Answered step by step

Verified Expert Solution

Question

1 Approved Answer

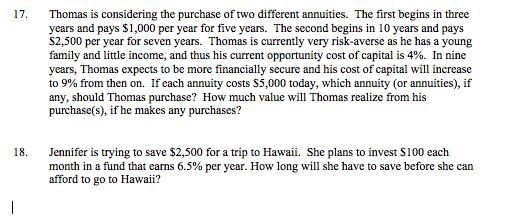

17. Thomas is considering the purchase of two different annuities. The first begins in three years and pays $1,000 per year for five years.

17. Thomas is considering the purchase of two different annuities. The first begins in three years and pays $1,000 per year for five years. The second begins in 10 years and pays $2,500 per year for seven years. Thomas is currently very risk-averse as he has a young family and little income, and thus his current opportunity cost of capital is 4%. In nine years, Thomas expects to be more financially secure and his cost of capital will increase to 9% from then on. If each annuity costs S5,000 today, which annuity (or annuities), if any, should Thomas purchase? How much value will Thomas realize from his purchase(s), if he makes any purchases? 18. Jennifer is trying to save $2,500 for a trip to Hawaii. She plans to invest S100 each month in a fund that earns 6.5% per year. How long will she have to save before she can afford to go to Hawaii?

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer 17 Before proceeding to solve and analyze Thomas situation one must recognize that the discou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started