Question: 17-20 Please Problems 17-20 (9 points each): 17. Malachi, Inc. has the following partial comparative balance sheet data for 2018-2019: December 31, 2019December 31, 2018

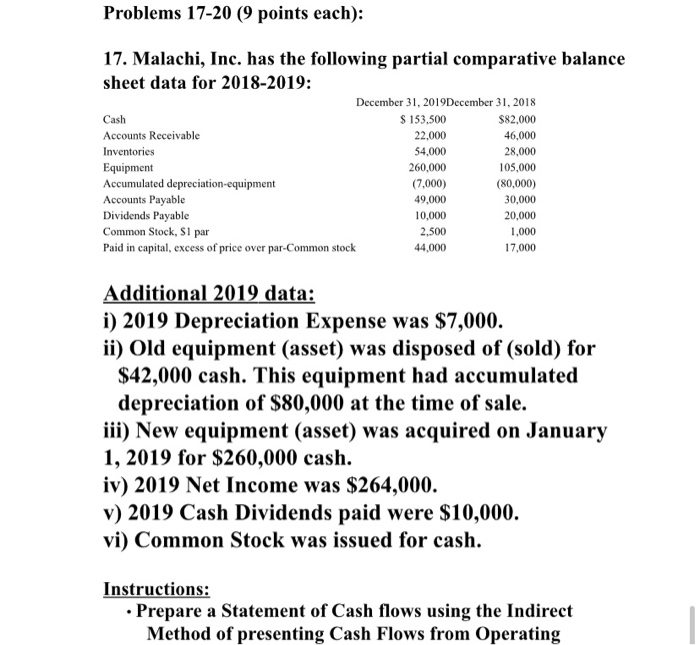

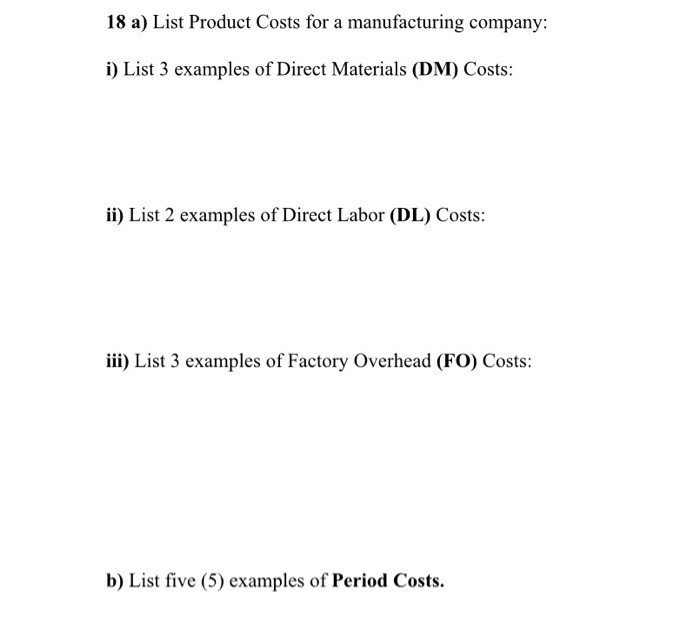

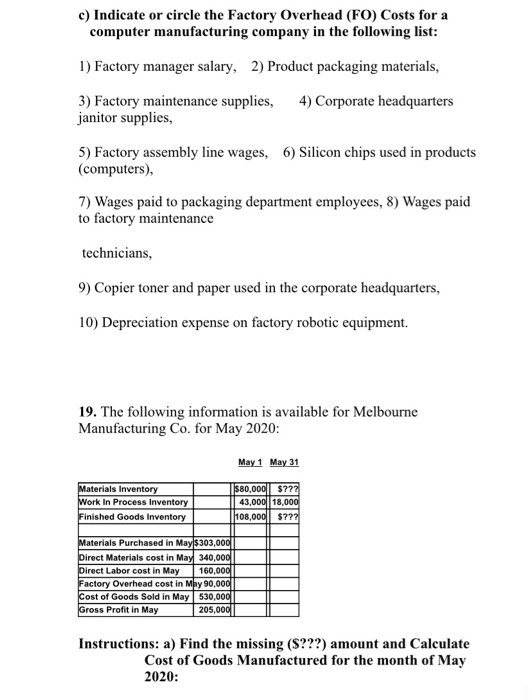

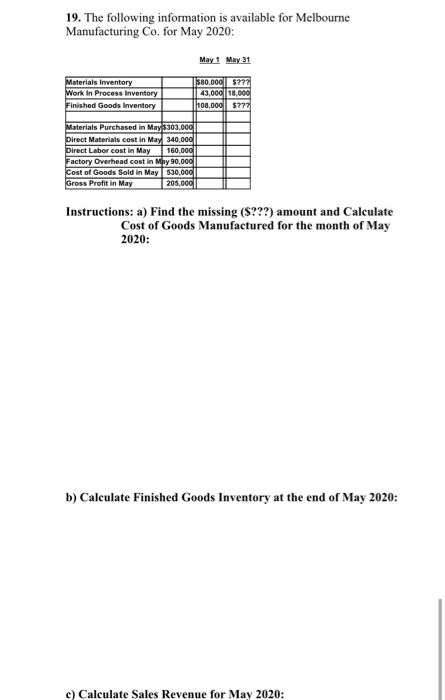

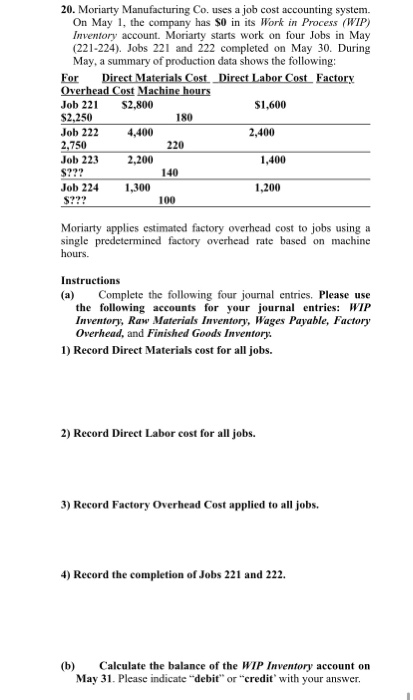

Problems 17-20 (9 points each): 17. Malachi, Inc. has the following partial comparative balance sheet data for 2018-2019: December 31, 2019December 31, 2018 Cash $ 153,500 $82,000 Accounts Receivable 22,000 46,000 Inventories 54,000 28,000 Equipment 260,000 105,000 Accumulated depreciation-equipment (7,000) (80,000) Accounts Payable 49,000 30,000 Dividends Payable 10,000 20,000 Common Stock, S1 par 2,500 1,000 Paid in capital, excess of price over par-Common stock 44,000 17,000 Additional 2019 data: i) 2019 Depreciation Expense was $7,000. ii) Old equipment (asset) was disposed of (sold) for $42,000 cash. This equipment had accumulated depreciation of $80,000 at the time of sale. iii) New equipment (asset) was acquired on January 1, 2019 for $260,000 cash. iv) 2019 Net Income was $264,000. v) 2019 Cash Dividends paid were $10,000. vi) Common Stock was issued for cash. Instructions: Prepare a Statement of Cash flows using the Indirect Method of presenting Cash Flows from Operating 18 a) List Product Costs for a manufacturing company: i) List 3 examples of Direct Materials (DM) Costs: ii) List 2 examples of Direct Labor (DL) Costs: iii) List 3 examples of Factory Overhead (FO) Costs: b) List five (5) examples of Period Costs. c) Indicate or circle the Factory Overhead (FO) Costs for a computer manufacturing company in the following list: 1) Factory manager salary, 2) Product packaging materials, 3) Factory maintenance supplies, 4) Corporate headquarters janitor supplies, 5) Factory assembly line wages, 6) Silicon chips used in products (computers), 7) Wages paid to packaging department employees, 8) Wages paid to factory maintenance technicians, 9) Copier toner and paper used in the corporate headquarters, 10) Depreciation expense on factory robotic equipment. 19. The following information is available for Melbourne Manufacturing Co. for May 2020: May 1 May 31 Materials Inventory Work In Process Inventory Finished Goods Inventory $80,000 $777 43,000 18,000 108,000||$7221 Materials Purchased in May S303,000 Direct Materials cost in May 340,000 Direct Labor cost in May 160,000 Factory Overhead cost in Mpy 90,000 Cost of Goods Sold in May 530,000 Gross Profit in May 205,000 Instructions: a) Find the missing (S???) amount and Calculate Cost of Goods Manufactured for the month of May 2020: 19. The following information is available for Melbourne Manufacturing Co. for May 2020: May 1 May 31 Materials Inventory Work In Process Inventory Finished Goods Inventory 380,000 $777 43,000 18.000 108,000 5772 Materials Purchased in May 303,000 Direct Materials cost in May 340,000 Direct Labor cost in May 160,000 Factory Overhead cost in May 90,000 Cost of Goods Sold in May 530,000 Gross Profit in May 205,000 Instructions: a) Find the missing (S???) amount and Calculate Cost of Goods Manufactured for the month of May 2020: b) Calculate Finished Goods Inventory at the end of May 2020: c) Calculate Sales Revenue for May 2020: 20. Moriarty Manufacturing Co. uses a job cost accounting system. On May 1, the company has so in its Work in Process (WIP) Inventory account. Moriarty starts work on four Jobs in May (221-224). Jobs 221 and 222 completed on May 30. During May, a summary of production data shows the following: For Direct Materials Cost. Direct Labor Cost Factory Overhead Cost Machine hours Job 221 $2,800 $1,600 $2,250 180 Job 222 4,400 2,400 2,750 220 Job 223 2,200 1,400 S??? 140 Job 224 1,300 1,200 100 Moriarty applies estimated factory overhead cost to jobs using a single predetermined factory overhead rate based on machine hours. Instructions Complete the following four journal entries. Please use the following accounts for your journal entries: WIP Inventory, Raw Materials Inventory, Wages Payable, Factory Overhead, and Finished Goods Inventory. 1) Record Direct Materials cost for all jobs. 2) Record Direct Labor cost for all jobs. 3) Record Factory Overhead Cost applied to all jobs. 4) Record the completion of Jobs 221 and 222. (b) Calculate the balance of the WIP Inventory account on May 31. Please indicate "debit" or "credit' with your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts