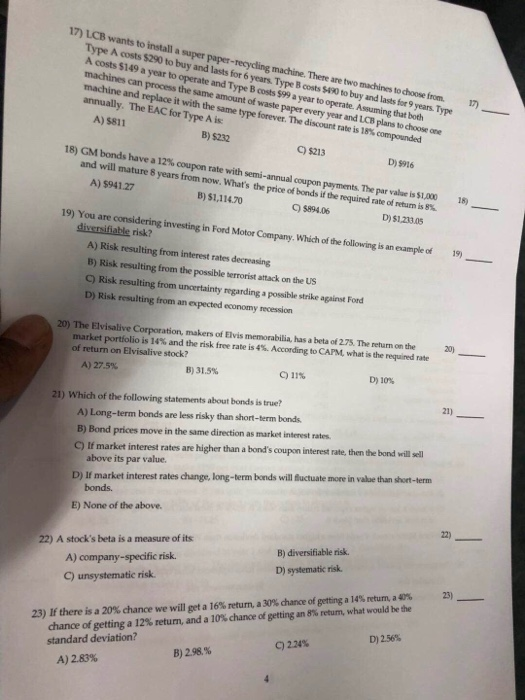

17) LCB wants to install a super paper-recycling machine. There are two machines to choose from Type A costs $290 to buy and lasts for 6 years. Type B costs $490 to buy and lasts for 9 years. Type A costs $149 a year to operate and Type B costs $99 a year to operate. Assuming that both machines can process the same amount of waste paper every year and LCB plans to choose one machine and replace it with the same type forever. The discount rate is 18% compounded annually. The EAC for Type A is 17) A) 5811 B) $232 ) $213 D)9916 18) GM bonds have a 12% coupon rate with semi-annual coupon payments. The par value is $1,0 and will mature 8 years from now, What's the price of bonds if the required rate of retum is 8% 18) A) $941.27 B) $1,114.70 9 $894.06 D) $1233.05 19) You are considering investing in Ford Motor Company. Which of the following is an example of diversifiable risk? 19) A) Risk resulting from interest rates decreasing B) Risk resulting from the possible terrorist attack on the US 9 Risk resulting from uncertainty regarding a possible strike against Ford D) Risk resulting from an expected economy recession 20) The Elvisalive Corporation, makers of Elvis memorabilia, has a beta of 2.75. The retum on the market portiolio is 14 % and the risk free rate is 4 %. According to CAPM, what is the required rate of return on Elvisalive stock? 20 B) 31.5 % A) 27.5 % D) 10 % C) 11% 21) 21) Which of the following statements about bonds is true? A) Long-term bonds are less risky than short-term bonds B) Bond prices move in the same direction as market interest rates C) If market interest rates are higher than a bond's coupon interest rate, then the bond will sell above its par value. D) If market interest rates change, long-term bonds will fuctuate more in valae than short-term bonds. E) None of the above. 22) 22) A stock's beta is a measure of its B) diversifiable risk A) company-specific risk. D) systematic risk 23) 23) If there is a 20% chance we will get a 16% return, a 30% chance of getting a 14% return, a 40% chance of getting a 12% return, and a 10% chance of getting an 8 % retum, what would be the standard deviation? C) unsystematic risk D) 256% 9 224 % B) 2.98,% A) 2.83%