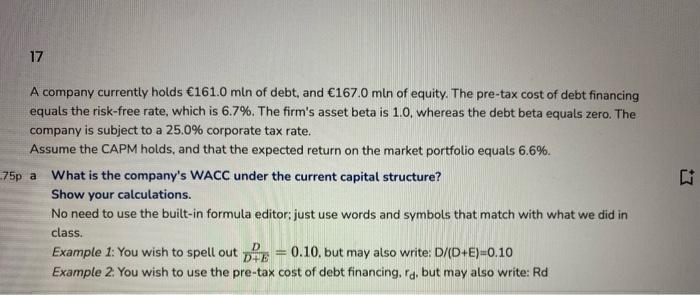

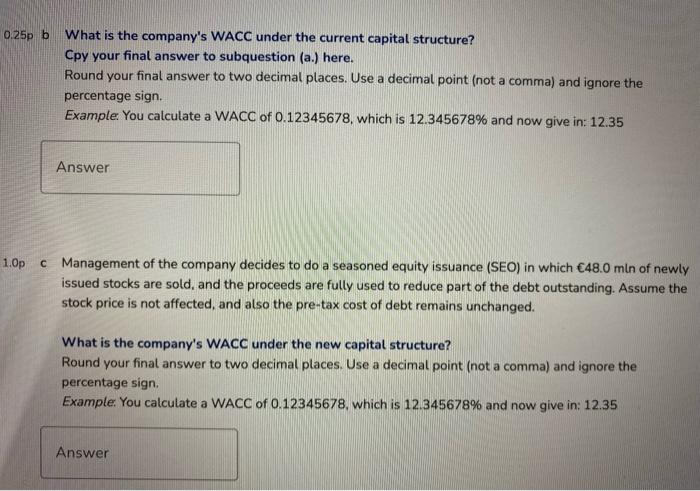

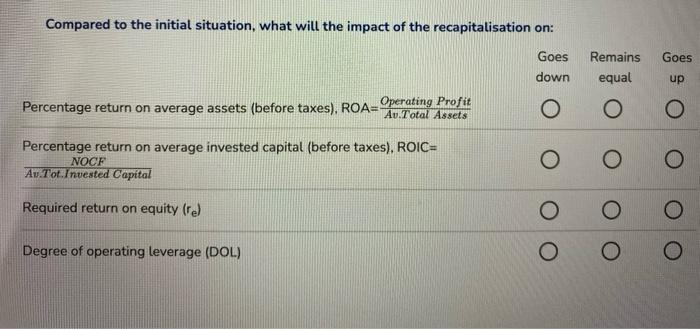

17 A company currently holds 161.0 mln of debt, and 167.0 mln of equity. The pre-tax cost of debt financing equals the risk-free rate, which is 6.7%. The firm's asset beta is 1.0, whereas the debt beta equals zero. The company is subject to a 25.0% corporate tax rate. Assume the CAPM holds, and that the expected return on the market portfolio equals 6.6%. 75p a What is the company's WACC under the current capital structure? Show your calculations. No need to use the built-in formula editor:just use words and symbols that match with what we did in class. Example 1: You wish to spell out Die = 0.10, but may also write: D/(D+E)=0.10 Example 2. You wish to use the pre-tax cost of debt financing, d, but may also write: Rd 0.25p b What is the company's WACC under the current capital structure? Cpy your final answer to subquestion (a.) here. Round your final answer to two decimal places. Use a decimal point (not a comma) and ignore the percentage sign. Example: You calculate a WACC of 0.12345678, which is 12.345678% and now give in: 12.35 Answer 1.Op c Management of the company decides to do a seasoned equity issuance (SEO) in which 48.0 min of newly issued stocks are sold, and the proceeds are fully used to reduce part of the debt outstanding. Assume the stock price is not affected, and also the pre-tax cost of debt remains unchanged. What is the company's WACC under the new capital structure? Round your final answer to two decimal places. Use a decimal point (not a comma) and ignore the percentage sign Example: You calculate a WACC of 0.12345678, which is 12.345678% and now give in: 12.35 Answer Compared to the initial situation, what will the impact of the recapitalisation on: Goes Goes down Remains equal up Operating Profit Percentage return on average assets (before taxes), ROA= Av.Total Assets O O O Percentage return on average invested capital (before taxes), ROIC= NOCF Av. Tot.Inuested Capital O Required return on equity (re) O Degree of operating leverage (DOL) O O 17 A company currently holds 161.0 mln of debt, and 167.0 mln of equity. The pre-tax cost of debt financing equals the risk-free rate, which is 6.7%. The firm's asset beta is 1.0, whereas the debt beta equals zero. The company is subject to a 25.0% corporate tax rate. Assume the CAPM holds, and that the expected return on the market portfolio equals 6.6%. 75p a What is the company's WACC under the current capital structure? Show your calculations. No need to use the built-in formula editor:just use words and symbols that match with what we did in class. Example 1: You wish to spell out Die = 0.10, but may also write: D/(D+E)=0.10 Example 2. You wish to use the pre-tax cost of debt financing, d, but may also write: Rd 0.25p b What is the company's WACC under the current capital structure? Cpy your final answer to subquestion (a.) here. Round your final answer to two decimal places. Use a decimal point (not a comma) and ignore the percentage sign. Example: You calculate a WACC of 0.12345678, which is 12.345678% and now give in: 12.35 Answer 1.Op c Management of the company decides to do a seasoned equity issuance (SEO) in which 48.0 min of newly issued stocks are sold, and the proceeds are fully used to reduce part of the debt outstanding. Assume the stock price is not affected, and also the pre-tax cost of debt remains unchanged. What is the company's WACC under the new capital structure? Round your final answer to two decimal places. Use a decimal point (not a comma) and ignore the percentage sign Example: You calculate a WACC of 0.12345678, which is 12.345678% and now give in: 12.35 Answer Compared to the initial situation, what will the impact of the recapitalisation on: Goes Goes down Remains equal up Operating Profit Percentage return on average assets (before taxes), ROA= Av.Total Assets O O O Percentage return on average invested capital (before taxes), ROIC= NOCF Av. Tot.Inuested Capital O Required return on equity (re) O Degree of operating leverage (DOL) O O