Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17. Red Corporation, which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of S40,000.

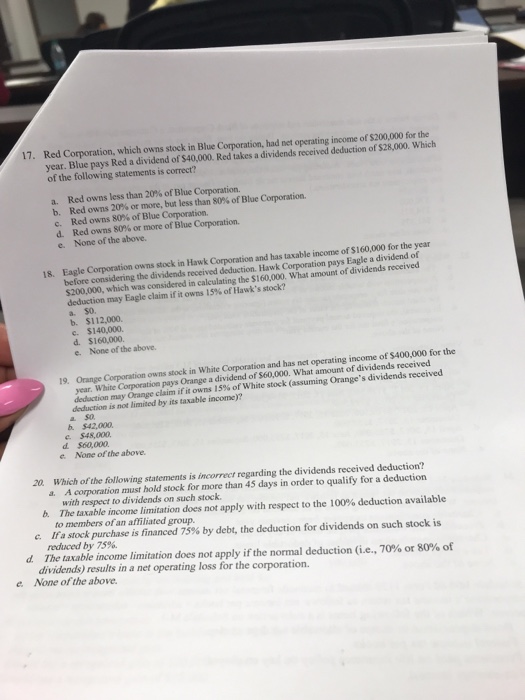

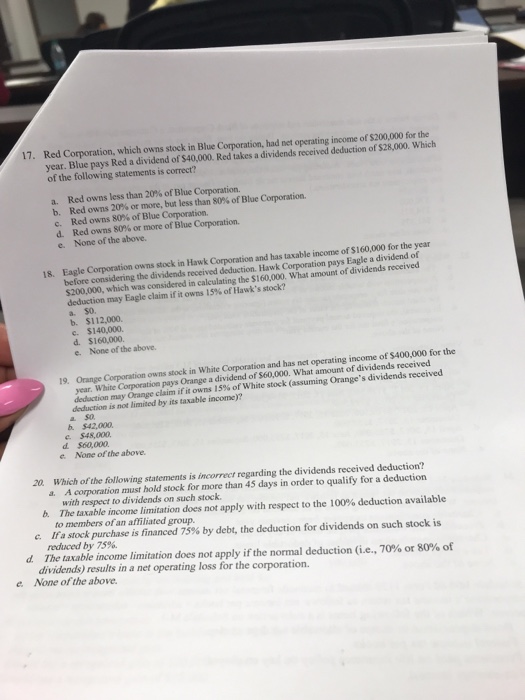

17. Red Corporation, which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of S40,000. Red takes a dividends received deduction of $28,000. Which of the following statements is correct? a. b. c. d. e. Red owns less than 20% of Blue Corporation. Red owns 20% or more, Red owns 80% of Blue Corporation. Red owns 80% or more of Blue Corporation. None of the above. but less than S0% of Blue Coporation. before considering the dividends received deduction. Hawk Corporation pays Eagle a dividend of $200,000, which was considered in calculating the $160,000. What amount of dividends received deduction may Eagle claim if it owns 15% of Hawk's stock? a. $0. b. $112,000. C. $140,000. d. $160,000. e. None of the above 19. Orange Corporation owns stock in White Corporation and has net operating income of $400,000 for the year. White Corporation pays Orange a dividend of S60,000. What amount of dividends received det tion may Orange claim ifit owns l 5% of white stock (assuming Orange's dividends received deduction is not limited by its taxable income)? b. $42,000 e. $48,000 d $60,000 e. None of the above 20. Which of the following statements is incorrect regarding the dividends received deduction? A corporation must hold stock for more than 45 days in order to qualify for a deduction a. with respect to dividends on such stock. b. The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group. Ifa stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%. c. d. The taxable income limitation does not applyifthe normal deduction (i.e., 70% or 80% of dividends) results in a net operating loss for the corporation. e None of the above

17. Red Corporation, which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of S40,000. Red takes a dividends received deduction of $28,000. Which of the following statements is correct? a. b. c. d. e. Red owns less than 20% of Blue Corporation. Red owns 20% or more, Red owns 80% of Blue Corporation. Red owns 80% or more of Blue Corporation. None of the above. but less than S0% of Blue Coporation. before considering the dividends received deduction. Hawk Corporation pays Eagle a dividend of $200,000, which was considered in calculating the $160,000. What amount of dividends received deduction may Eagle claim if it owns 15% of Hawk's stock? a. $0. b. $112,000. C. $140,000. d. $160,000. e. None of the above 19. Orange Corporation owns stock in White Corporation and has net operating income of $400,000 for the year. White Corporation pays Orange a dividend of S60,000. What amount of dividends received det tion may Orange claim ifit owns l 5% of white stock (assuming Orange's dividends received deduction is not limited by its taxable income)? b. $42,000 e. $48,000 d $60,000 e. None of the above 20. Which of the following statements is incorrect regarding the dividends received deduction? A corporation must hold stock for more than 45 days in order to qualify for a deduction a. with respect to dividends on such stock. b. The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group. Ifa stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%. c. d. The taxable income limitation does not applyifthe normal deduction (i.e., 70% or 80% of dividends) results in a net operating loss for the corporation. e None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started