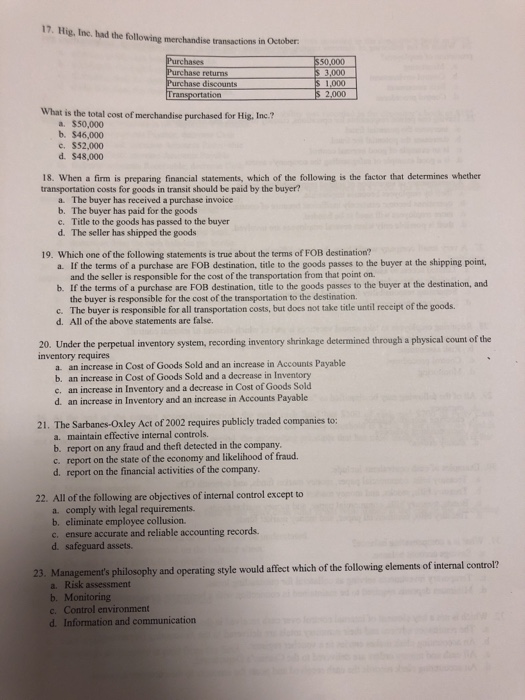

17. Hig, Inc. had the following merchandise transactions in October. Purchases Purchase returns Purchase discounts 50 1,000 What is the total cost of merchandise purchased for Hig. Inc.? a. $50,000 b. $46,000 c. $52,000 d. $48,000 18. When a firm is preparing financial statements, which of the following is the factor that determines whether transportation costs for goods in transit should be paid by the buyer? a. The buyer has received a purchase invoice b. The buyer has paid for the goods c. Title to the goods has passed to the buyer d. The seller has shipped the goods 19. Which one of the following statements is true about the terms of FOB destination? a. If the terms of a purchase are FOB destination, title to the goods passes to the buyer at the shipping point, and the seller is responsible for the cost of the transportation from that point on. If the terms of a purchase are FOB destination, title to the goods passes to the buyer at the destination, and the buyer is responsible for the cost of the transportation to the destination. The buyer is responsible for all transportation costs, but does not take title until receipt of the goods. All of the above statements are false. b. c. d. 20. Under the perpetual inventory system, recording inventory shrinkage determined through a physical count of the inventory requires a. an increase in Cost of Goods Sold and an increase in Accounts Payable b. an increase in Cost of Goods Sold and a decrease in Inventory c. an increase in Inventory and a decrease in Cost of Goods Sold d. an increase in Inventory and an increase in Accounts Payable 21. The Sarbanes-Oxley Act of 2002 requires publicly traded companies to: a. maintain effective internal controls. b. report on any fraud and theft detected in the company c. report on the state of the economy and likelihood of fraud d. report on the financial activities of the company 22. All of the following are objectives of internal control except to a. comply with legal requirements. b. eliminate employee collusion c. ensure accurate and reliable accounting records. d. safeguard assets. s philosophy and operating style would affect which of the following elements of internal control? a. Risk assessment b. Monitoring c. Control environment d. Information and communication