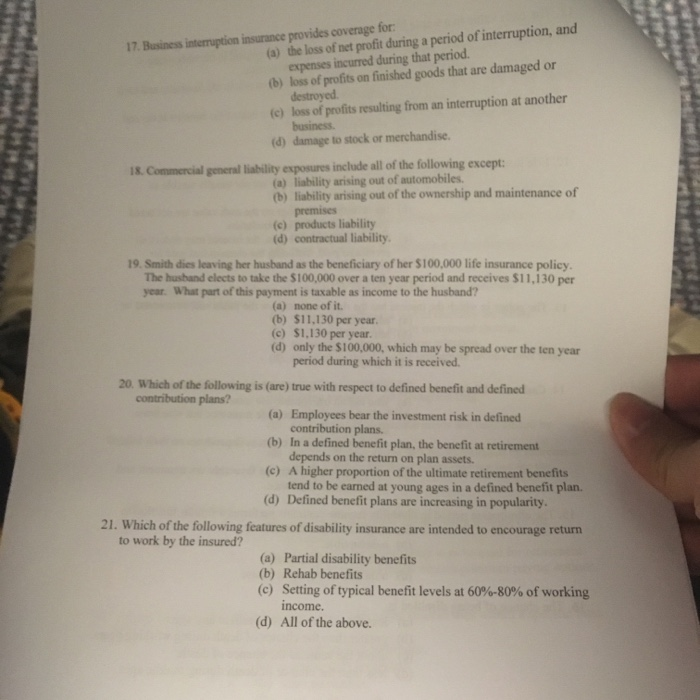

17.Business interruption insurance provides coverage for (a) the loss of net profit during a period of interruption, and expenses incurred during that period b) loss of profits on finished goods that are damaged or destroyed (c) loss of profits resulting from an interruption at another business. 2 (d) damage to stock or merchandise. (a) liability arising out of automobiles (b) liability arising out of the ownership and maintenance of premises (c) products liability d) contractual liability 19. Smith dies leaving her husband as the beneficiary of her $100,000 life insurance policy The hushand elects to take the $100,000 over a ten year period and receives $11,130 per year. What part of this payment is taxable as income to the husband? (a) none of it. (b) $11,130 per year. (c) $1,130 per year (d) only the $100,000, which may be spread over the ten year period during which it is received 20. Which of the following is (are) true with respect to defined benefit and defined contribution plans? (a) Employees bear the investment risk in defined contribution plans. (b) In a defined benefit plan, the benefit at retirement depends on the return on plan assets. (c) A higher proportion of the ultimate retirement benefits tend to be earned at young ages in a defined benefit plan. (d) Defined benefit plans are increasing in popularity. 21. Which of the following features of disability insurance are intended to encourage return to work by the insured? (a) Partial disability benefits (b) Rehab benefits (c) Setting of typical benefit levels at 60%-80% of working income (d) All of the above. 17.Business interruption insurance provides coverage for (a) the loss of net profit during a period of interruption, and expenses incurred during that period b) loss of profits on finished goods that are damaged or destroyed (c) loss of profits resulting from an interruption at another business. 2 (d) damage to stock or merchandise. (a) liability arising out of automobiles (b) liability arising out of the ownership and maintenance of premises (c) products liability d) contractual liability 19. Smith dies leaving her husband as the beneficiary of her $100,000 life insurance policy The hushand elects to take the $100,000 over a ten year period and receives $11,130 per year. What part of this payment is taxable as income to the husband? (a) none of it. (b) $11,130 per year. (c) $1,130 per year (d) only the $100,000, which may be spread over the ten year period during which it is received 20. Which of the following is (are) true with respect to defined benefit and defined contribution plans? (a) Employees bear the investment risk in defined contribution plans. (b) In a defined benefit plan, the benefit at retirement depends on the return on plan assets. (c) A higher proportion of the ultimate retirement benefits tend to be earned at young ages in a defined benefit plan. (d) Defined benefit plans are increasing in popularity. 21. Which of the following features of disability insurance are intended to encourage return to work by the insured? (a) Partial disability benefits (b) Rehab benefits (c) Setting of typical benefit levels at 60%-80% of working income (d) All of the above