Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17. Mr. Delroy Morgan is a supplier of marl and a haulage contractor who operates his business from premises which he owns in Waltham Park

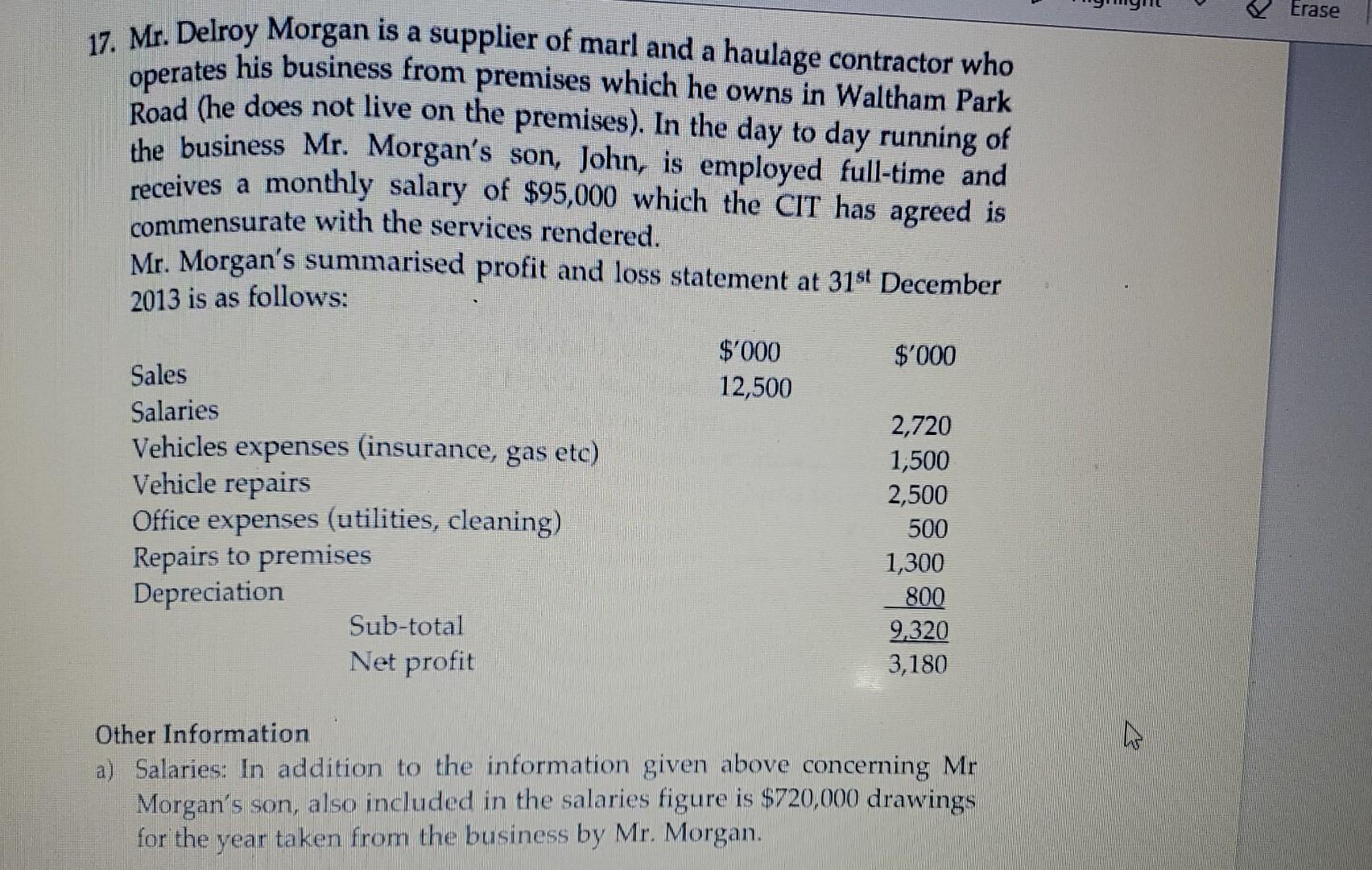

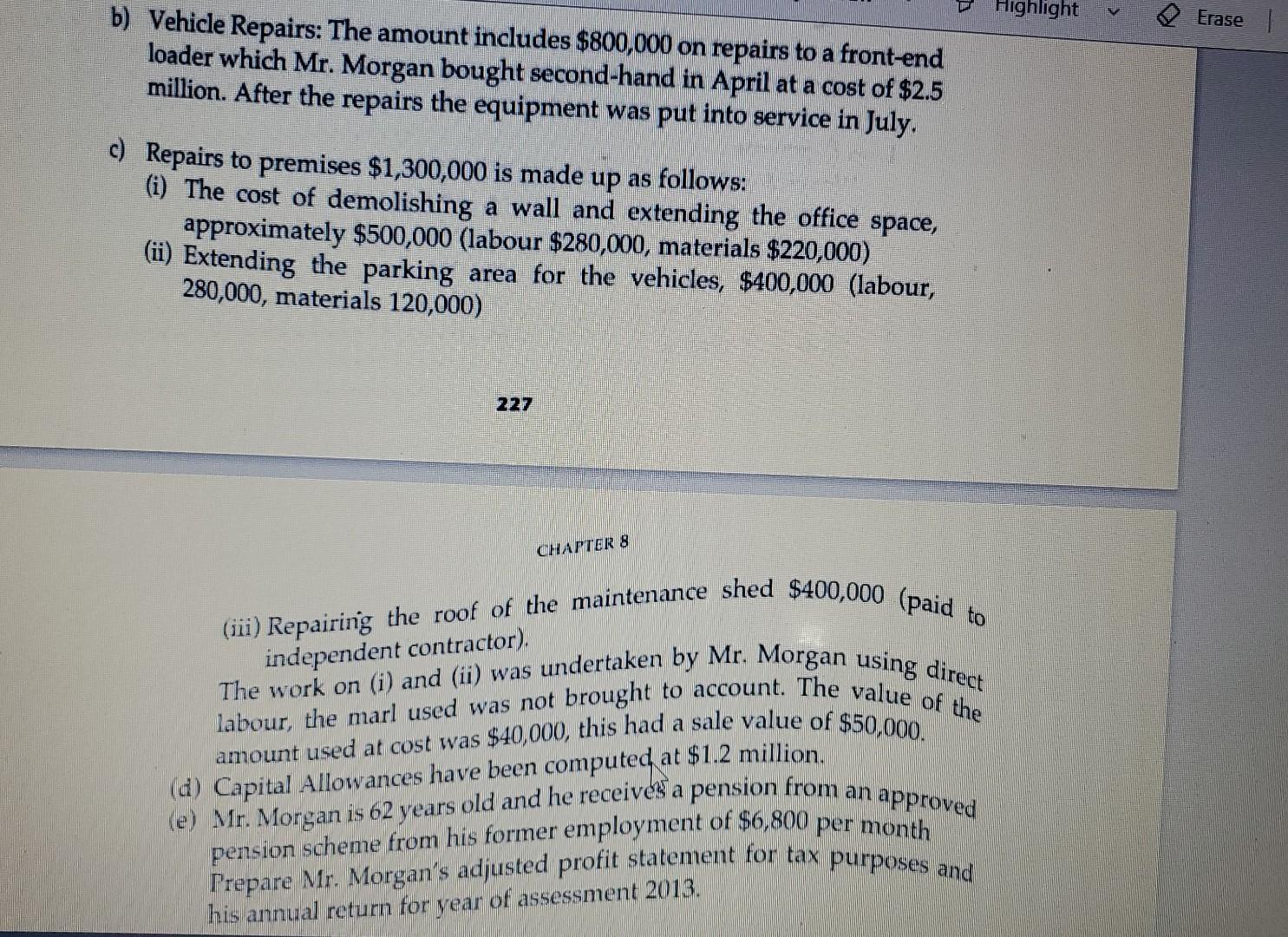

17. Mr. Delroy Morgan is a supplier of marl and a haulage contractor who operates his business from premises which he owns in Waltham Park Road (he does not live on the premises). In the day to day running of the business Mr. Morgan's son, John, is employed full-time and receives a monthly salary of $95,000 which the CIT has agreed is commensurate with the services rendered. Mr. Morgan's summarised profit and loss statement at 31st December 2013 is as follows: Other Information a) Salaries: In addition to the information given above concerning Mr Morgan's son, also included in the salaries figure is $720,000 drawings for the year taken from the business by Mr. Morgan. b) Vehicle Repairs: The amount includes $800,000 on repairs to a front-end loader which Mr. Morgan bought second-hand in April at a cost of $2.5 million. After the repairs the equipment was put into service in July. c) Repairs to premises $1,300,000 is made up as follows: (i) The cost of demolishing a wall and extending the office space, approximately $500,000 (labour $280,000, materials $220,000 ) (ii) Extending the parking area for the vehicles, $400,000 (labour, 280,000 , materials 120,000 ) 227 CHAFTER 8 (iii) Repairing the roof of the maintenance shed $400,000 (paid to independent contractor). The work on (i) and (ii) was undertaken by Mr. Morgan using direct labour, the marl used was not brought to account. The value of the amount used at cost was $40,000, this had a sale value of $50,000. (d) Capital Allowances have been computed at $1.2 million. (e) Mr. Morgan is 62 years old and he receives a pension from an approved pension scheme from his former employment of $6,800 per month Prepare Mr. Morgan's adjusted profit statement for tax purposes and his annual return for year of assessment 2013. 17. Mr. Delroy Morgan is a supplier of marl and a haulage contractor who operates his business from premises which he owns in Waltham Park Road (he does not live on the premises). In the day to day running of the business Mr. Morgan's son, John, is employed full-time and receives a monthly salary of $95,000 which the CIT has agreed is commensurate with the services rendered. Mr. Morgan's summarised profit and loss statement at 31st December 2013 is as follows: Other Information a) Salaries: In addition to the information given above concerning Mr Morgan's son, also included in the salaries figure is $720,000 drawings for the year taken from the business by Mr. Morgan. b) Vehicle Repairs: The amount includes $800,000 on repairs to a front-end loader which Mr. Morgan bought second-hand in April at a cost of $2.5 million. After the repairs the equipment was put into service in July. c) Repairs to premises $1,300,000 is made up as follows: (i) The cost of demolishing a wall and extending the office space, approximately $500,000 (labour $280,000, materials $220,000 ) (ii) Extending the parking area for the vehicles, $400,000 (labour, 280,000 , materials 120,000 ) 227 CHAFTER 8 (iii) Repairing the roof of the maintenance shed $400,000 (paid to independent contractor). The work on (i) and (ii) was undertaken by Mr. Morgan using direct labour, the marl used was not brought to account. The value of the amount used at cost was $40,000, this had a sale value of $50,000. (d) Capital Allowances have been computed at $1.2 million. (e) Mr. Morgan is 62 years old and he receives a pension from an approved pension scheme from his former employment of $6,800 per month Prepare Mr. Morgan's adjusted profit statement for tax purposes and his annual return for year of assessment 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started