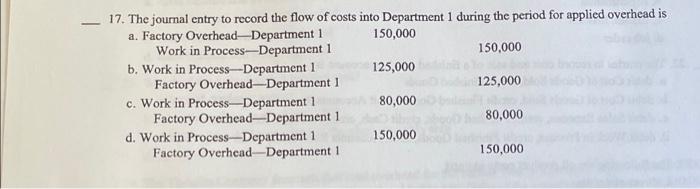

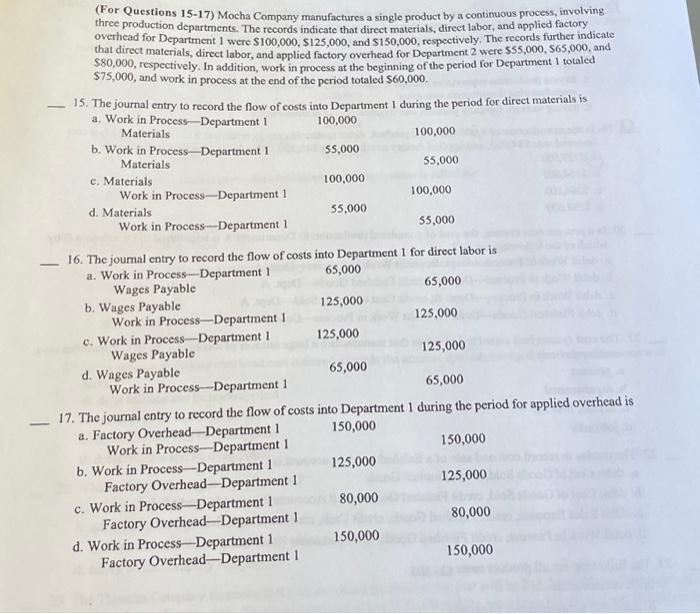

17. The journal entry to record the flow of costs into Department 1 during the period for applied overhead is 1 150,000 a. Factory Overhead-Department Work in Process-Department 1 b. Work in Process-Department 1 Factory Overhead-Department 1 c. Work in Process-Department 1 Factory Overhead-Department 1 d. Work in Process-Department 1 Factory Overhead-Department 1 125,000 80,000 150,000 150,000 125,000 80,000 150,000

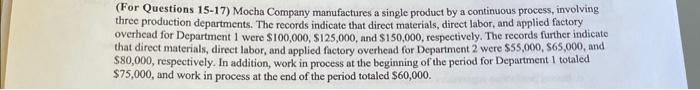

(For Questions 15-17) Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000,$125,000, and $150,000, respectively. The records further indieate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000,$65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000. 17. The journal entry to record the flow of costs into Department 1 during the period for applied overhead is a. Factory Overhead-Department 1150,000 Work in Process-Department 1150,000 b. Work in Process-Department 1125,000 Factory Overhead-Department 1125,000 c. Work in Process-Department 180,000 Factory Overhead-Department 180,000 d. Work in Process-Department 1150,000 FactoryOverhead-Department1150,000 (For Questions 15-17) Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000,$125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000,$65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000. (For Questions 15-17) Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000,$125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overticad for Department 2 were $5,000,$65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000. (For Questions 15-17) Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000,$125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000,$65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000