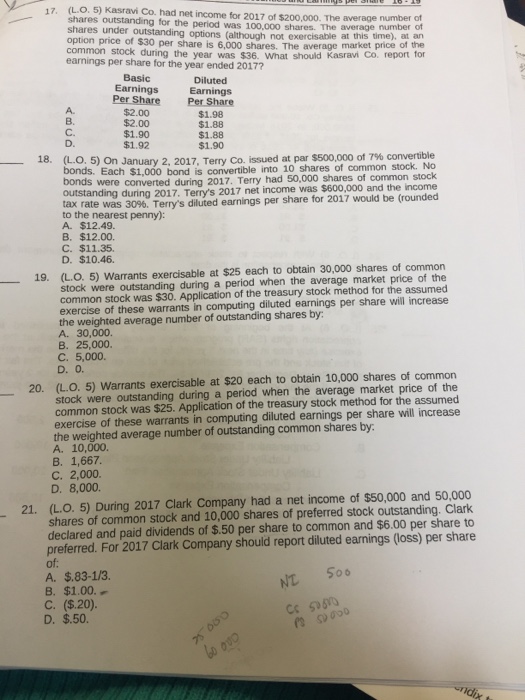

17. (L.O. 5) Kasravi Co. had net income for 2017 of $200,000. The outstanding for the average number of period was 100,000 shares. The average number of ceotg opions (although not exercisable at this time), at an per share is 6,000 shares. The average market price of the common stock during the year was $36. What should Kasravi Co. report for earnings per share for the year ended 20177 A. B. . D. Basic Earnings Per Share $2.00 $2.00 $1.90 $1.92 Diluted Earnings Per Share $1.98 $1.88 $1.88 $1.90 18. (L.O. 5) On January 2, 2017, Terry Co. issued at par S500.000 of 7% convertible bonds. Each bonds $1,000 bond is convertible into 1o shares of common stock. No were converted during 2017. Terry had 50,000 shares of common stock was $600,000 and the income outstanding during 2017. Terry's 2017 net income tax rate was 30% to the nearest penny): A. $12.49. B. $12.00. C. $11.35. D. $10.46. . Terry's diluted earnings per share for 2017 would be (rounded stock were outstanding during a period when the average market price of the common stock was $30. Application of the treasury stock method for the assumed exercise of these warrants in computing diluted earnings per share will increase the weighted average number of outstanding shares by A. 30,000. B. 25,000. C. 5,000. -19. (L.. 5) warrants exercisable at $25 each to obtain 30,000 shares of common 20. (L.. 5) warrants exercisable at $20 each to obtain 10,000 shares of common common stock was $25. Application of the treasury stock method for the assumed exercise of these warrants in computing diluted earnings per share will increase stock were outstanding during a period when the average market price of the the weighted average number of outstanding common shares by A. 10,000 B. 1,667. C. 2,000 D. 8,000. (L.O. 5) During 2017 Clark Company had a net income of $50,000 and 50,000 shares of common stock and 10,000 shares of preferred stock outstanding. Clark declared and paid dividends of $.50 per share to common and $6.00 per share to preferred. For 2017 Clark Company should report diluted earnings (loss) per share of: A. $.83-1/3. B. $1.00. C. ($.20) 21. NL Cs D. $.50