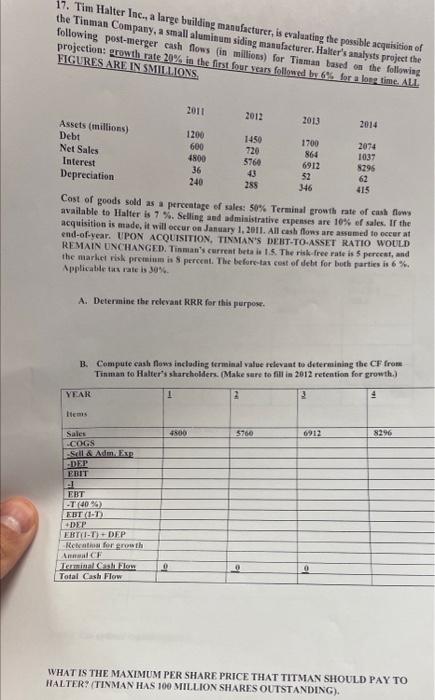

17. Tim Halter Inc., a large building manufacturer, is evaluating the possible acquisition of the Tinman Company, a small aluminum siding manufacturer. Halter's analysts project the following post-merger cash flows in millions) for Timman tased on the following projection: growth rate 20% in the first four years followed by 6% for a long time. ALL FIGURES ARE IN SMILLIONS, Assets (millions) Debt Net Sales Interest Depreciation 2011 2012 2013 2014 1200 1450 1700 600 2074 720 864 4800 1037 5760 6912 8296 36 43 52 62 240 285 346 415 Cost of goods sold as a percentage of sales: 50% Terminal growth rate of cash flows available to Halter is 7 %. Selling and administrative expenses are 10% of sales. If the acquisition is made, it will occur on January 1, 2011. Alle flows are assumed to occur at end-of-year. UPON ACQUISITION, TINMAN'S DEBT-TO-ASSET RATIO WOULD REMAIN UNCHANGED. Tinman's current betale 1.5 The risk-free rate is 5 percent, and the market risk premium is 8 percent. The before-tax cost of debt for both parties is 6%. Applicable tax rate is 30% A. Determine the relevant RRR for this purpose. B. Compute cash Nons including terminal value relevant to determining the CF from Tinman to Halter's shareholders. (Make sure to fill in 2012 retention for growth.) YEAR 1 2 3 9 4500 5760 6912 8296 Sales COGS Sal & Adm. Exp -DEP EBIT ERT -T (40) EBT(ID DEP EBITI-T) DEP Rotate for growth Anna CF Terminal Cash Flow Total Cash Flow 0 0 WHAT IS THE MAXIMUM PER SHARE PRICE THAT TITMAN SHOULD PAY TO HALTER (TINMAN HAS 100 MILLION SHARES OUTSTANDING). 17. Tim Halter Inc., a large building manufacturer, is evaluating the possible acquisition of the Tinman Company, a small aluminum siding manufacturer. Halter's analysts project the following post-merger cash flows in millions) for Timman tased on the following projection: growth rate 20% in the first four years followed by 6% for a long time. ALL FIGURES ARE IN SMILLIONS, Assets (millions) Debt Net Sales Interest Depreciation 2011 2012 2013 2014 1200 1450 1700 600 2074 720 864 4800 1037 5760 6912 8296 36 43 52 62 240 285 346 415 Cost of goods sold as a percentage of sales: 50% Terminal growth rate of cash flows available to Halter is 7 %. Selling and administrative expenses are 10% of sales. If the acquisition is made, it will occur on January 1, 2011. Alle flows are assumed to occur at end-of-year. UPON ACQUISITION, TINMAN'S DEBT-TO-ASSET RATIO WOULD REMAIN UNCHANGED. Tinman's current betale 1.5 The risk-free rate is 5 percent, and the market risk premium is 8 percent. The before-tax cost of debt for both parties is 6%. Applicable tax rate is 30% A. Determine the relevant RRR for this purpose. B. Compute cash Nons including terminal value relevant to determining the CF from Tinman to Halter's shareholders. (Make sure to fill in 2012 retention for growth.) YEAR 1 2 3 9 4500 5760 6912 8296 Sales COGS Sal & Adm. Exp -DEP EBIT ERT -T (40) EBT(ID DEP EBITI-T) DEP Rotate for growth Anna CF Terminal Cash Flow Total Cash Flow 0 0 WHAT IS THE MAXIMUM PER SHARE PRICE THAT TITMAN SHOULD PAY TO HALTER (TINMAN HAS 100 MILLION SHARES OUTSTANDING)