Answered step by step

Verified Expert Solution

Question

1 Approved Answer

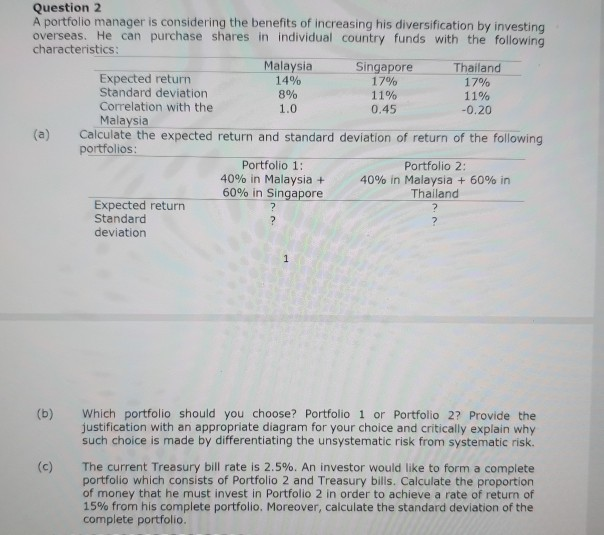

17% Question 2 A portfolio manager is considering the benefits of increasing his diversification by investing overseas. He can purchase shares in individual country funds

17% Question 2 A portfolio manager is considering the benefits of increasing his diversification by investing overseas. He can purchase shares in individual country funds with the following characteristics: Malaysia Singapore Thailand Expected return 14% 17% Standard deviation 8% 11% 11% Correlation with the 1.0 0.45 -0.20 Malaysia Calculate the expected return and standard deviation of return of the following portfolios: Portfolio 1: Portfolio 2: 40% in Malaysia + 40% in Malaysia + 60% in 60% in Singapore Thailand Expected return Standard deviation (b) Which portfolio should you choose? Portfolio 1 or Portfolio 2? Provide the justification with an appropriate diagram for your choice and critically explain why such choice is made by differentiating the unsystematic risk from systematic risk. c) The current Treasury bill rate is 2.5%. An investor would like to form a complete portfolio which consists of Portfolio 2 and Treasury bills. Calculate the proportion of money that he must invest in Portfolio 2 in order to achieve a rate of return of 15% from his complete portfolio. Moreover, calculate the standard deviation of the complete portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started