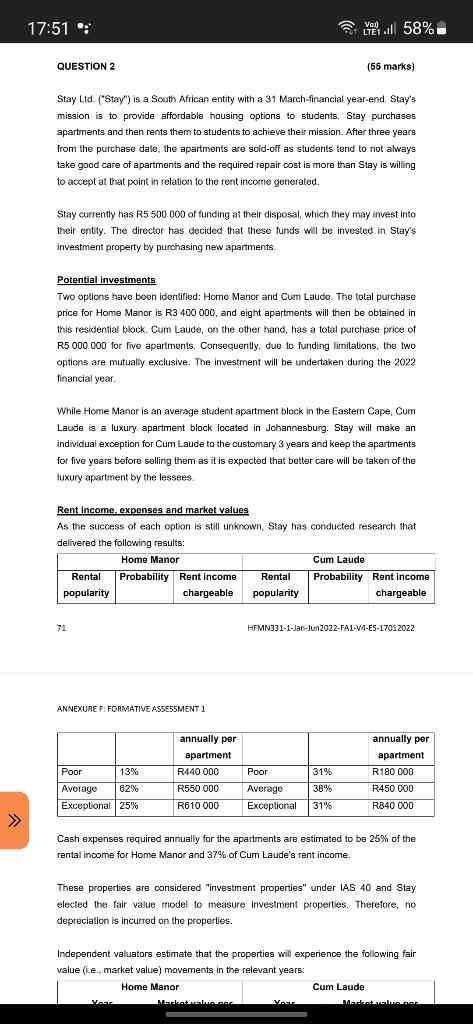

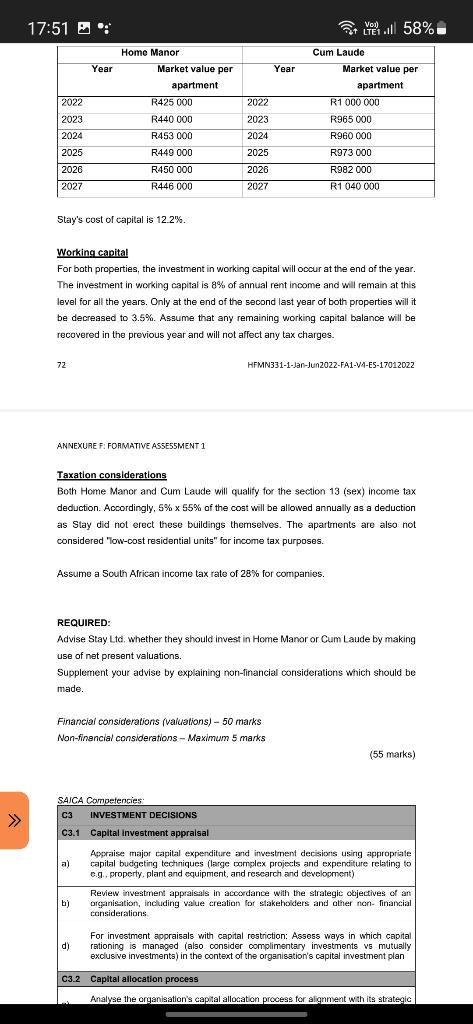

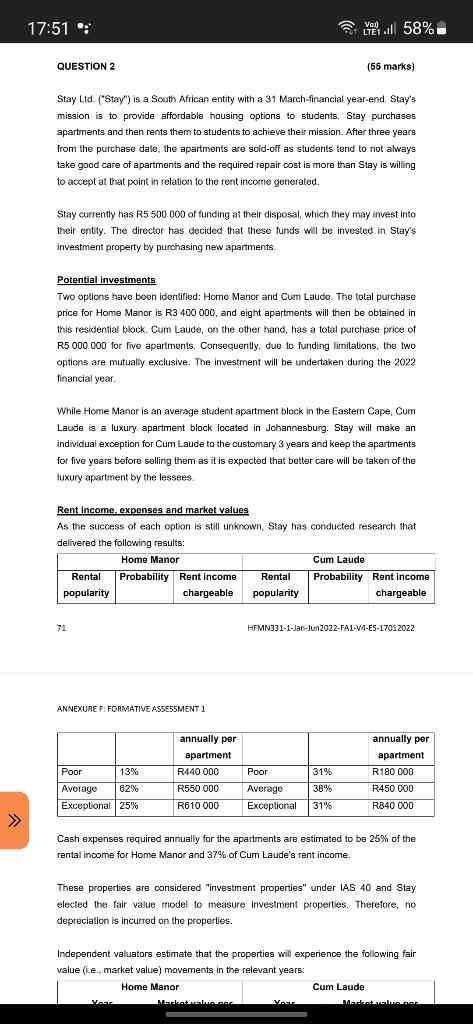

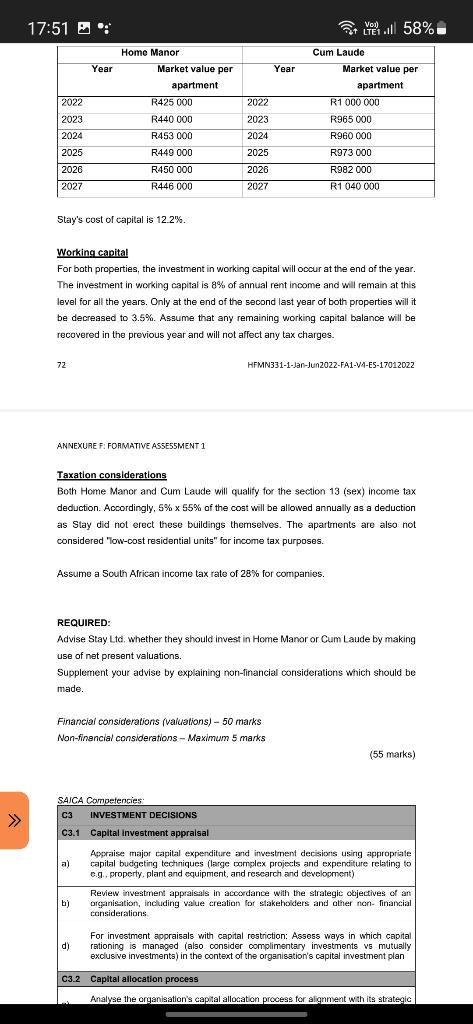

17:51 : Vol LTE1 . .ull 58% QUESTION 2 (55 marks) ) Stay Ltd. ("Stay") is a South African entity with a 31 March-financial year-end. Stay's mission is to provide affordable housing options to students. Stay purchases apartments and then rents them to students to achieve their mission. After three years from the purchase date, the apartments are sold-off as students tend to not always take good care of apartments and the required repair cost is more than Stay is willing to accept at that point in relation to the rent income generated. . Stay currently has R5 500 000 of funding at their disposal, which they may invest into their entity. The director has decided that these funds will be invested in Stay's investment property by purchasing new apartments. Potential investments Two options have been identified: Home Manor and Cum Laude. The total purchase price for Home Manor is R3 400 000, and eight apartments will then be obtained in this residential block. Cum Laude, on the other hand, has a total purchase price of R5 000 000 for five apartments. Consequently, due to funding limitations, the two options are mutually exclusive. The investment will be undertaken during the 2022 financial year. While Home Manor is an average student apartment block in the Eastern Cape, Cum Laude is a luxury apartment block located in Johannesburg. Stay will make an individual exception for Cum Laude to the customary 3 years and keep the apartments for five years before selling them as it is expected that better care will be taken of the luxury apartment by the lessees Rent Income. expenses and market values As the success of each option is still unknown, Stay has conducted research that delivered the following results: Home Manor Cum Laude Rental Probability Rent income Rental Probability Rent income popularity chargeable popularity chargeable 71 HEMN331-1-Jan-Jun2022-FA1-V4-E5-17012022 ANNEXURE F. FORMATIVE ASSESSMENT 1 Poor 13% annually por apartment R440 000 R550 000 R610 000 Poor 31% annually per apartment R180 000 R450 000 R840 000 38% Average 62% Exceptional 25% Average Exceptional 31% >> Cash expenses required annually for the apartments are estimated to be 25% of the rental income for Home Manor and 37% of Cum Laude's rent income. These properties are considered "investment properties" under IAS 40 and Stay elected the fair value model to measure investment properties. Therefore, no depreciation is incurred on the properties. Independent valuators estimate that the properties will experience the following fair value (i.e., market value) movements in the relevant years: Home Manor Cum Laude Var Markt der We Medtem 17:51 B : et vell 58%. Vol) Il Home Manor Market value per Year Year 2022 2023 2022 2023 Cum Laude Market value per apartment R1 000 000 R965 000 R960 000 R973 000 R982 000 R1 040 000 apartment R425 000 R440 000 R453 000 R449 000 R450 000 R446 000 2024 2024 2025 2026 2027 2025 2026 2027 Stay's cost of capital is 12.2% Working capital For both properties, the investment in working capital will occur at the end of the year. The investment in working capital is 8% of annual rent income and will remain at this level for all the years. Only at the end of the second last year of both properties will it be decreased to 3.5%. Assume that any remaining working capital balance will be recovered in the previous year and will not affect any tax charges. 72 HEMN331-1-Jan-Jun2022-FA1-V4-E5-17012022 ANNEXURE F. FORMATIVE ASSESSMENT 1 Taxation considerations Both Home Manor and Cum Laude will qualify for the section 13 (sex) income tax deduction. Accordingly, 5% x 55% of the cost will be allowed annually as a deduction as Stay did not erect these buildings themselves. The apartenents are also not considered 'low-cost residential units" for income tax purposes. Assume a South African income tax rate of 28% for companies. REQUIRED: Advise Stay Ltd, whether they should invest in Home Manor or Cum Laude by making use of net present valuations. Supplement your advise by explaining non-financial considerations which should be made Financial considerations (valuations) - 50 marks Non-financial considerations - Maximum 5 marks (55 marks) >> SAICA Competencies: C3 INVESTMENT DECISIONS C3.1 Capital Investment appraisal a) Appraise major capital expenditure and investment decisions using appropriate capital budgeting techniques (large complex projects and expenditure relating to c.g.property, plant and equipment, and research and development) Review investment appraisals in accordance with the strategic objectives of an organisation, including value creation for stakeholders and other non financial b) siderations d) For investment appraisals with capital restriction: Assess ways in which capital rationing is managed (also consider complimentary investments vs mutually exclusive investments) in the context of the organisation's capital investment plan C3.2 Capital allocation process Analyse the organisation's capital allocation process for alignment with its strategia 17:51 : Vol LTE1 . .ull 58% QUESTION 2 (55 marks) ) Stay Ltd. ("Stay") is a South African entity with a 31 March-financial year-end. Stay's mission is to provide affordable housing options to students. Stay purchases apartments and then rents them to students to achieve their mission. After three years from the purchase date, the apartments are sold-off as students tend to not always take good care of apartments and the required repair cost is more than Stay is willing to accept at that point in relation to the rent income generated. . Stay currently has R5 500 000 of funding at their disposal, which they may invest into their entity. The director has decided that these funds will be invested in Stay's investment property by purchasing new apartments. Potential investments Two options have been identified: Home Manor and Cum Laude. The total purchase price for Home Manor is R3 400 000, and eight apartments will then be obtained in this residential block. Cum Laude, on the other hand, has a total purchase price of R5 000 000 for five apartments. Consequently, due to funding limitations, the two options are mutually exclusive. The investment will be undertaken during the 2022 financial year. While Home Manor is an average student apartment block in the Eastern Cape, Cum Laude is a luxury apartment block located in Johannesburg. Stay will make an individual exception for Cum Laude to the customary 3 years and keep the apartments for five years before selling them as it is expected that better care will be taken of the luxury apartment by the lessees Rent Income. expenses and market values As the success of each option is still unknown, Stay has conducted research that delivered the following results: Home Manor Cum Laude Rental Probability Rent income Rental Probability Rent income popularity chargeable popularity chargeable 71 HEMN331-1-Jan-Jun2022-FA1-V4-E5-17012022 ANNEXURE F. FORMATIVE ASSESSMENT 1 Poor 13% annually por apartment R440 000 R550 000 R610 000 Poor 31% annually per apartment R180 000 R450 000 R840 000 38% Average 62% Exceptional 25% Average Exceptional 31% >> Cash expenses required annually for the apartments are estimated to be 25% of the rental income for Home Manor and 37% of Cum Laude's rent income. These properties are considered "investment properties" under IAS 40 and Stay elected the fair value model to measure investment properties. Therefore, no depreciation is incurred on the properties. Independent valuators estimate that the properties will experience the following fair value (i.e., market value) movements in the relevant years: Home Manor Cum Laude Var Markt der We Medtem 17:51 B : et vell 58%. Vol) Il Home Manor Market value per Year Year 2022 2023 2022 2023 Cum Laude Market value per apartment R1 000 000 R965 000 R960 000 R973 000 R982 000 R1 040 000 apartment R425 000 R440 000 R453 000 R449 000 R450 000 R446 000 2024 2024 2025 2026 2027 2025 2026 2027 Stay's cost of capital is 12.2% Working capital For both properties, the investment in working capital will occur at the end of the year. The investment in working capital is 8% of annual rent income and will remain at this level for all the years. Only at the end of the second last year of both properties will it be decreased to 3.5%. Assume that any remaining working capital balance will be recovered in the previous year and will not affect any tax charges. 72 HEMN331-1-Jan-Jun2022-FA1-V4-E5-17012022 ANNEXURE F. FORMATIVE ASSESSMENT 1 Taxation considerations Both Home Manor and Cum Laude will qualify for the section 13 (sex) income tax deduction. Accordingly, 5% x 55% of the cost will be allowed annually as a deduction as Stay did not erect these buildings themselves. The apartenents are also not considered 'low-cost residential units" for income tax purposes. Assume a South African income tax rate of 28% for companies. REQUIRED: Advise Stay Ltd, whether they should invest in Home Manor or Cum Laude by making use of net present valuations. Supplement your advise by explaining non-financial considerations which should be made Financial considerations (valuations) - 50 marks Non-financial considerations - Maximum 5 marks (55 marks) >> SAICA Competencies: C3 INVESTMENT DECISIONS C3.1 Capital Investment appraisal a) Appraise major capital expenditure and investment decisions using appropriate capital budgeting techniques (large complex projects and expenditure relating to c.g.property, plant and equipment, and research and development) Review investment appraisals in accordance with the strategic objectives of an organisation, including value creation for stakeholders and other non financial b) siderations d) For investment appraisals with capital restriction: Assess ways in which capital rationing is managed (also consider complimentary investments vs mutually exclusive investments) in the context of the organisation's capital investment plan C3.2 Capital allocation process Analyse the organisation's capital allocation process for alignment with its strategia