Answered step by step

Verified Expert Solution

Question

1 Approved Answer

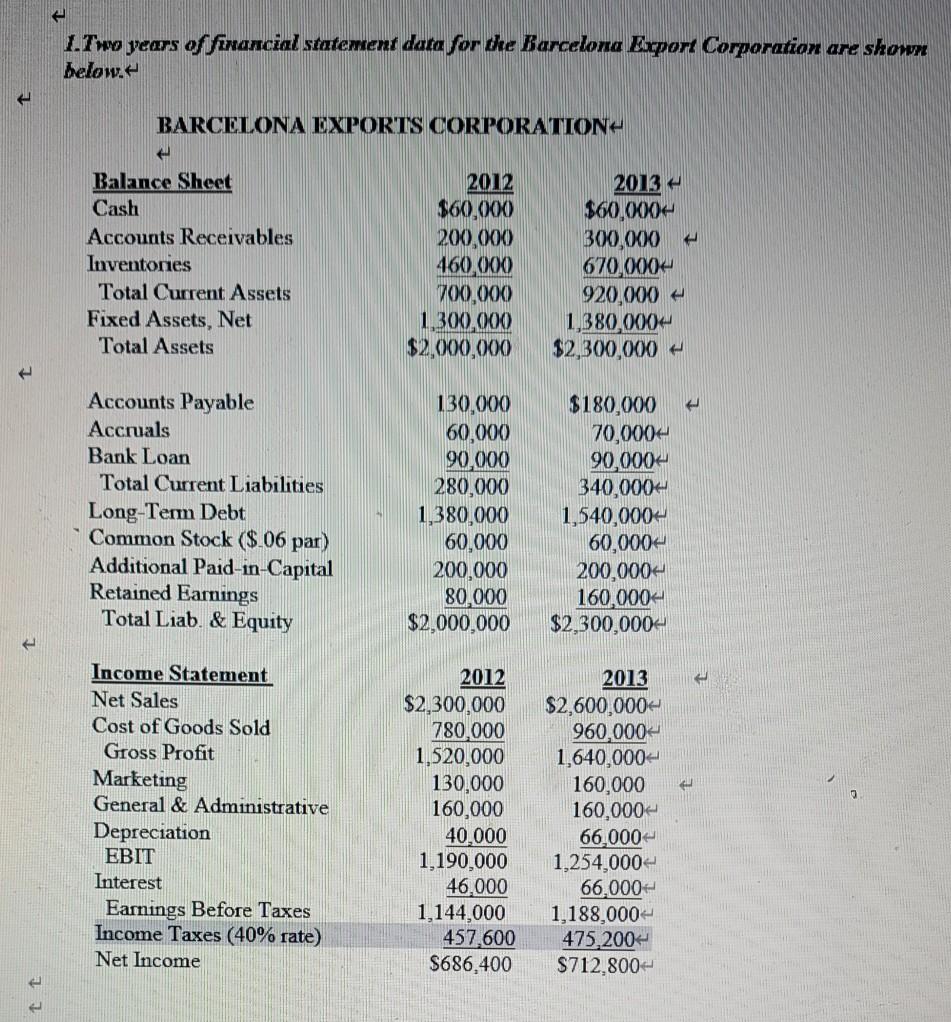

1.7'w years of financial statement data for the Barcelona Export Corporation are shown below. BARCELONA EXPORTS CORPORATION Balance Sheet Cash Accounts Receivables Inventories Total Current

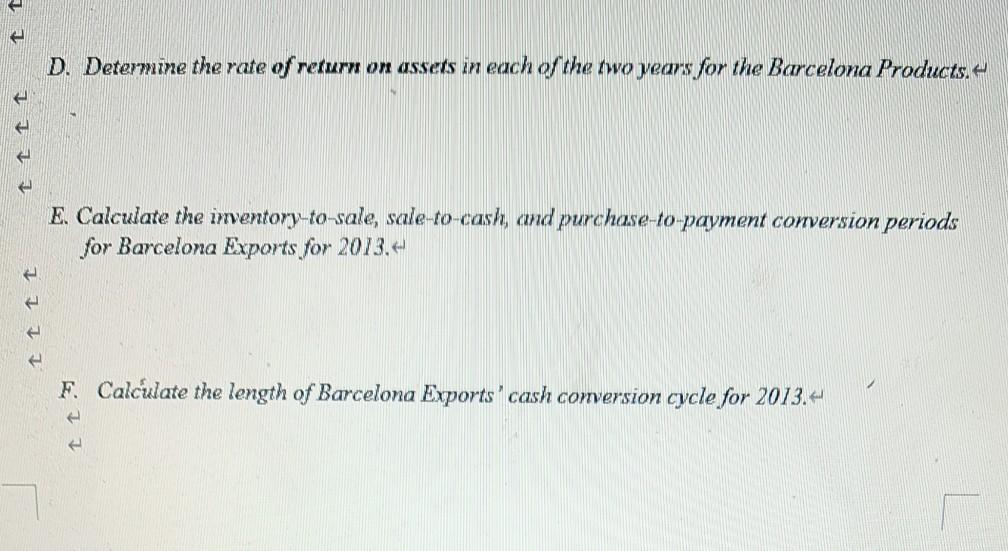

1.7'w years of financial statement data for the Barcelona Export Corporation are shown below. BARCELONA EXPORTS CORPORATION Balance Sheet Cash Accounts Receivables Inventories Total Current Assets Fixed Assets, Net Total Assets 2012 $60,000 200,000 460,000 700.000 1,300.000 $2,000,000 2013 - $60,000 300,000 670,000 920,000 1,380.000- $2,300,000 Accounts Payable Accruals Bank Loan Total Current Liabilities Long-Term Debt Common Stock ($ 06 par) Additional Paid-in-Capital Retained Earnings Total Liab. & Equity 130,000 60,000 90.000 280,000 1,380,000 60,000 200,000 80,000 $2,000,000 $180,000 70,000 90.000- 340,000+ 1,540,000+ 60,000 200,000 160.0004 $2,300,000 Income Statement Net Sales Cost of Goods Sold Gross Profit Marketing General & Administrative Depreciation EBIT Interest Earnings Before Taxes Income Taxes (40% rate) Net Income 2012 $2,300,000 780,000 1,520,000 130,000 160,000 40,000 1,190,000 46.000 1,144,000 457,600 $686,400 2013 $2,600,000+ 960,000~ 1,640,000 160,000 160,000 66.000 1,254,000 66.000- 1,188,000 475 2004 $712.800- D. Determine the rate of return on assets in each of the two years for the Barcelona Products.- E. Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Barcelona Exports for 2013. F. Calculate the length of Barcelona Exports' cash conversion cycle for 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started