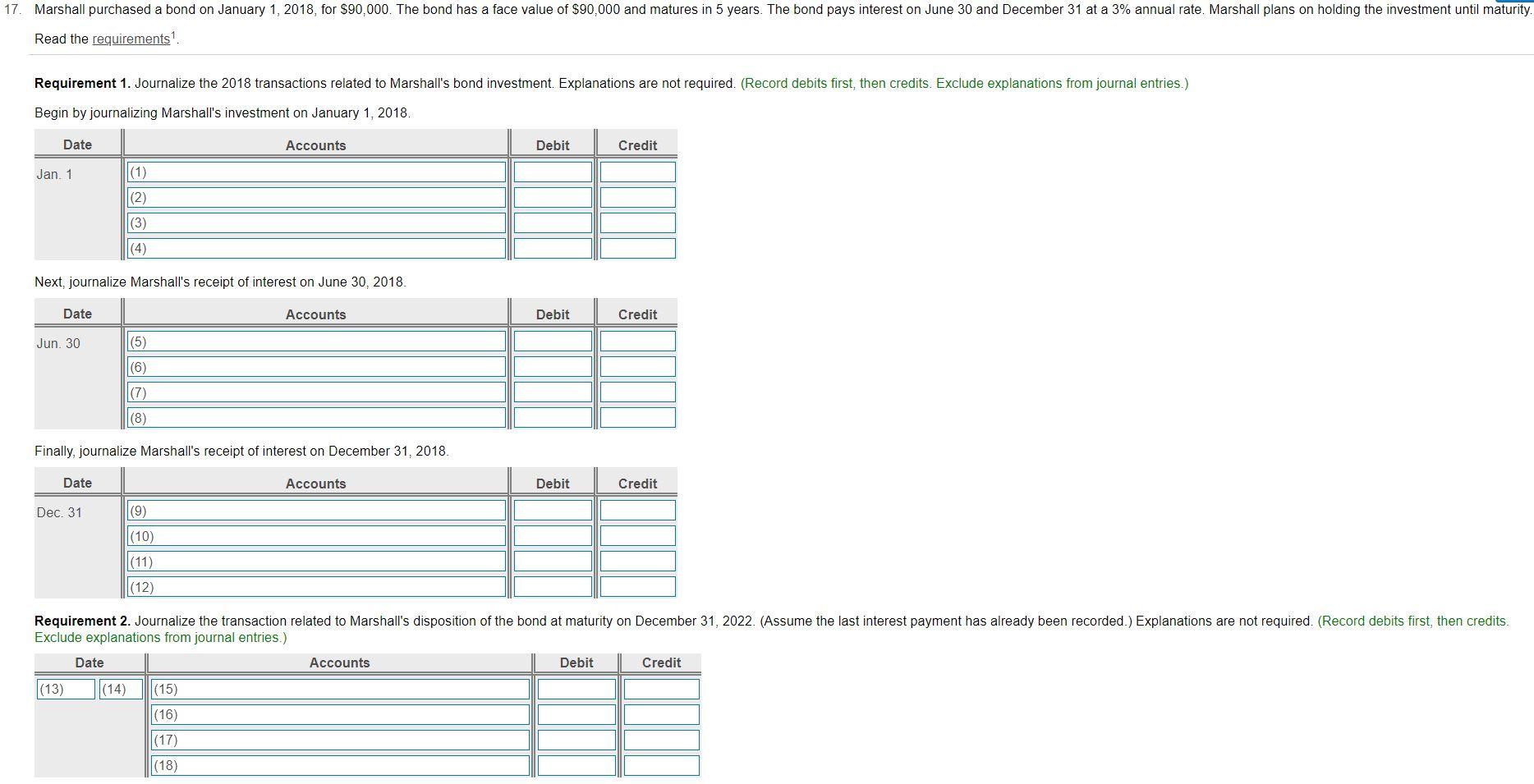

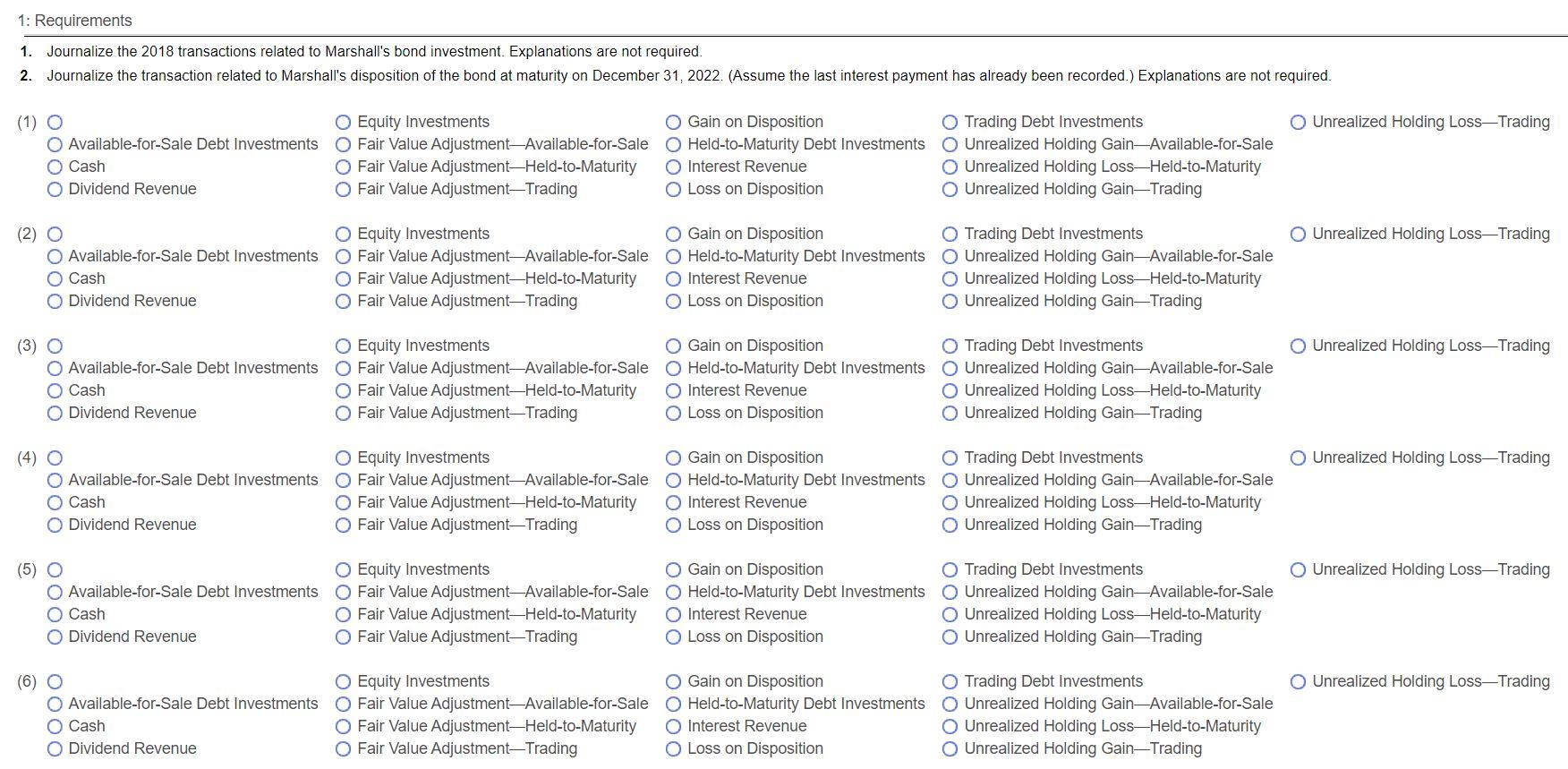

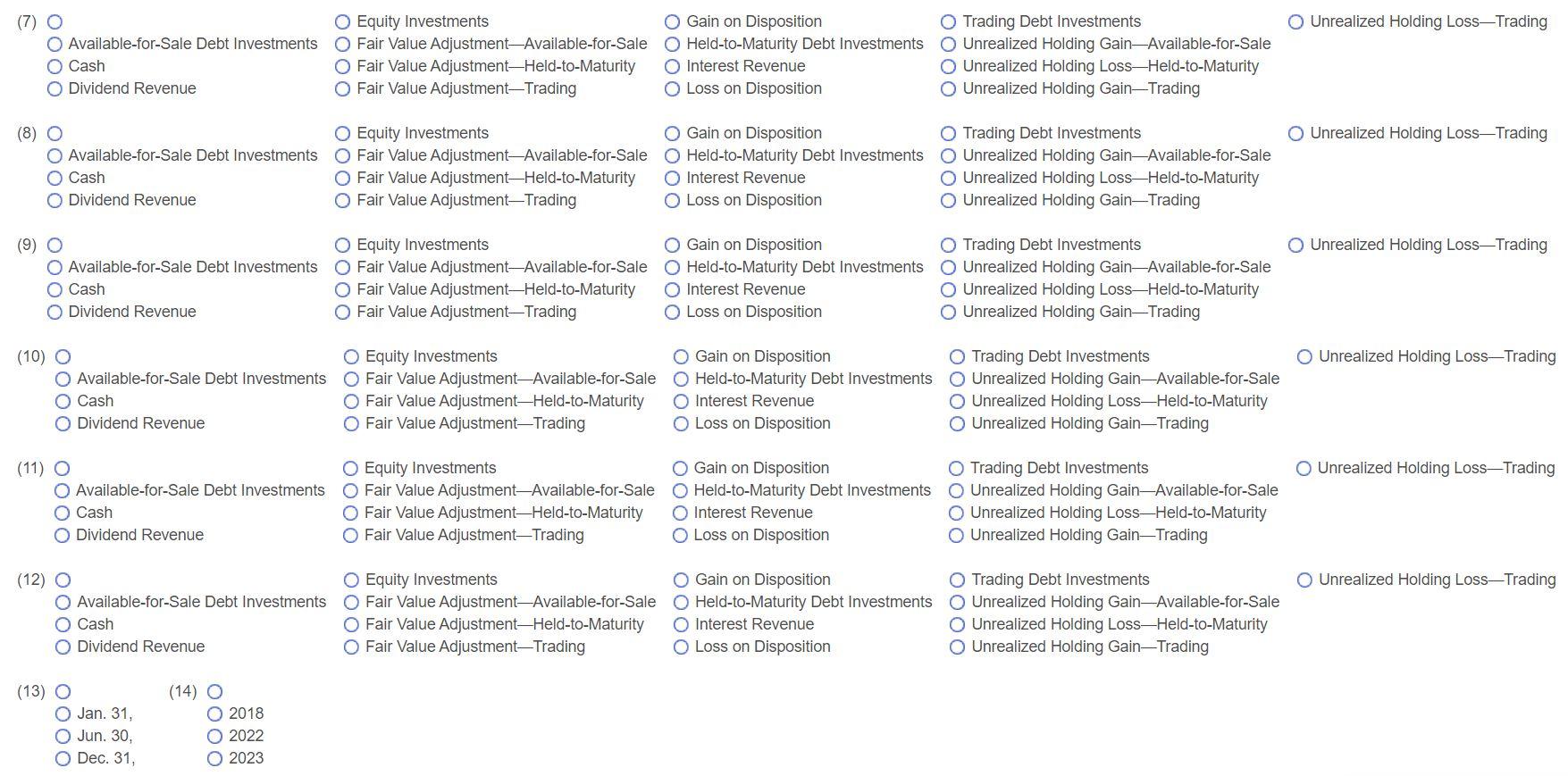

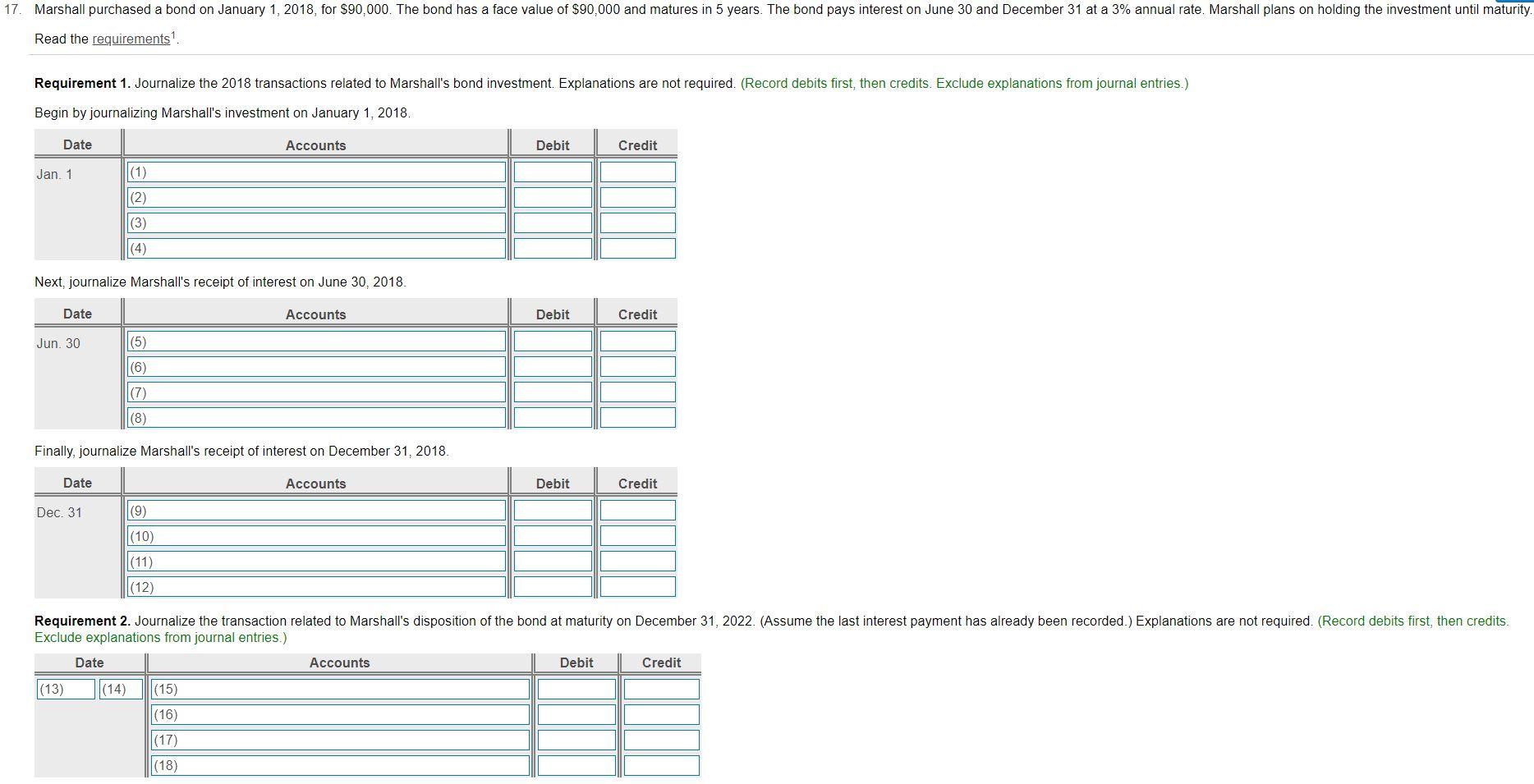

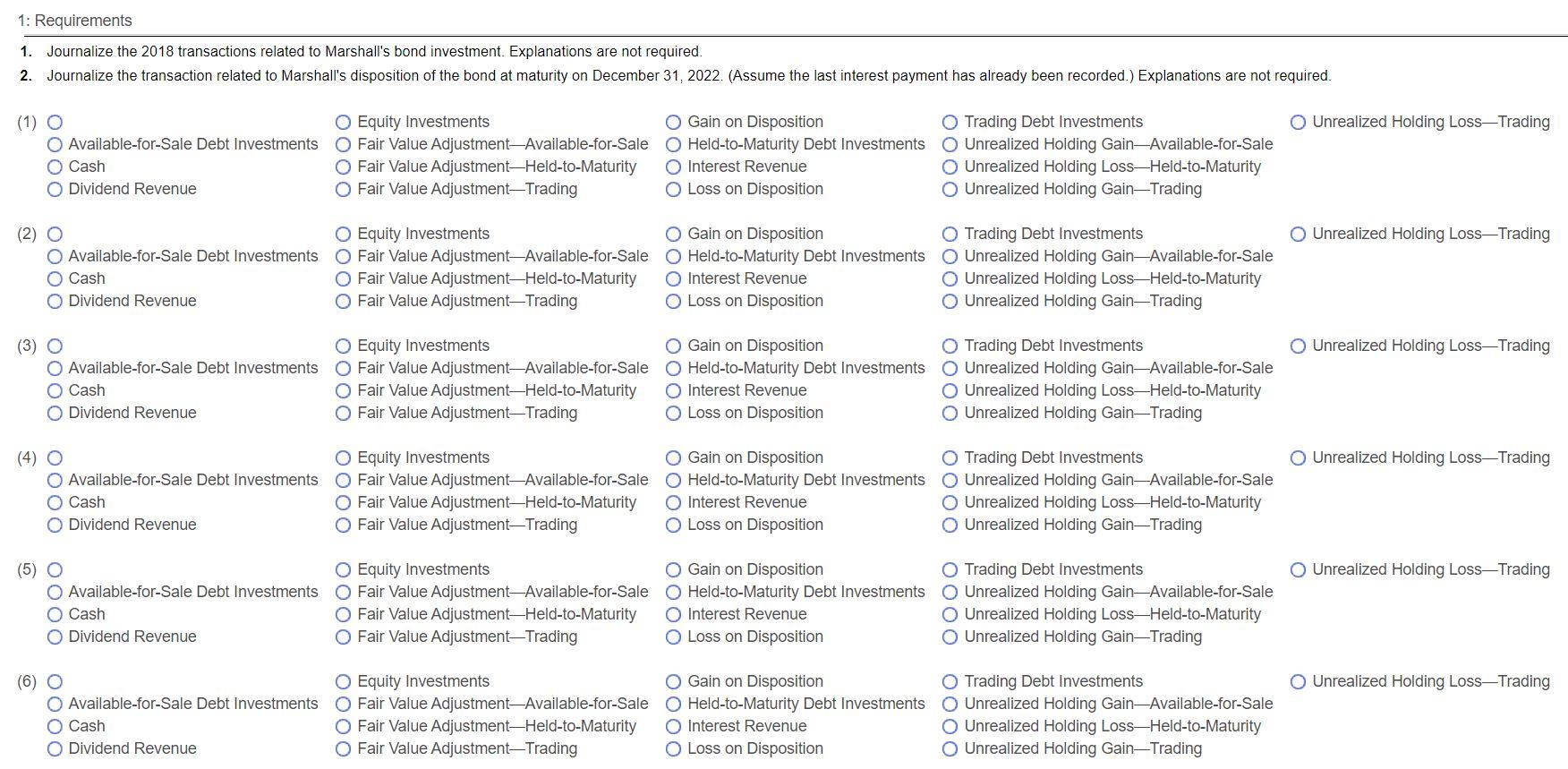

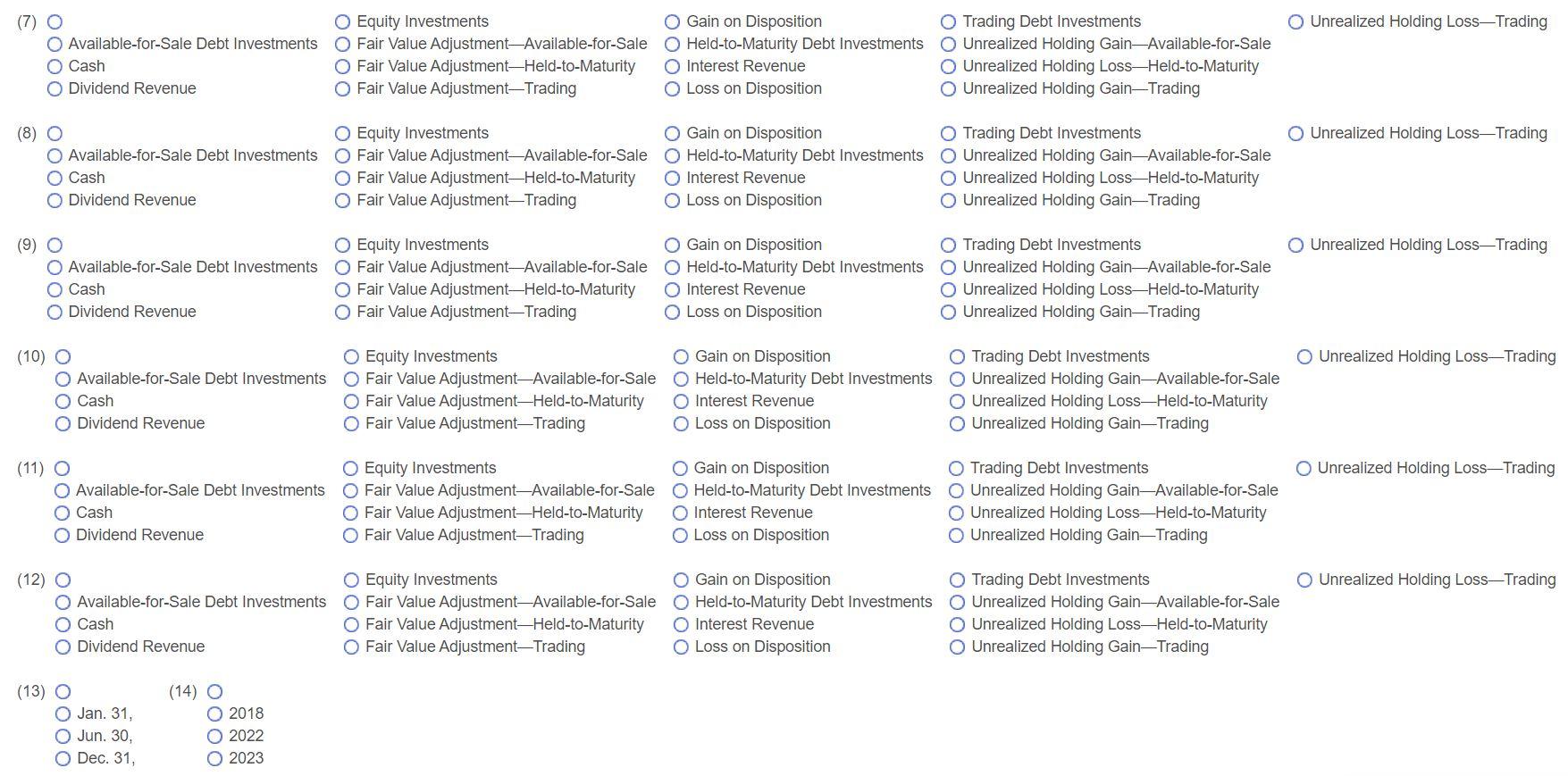

17. Marshall purchased a bond on January 1, 2018, for $90,000. The bond has a face value of $90,000 and matures in 5 years. The bond pays interest on June 30 and December 31 at a 3% annual rate. Marshall plans on holding the investment until maturity. Read the requirements Requirement 1. Journalize the 2018 transactions related to Marshall's bond investment. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Begin by journalizing Marshall's investment on January 1, 2018. Date Accounts Debit Credit Jan. 1 (1) (2) (3) (4) Next, journalize Marshall's receipt of interest on June 30, 2018. Date Accounts Debit Credit Jun. 30 (5) (6) (7) (8) Finally, journalize Marshall's receipt of interest on December 31, 2018 Date Accounts Debit Credit Dec. 31 (9) (10) (11) (12) Requirement 2. Journalize the transaction related to Marshall's disposition of the bond at maturity on December 31, 2022. (Assume the last interest payment has already been recorded.) Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Date Accounts Debit Credit (13) (14) (15) (16) (17) (18) 1: Requirements 1. Journalize the 2018 transactions related to Marshall's bond investment. Explanations are not required 2. Journalize the transaction related to Marshall's disposition of the bond at maturity on December 31, 2022. (Assume the last interest payment has already been recorded.) Explanations are not required Unrealized Holding Loss-Trading (1) O Available-for-Sale Debt Investments O Cash O Dividend Revenue Equity Investments O Fair Value Adjustment-Available-for-Sale Fair Value AdjustmentHeld-to-Maturity O Fair Value AdjustmentTrading O Gain on Disposition Held-to-Maturity Debt Investments O Interest Revenue O Loss on Disposition O Trading Debt Investments O Unrealized Holding GainAvailable-for-Sale Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading Unrealized Holding Loss-Trading (2) O Available-for-Sale Debt Investments O Cash O Dividend Revenue O Equity Investments O Gain on Disposition O Fair Value Adjustment-Available-for-Sale Held-to-Maturity Debt Investments O Fair Value Adjustment-Held-to-Maturity O Interest Revenue O Fair Value AdjustmentTrading Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity Unrealized Holding Gain-Trading Unrealized Holding Loss-Trading (3) O O Available-for-Sale Debt Investments O Cash Dividend Revenue O Equity Investments O Fair Value Adjustment-Available-for-Sale O Fair Value AdjustmentHeld-to-Maturity Fair Value Adju entTrading O Gain on Disposition O Held-to-Maturity Debt Investments Interest Revenue O Loss on Disposition Trading Debt Investments Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity Unrealized Holding GainTrading Unrealized Holding Loss-Trading (4) O Available-for-Sale Debt Investments O Cash Dividend Revenue O Equity Investments Gain on Disposition O Fair Value Adjustment-Available-for-Sale Held-to-Maturity Debt Investments O Fair Value Adjustment-Held-to-Maturity Interest Revenue O Fair Value Adjustment-Trading O Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity Unrealized Holding GainTrading (5) Unrealized Holding Loss-Trading Available-for-Sale Debt Investments O Cash Dividend Revenue Equity Investments O Gain on Disposition O Fair Value Adjustment-Available-for-Sale Held-to-Maturity Debt Investments O Fair Value Adjustment-Held-to-Maturity Interest Revenue O Fair Value AdjustmentTrading O Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading (6) Unrealized Holding LossTrading Available-for-Sale Debt Investments O Cash O Dividend Revenue O Equity Investments O Gain on Disposition O Fair Value Adjustment-Available-for-Sale Held-to-Maturity Debt Investments O Fair Value Adjustment-Held-to-Maturity Interest Revenue Fair Value AdjustmentTrading O Loss on Disposition O Trading Debt Investments O Unrealized Holding GainAvailable-for-Sale O Unrealized Holding LossHeld-to-Maturity Unrealized Holding Gain-Trading Unrealized Holding Loss-Trading (7) O Available-for-Sale Debt Investments O Cash O Dividend Revenue Equity Investments O Fair Value Adjustment-Available-for-Sale Fair Value AdjustmentHeld-to-Maturity O Fair Value Adjustment-Trading O Gain on Disposition O Held-to-Maturity Debt Investments Interest Revenue O Loss on Disposition Trading Debt Investments O Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading Unrealized Holding LossTrading (8) O Available-for-Sale Debt Investments O Cash O Dividend Revenue O Equity Investments O Gain on Disposition O Fair Value Adjustment-Available-for-Sale Held-to-Maturity Debt Investments O Fair Value Adjustment-Held-to-Maturity O Interest Revenue O Fair Value AdjustmentTrading Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity Unrealized Holding GainTrading O Unrealized Holding LossTrading (9) O O Available-for-Sale Debt Investments O Cash Dividend Revenue O Equity Investments O Fair Value Adjustment-Available-for-Sale Fair Value AdjustmentHeld-to-Maturity O Fair Value AdjustmentTrading O Gain on Disposition O Held-to-Maturity Debt Investments Interest Revenue O Loss on Disposition Trading Debt Investments O Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading (10) O Unrealized Holding Loss-Trading Available-for-Sale Debt Investments O Cash O Dividend Revenue Equity Investments O Fair Value Adjustment-Available-for-Sale O Fair Value AdjustmentHeld-to-Maturity O Fair Value AdjustmentTrading O Gain on Disposition O Held-to-Maturity Debt Investments O Interest Revenue Loss on Disposition O Trading Debt Investments O Unrealized Holding Gain-Available-for-Sale O Unrealized Holding Loss-Held-to-Maturity Unrealized Holding Gain-Trading (11) O Unrealized Holding Loss-Trading O Available-for-Sale Debt Investments O Cash O Dividend Revenue Equity Investments O Fair Value Adjustment-Available-for-Sale Fair Value AdjustmentHeld-to-Maturity O Fair Value AdjustmentTrading O Gain on Disposition Held-to-Maturity Debt Investments O Interest Revenue Loss on Disposition Trading Debt Investments Unrealized Holding GainAvailable-for-Sale Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading Unrealized Holding Loss-Trading (12) O O Available-for-Sale Debt Investments O Cash O Dividend Revenue O Equity Investments O Fair Value Adjustment-Available-for-Sale O Fair Value AdjustmentHeld-to-Maturity O Fair Value AdjustmentTrading O Gain on Disposition O Held-to-Maturity Debt Investments Interest Revenue O Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale Unrealized Holding LossHeld-to-Maturity Unrealized Holding Gain-Trading (13) O O Jan. 31, O Jun 30, O Dec. 31, (14) O 2018 O 2022 O 2023 (15) O Unrealized Holding Loss-Trading OOOO Available-for-Sale Debt Investments Cash Dividend Revenue Equity Investments O Fair Value AdjustmentAvailable-for-Sale O Fair Value Adjustment-Held-to-Maturity Fair Value AdjustmentTrading O Gain on Disposition Held-to-Maturity Debt Investments O Interest Revenue O Loss on Disposition O Trading Debt Investments O Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading (16) Unrealized Holding Loss-Trading O Available-for-Sale Debt Investments O Cash Dividend Revenue O Equity Investments O Fair Value Adjustment-Available-for-Sale O Fair Value Adjustment-Held-to-Maturity O Fair Value Adjustment-Trading O Gain on Disposition O Held-to-Maturity Debt Investments O Interest Revenue O Loss on Disposition O Trading Debt Investments O Unrealized Holding GainAvailable-for-Sale O Unrealized Holding Loss-Held-to-Maturity O Unrealized Holding Gain-Trading O Unrealized Holding Loss-Trading (17) O Available-for-Sale Debt Investments O Cash O Dividend Revenue O Equity Investments O Fair Value Adjustment-Available-for-Sale O Fair Value AdjustmentHeld-to-Maturity O Fair Value AdjustmentTrading Gain on Disposition Held-to-Maturity Debt Investments Interest Revenue O Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale O Unrealized Holding LossHeld-to-Maturity O Unrealized Holding Gain-Trading Unrealized Holding Loss-Trading (18) O Available-for-Sale Debt Investments Cash O Dividend Revenue O Equity Investments Gain on Disposition O Fair Value Adjustment-Available-for-Sale Held-to-Maturity Debt Investments O Fair Value AdjustmentHeld-to-Maturity Interest Revenue O Fair Value Adjustment Trading O Loss on Disposition O Trading Debt Investments Unrealized Holding GainAvailable-for-Sale O Unrealized Holding LossHeld-to-Maturity Unrealized Holding GainTrading