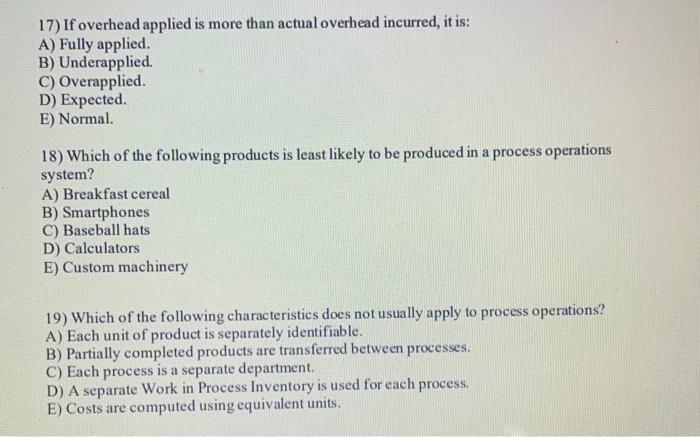

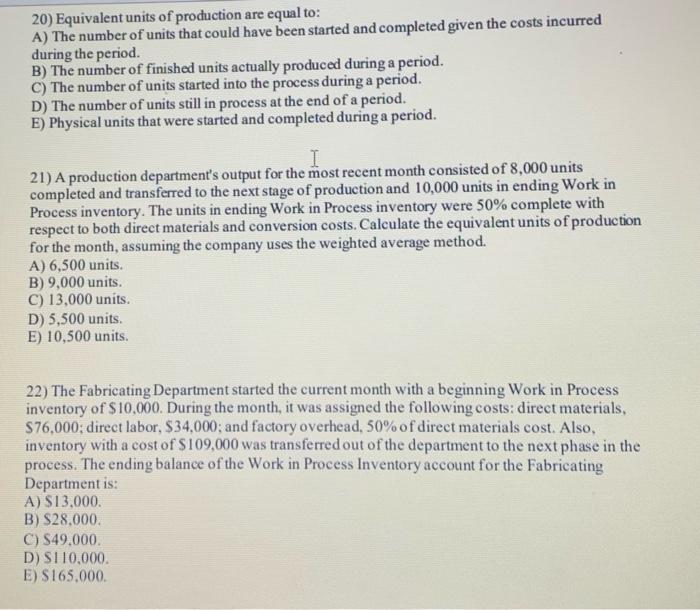

17) If overhead applied is more than actual overhead incurred, it is: A) Fully applied. B) Underapplied. C) Overapplied D) Expected. E) Normal. 18) Which of the following products is least likely to be produced in a process operations system? A) Breakfast cereal B) Smartphones C) Baseball hats D) Calculators E) Custom machinery 19) Which of the following characteristics does not usually apply to process operations? A) Each unit of product is separately identifiable. B) Partially completed products are transferred between processes. C) Each process is a separate department. D) A separate Work in Process Inventory is used for each process. E) Costs are computed using equivalent units. 20) Equivalent units of production are equal to: A) The number of units that could have been started and completed given the costs incurred during the period. B) The number of finished units actually produced during a period. C) The number of units started into the process during a period. D) The number of units still in process at the end of a period. E) Physical units that were started and completed during a period. 21) A production department's output for the most recent month consisted of 8,000 units completed and transferred to the next stage of production and 10,000 units in ending Work in Process inventory. The units in ending Work in Process inventory were 50% complete with respect to both direct materials and conversion costs. Calculate the equivalent units of production for the month, assuming the company uses the weighted average method. A) 6,500 units. B) 9,000 units. C) 13,000 units. D) 5,500 units. E) 10,500 units. 22) The Fabricating Department started the current month with a beginning Work in Process inventory of $10,000. During the month, it was assigned the following costs: direct materials, S76,000; direct labor, $34.000; and factory overhead, 50% of direct materials cost. Also, inventory with a cost of $109,000 was transferred out of the department to the next phase in the process. The ending balance of the Work in Process Inventory account for the Fabricating Department is: A) $13,000. B) $28,000. C) S49,000 D) $110,000 E) S165.000