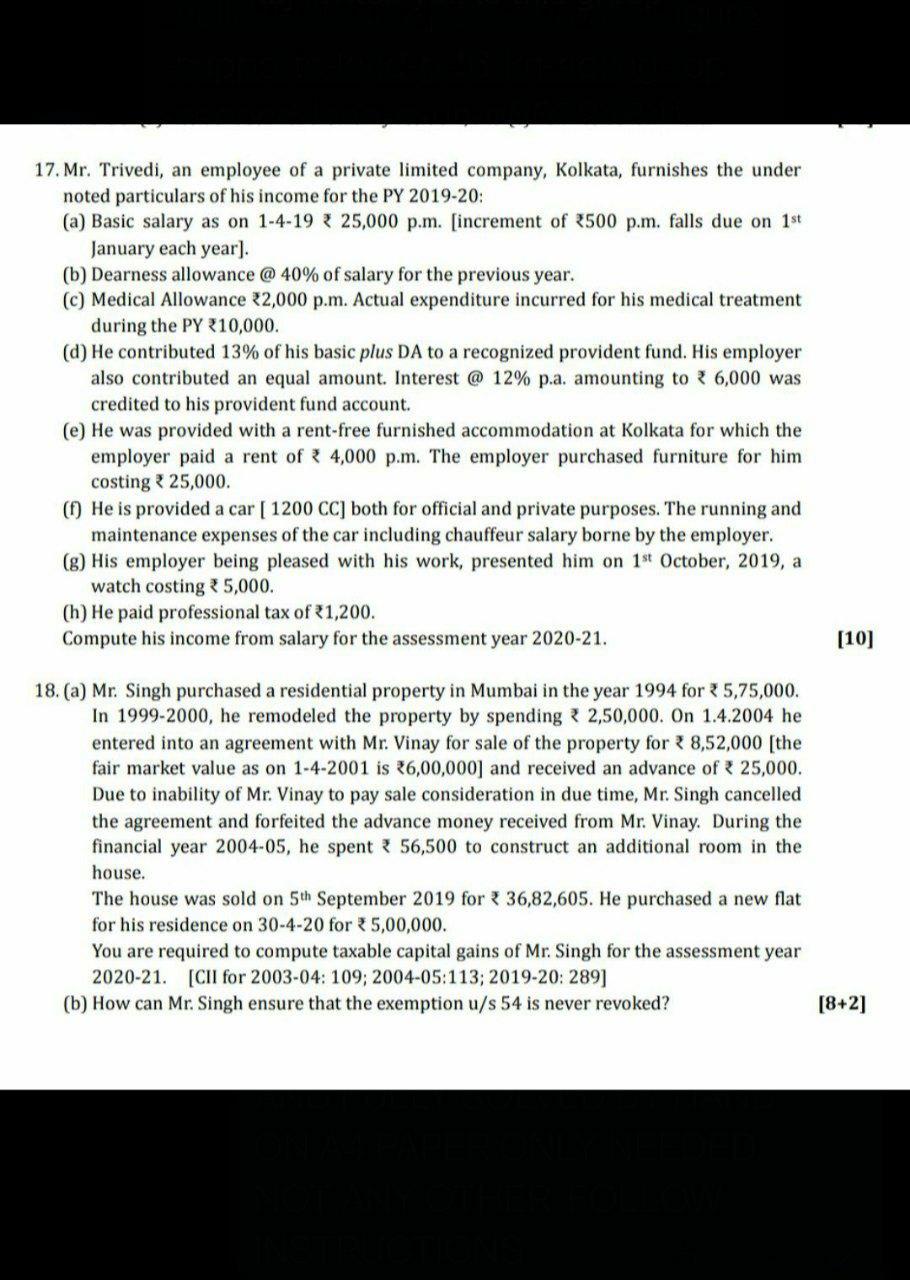

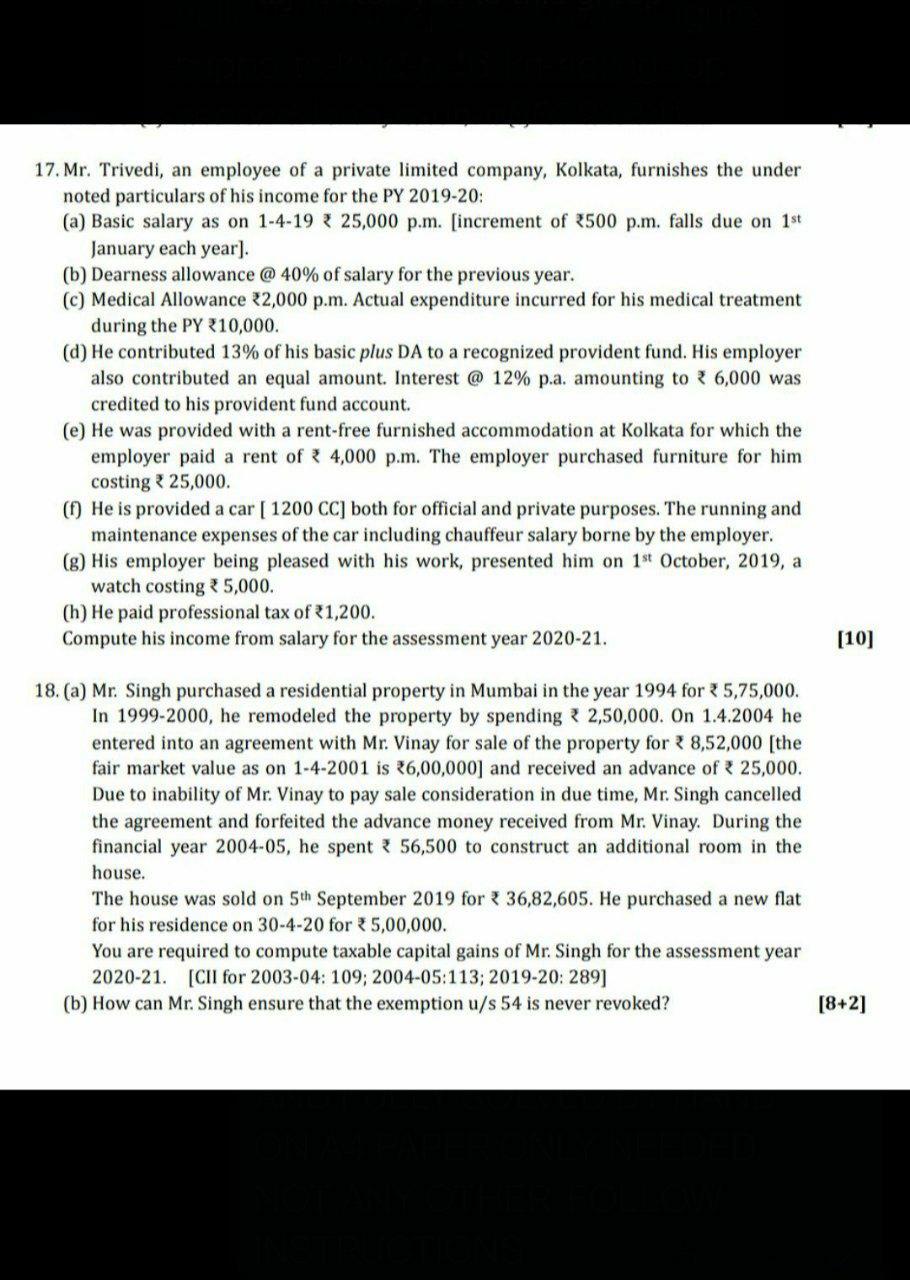

17. Mr. Trivedi, an employee of a private limited company, Kolkata, furnishes the under noted particulars of his income for the PY 2019-20: (a) Basic salary as on 1-4-1925,000 p.m. [increment of 500 p.m. falls due on 1st January each year) (b) Dearness allowance @ 40% of salary for the previous year. (c) Medical Allowance +2,000 p.m. Actual expenditure incurred for his medical treatment during the PY 10,000. (d) He contributed 13% of his basic plus DA to a recognized provident fund. His employer also contributed an equal amount. Interest @ 12% p.a. amounting to 6,000 was credited to his provident fund account. (e) He was provided with a rent-free furnished accommodation at Kolkata for which the employer paid a rent of 4,000 p.m. The employer purchased furniture for him costing 25,000 (1) He is provided a car [ 1200 CC] both for official and private purposes. The running and maintenance expenses of the car including chauffeur salary borne by the employer. (8) His employer being pleased with his work, presented him on 1st October, 2019, a watch costing 5,000. (h) He paid professional tax of 1,200. Compute his income from salary for the assessment year 2020-21. [10] 18. (a) Mr. Singh purchased a residential property in Mumbai in the year 1994 for 5,75,000. In 1999-2000, he remodeled the property by spending 2,50,000. On 1.4.2004 he entered into an agreement with Mr. Vinay for sale of the property for 8,52,000 [the fair market value as on 1-4-2001 is 26,00,000) and received an advance of 25,000. Due to inability of Mr. Vinay to pay sale consideration in due time, Mr. Singh cancelled the agreement and forfeited the advance money received from Mr. Vinay. During the financial year 2004-05, he spent 56,500 to construct an additional room in the house. The house was sold on 5th September 2019 for 36,82,605. He purchased a new flat for his residence on 30-4-20 for 5,00,000. You are required to compute taxable capital gains of Mr. Singh for the assessment year 2020-21. [CII for 2003-04: 109; 2004-05:113; 2019-20: 289] (b) How can Mr. Singh ensure that the exemption u/s 54 is never revoked? [8+2]