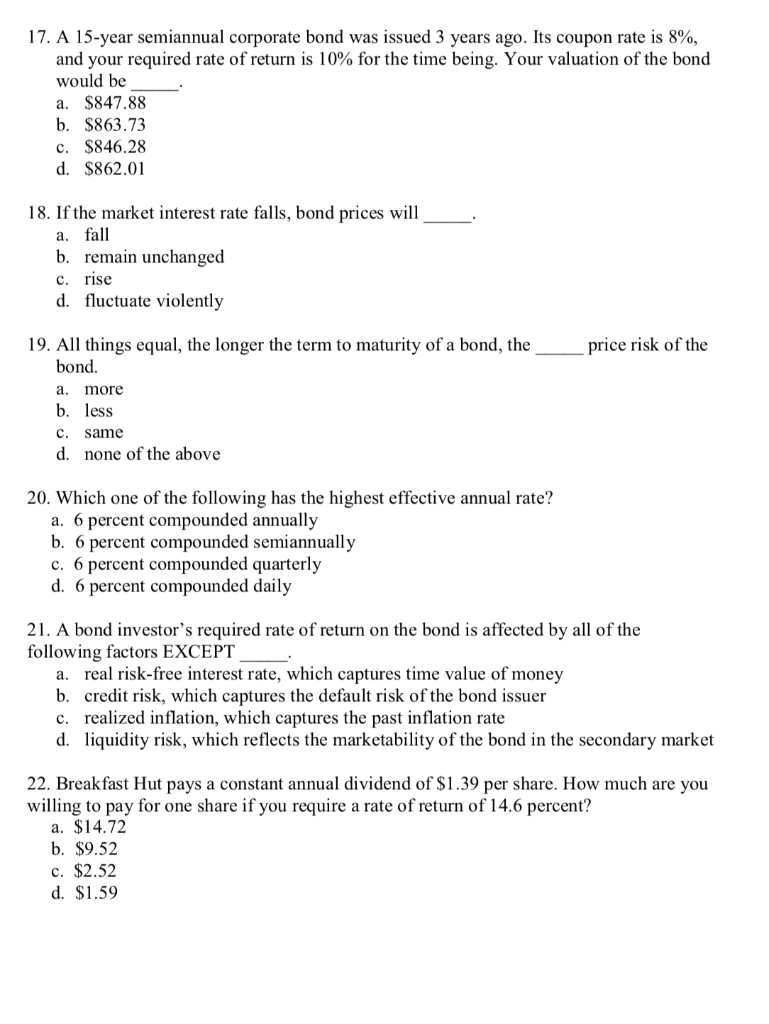

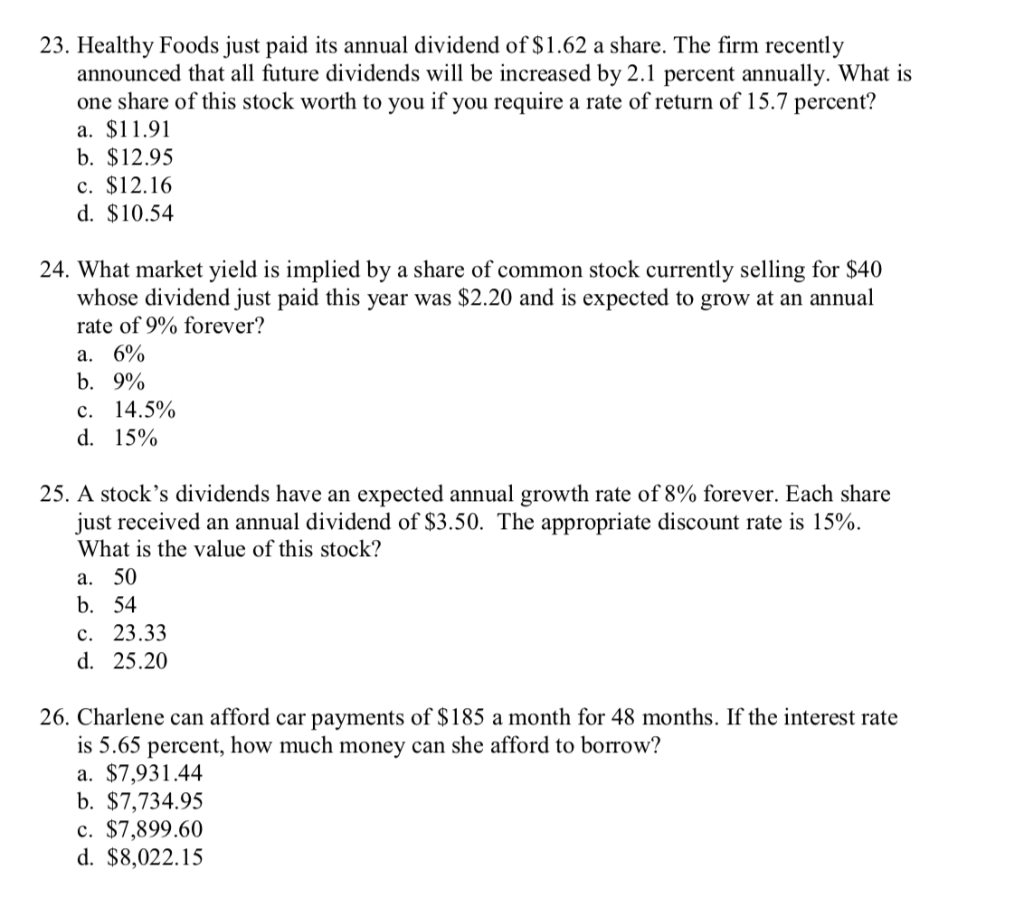

17, A 15-year semiannual corporate bond was issued 3 years ago. Its coupon rate is 8%, and your required rate of return is 10% for the time being. Your valuation of the bond would be a. $847.88 b. $863.73 c. $846.28 d. $862.01 18. If the market interest rate falls, bond prices will a. fall b. remain unchanged C. rise d. fluctuate violently 19. All things equal, the longer the term to maturity of a bond, the price risk of the bond. a. more b. less c. same d. none of the above 20. Which one of the following has the highest effective annual rate? a. 6 percent compounded annually b. 6 percent compounded semiannually c. 6 percent compounded quarterly d. 6 percent compounded daily 21. A bond investor's required rate of return on the bond is affected by all of the following factors EXCEPT real risk-free interest rate, which captures time value of money b. a. credit risk, which captures the default risk of the bond issuer realized inflation, which captures the past inflation rate d. c. liquidity risk, which reflects the marketability of the bond in the secondary market 22. Breakfast Hut pays a constant annual dividend of $1.39 per share. How much are you willing to pay for one share if you require a rate of return of 14.6 percent? a. $14.72 b. $9.52 c. $2.52 d. $1.59 23. Healthy Foods just paid its annual dividend of $1.62 a share. The firm recently announced that all future dividends will be increased by 2.1 percent annually. What is one share of this stock worth to you if you require a rate of return of 15.7 percent? a. $11.91 b. $12.9:5 c. $12.16 d. $10.54 24. What market yield is implied by a share of common stock currently selling for $40 whose dividend just paid this year was $2.20 and is expected to grow at an annual rate of 9% forever? a. 6% b. 9% c. 14.5% d. 15% 25, A stock's dividends have an expected annual growth rate of 8% forever. Each share just received an annual dividend of $3.50. The appropriate discount rate is 15%. What is the value of this stock? a. 50 b. 54 c. 23.33 d. 25.20 26. Charlene can afford car payments of $185 a month for 48 months. If the interest rate is 5.65 percent, how much money can she afford to borrow? a. $7,931.44 b. $7,734.95 c. $7,899.60 d. $8,022.15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started