17. The plan manager used the historical return for investing in long-dated government bonds (7%) as the expected return for fixed-income component of plan

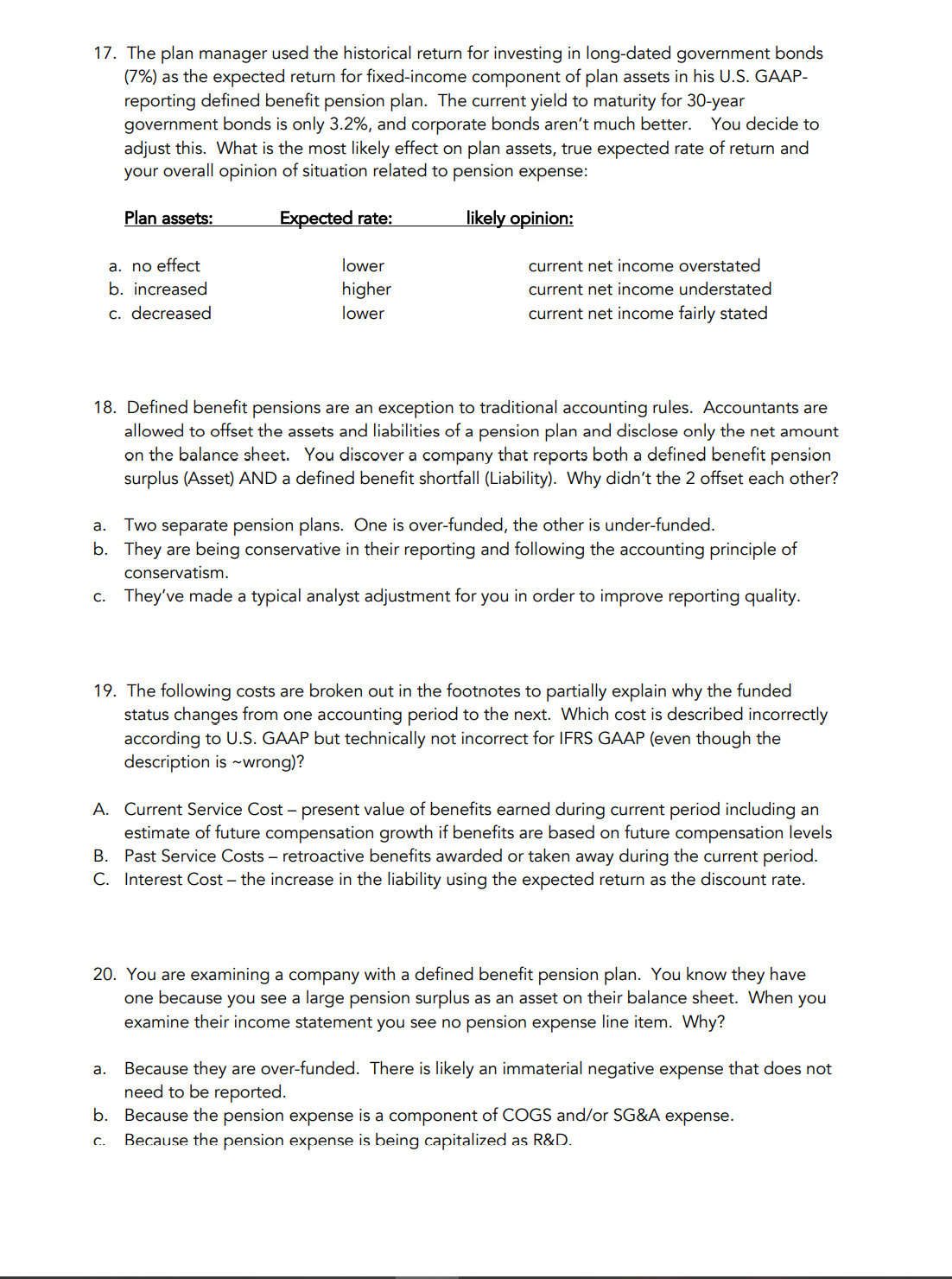

17. The plan manager used the historical return for investing in long-dated government bonds (7%) as the expected return for fixed-income component of plan assets in his U.S. GAAP- reporting defined benefit pension plan. The current yield to maturity for 30-year government bonds is only 3.2%, and corporate bonds aren't much better. You decide to adjust this. What is the most likely effect on plan assets, true expected rate of return and your overall opinion of situation related to pension expense: Expected rate: likely opinion: lower higher lower Plan assets: a. no effect b. increased c. decreased current net income overstated current net income understated current net income fairly stated 18. Defined benefit pensions are an exception to traditional accounting rules. Accountants are allowed to offset the assets and liabilities of a pension plan and disclose only the net amount on the balance sheet. You discover a company that reports both a defined benefit pension surplus (Asset) AND a defined benefit shortfall (Liability). Why didn't the 2 offset each other? a. Two separate pension plans. One is over-funded, the other is under-funded. b. They are being conservative in their reporting and following the accounting principle of conservatism. c. They've made a typical analyst adjustment for you in order to improve reporting quality. 19. The following costs are broken out in the footnotes to partially explain why the funded status changes from one accounting period to the next. Which cost is described incorrectly according to U.S. GAAP but technically not incorrect for IFRS GAAP (even though the description is wrong)? A. Current Service Cost - present value of benefits earned during current period including an estimate of future compensation growth if benefits are based on future compensation levels B. Past Service Costs - retroactive benefits awarded or taken away during the current period. C. Interest Cost - the increase in the liability using the expected return as the discount rate. a. 20. You are examining a company with a defined benefit pension plan. You know they have one because you see a large pension surplus as an asset on their balance sheet. When you examine their income statement you see no pension expense line item. Why? Because they are over-funded. There is likely an immaterial negative expense that does not need to be reported. b. Because the pension expense is a component of COGS and/or SG&A expense. C. Because the pension expense is being capitalized as R&D.

Step by Step Solution

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 17 The correct answer is b increased higher currentret income understated Explanation Adj...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started