Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17. Consider the following three statements: 1. The net present value method is simpler to use than the time-adjusted rate of return method. II. The

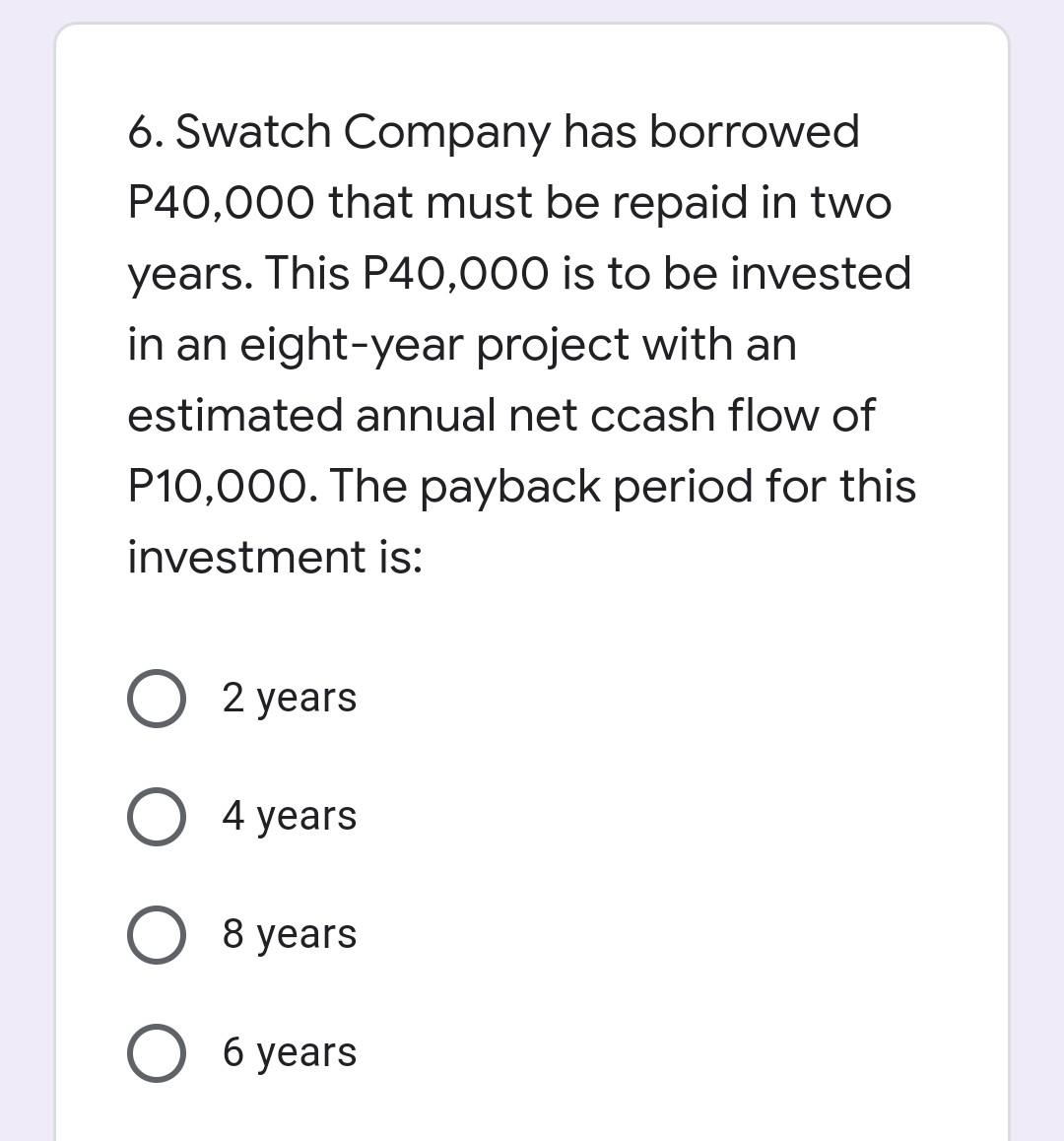

17. Consider the following three statements: 1. The net present value method is simpler to use than the time-adjusted rate of return method. II. The use of the net present value method makes it more difficult to adjust for risk than the time-adjusted rate of return method. III. The net present value method provides more usable information than does the time-adjusted rate of return method. Which of the above statements is (are) true? A. Only I B. Only 11 Only I and II O Only I and III 14. Viva Market has 3 stores: P, Q, R. During 2019, Store P had a contribution margin of P24,000 and a contribution margin ratio of 30%. Store O had variable costs of P48,000 and a contribution margin ration of 40%. Store R had variable costs of P84,000, which represented 70% of sales in the store. For 2019, Viva Market's total sales were Your answer 9. KG Inc. has the following mix of funds and costs Type Amount Cost Debt P 150,000 0.18% Preference share 500,000 0.15 Ordinary equity 700,000 0.12 Total funds P 1,350,000 What is KG's cost of capital? Your answer 6. Swatch Company has borrowed P40,000 that must be repaid in two years. This P40,000 is to be invested in an eight-year project with an estimated annual net ccash flow of P10,000. The payback period for this investment is: 2 years 4 years O 8 years O 6 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started