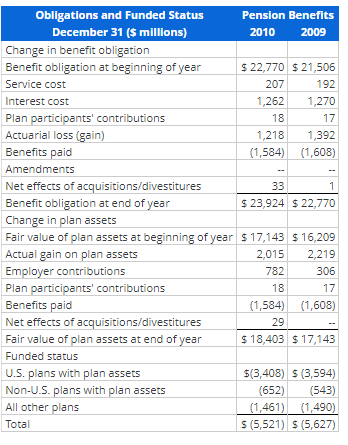

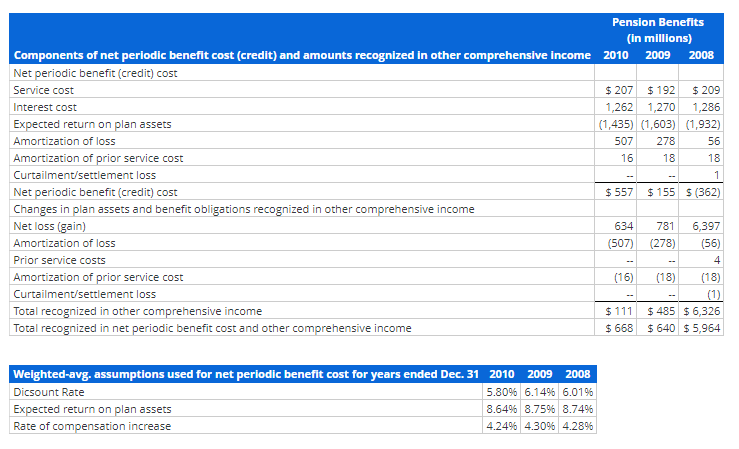

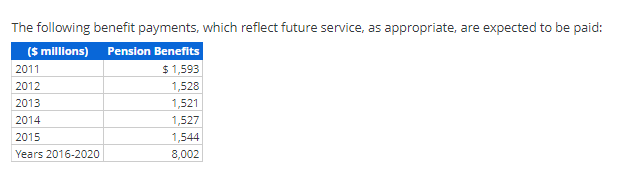

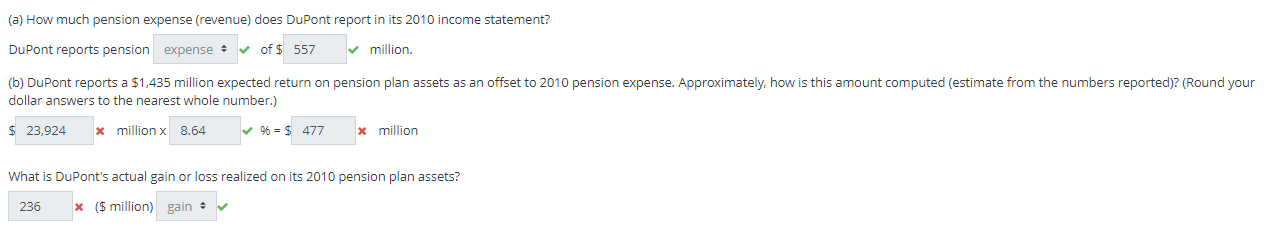

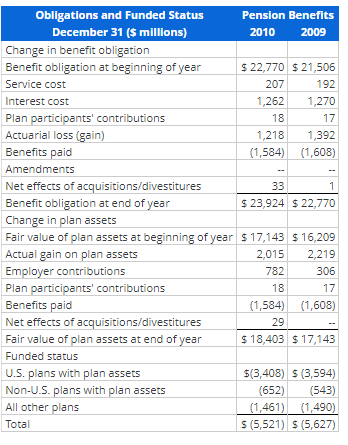

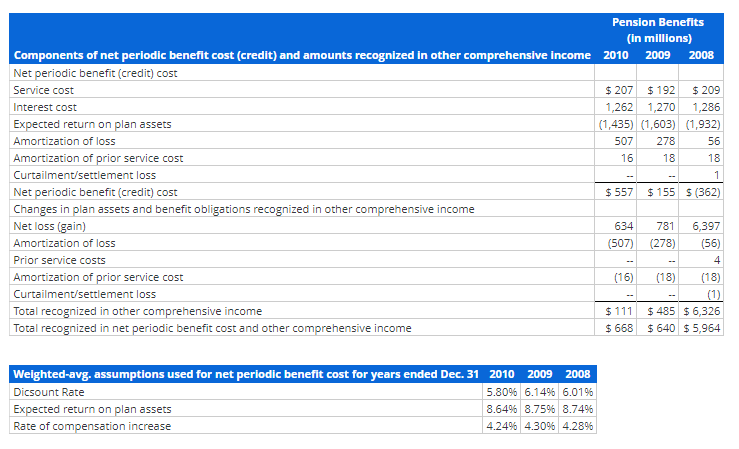

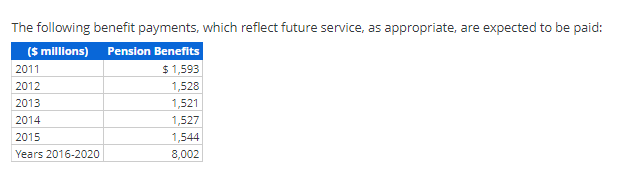

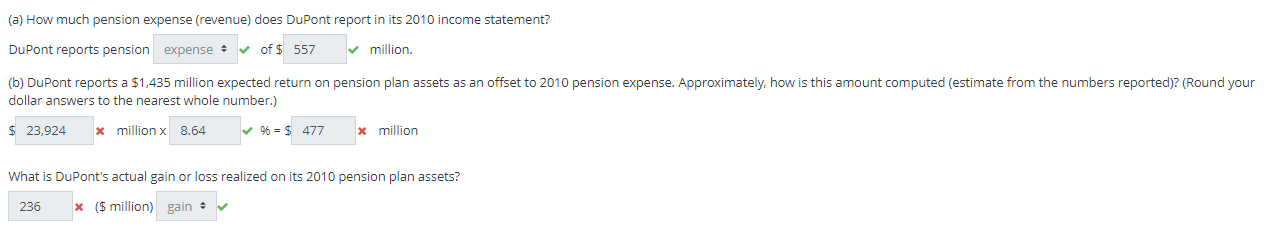

18 17 Obligations and Funded Status Pension Benefits December 31 ($ millions) 2010 2009 Change in benefit obligation Benefit obligation at beginning of year $ 22,770 $ 21,506 Service cost 207 192 Interest cost 1,262 1,270 Plan participants' contributions Actuarial loss (gain) 1,218 1,392 Benefits paid (1,584) (1,608) Amendments Net effects of acquisitions/divestitures 33 Benefit obligation at end of year $ 23,924 $ 22,770 Change in plan assets Fair value of plan assets at beginning of year $17,143 $ 16,209 Actual gain on plan assets 2,015 2,219 Employer contributions 782306 Plan participants' contributions 18 17 Benefits paid (1,584) (1,608) Net effects of acquisitions divestitures 29 Fair value of plan assets at end of year $ 18,403 $ 17,143 Funded status U.S. plans with plan assets $(3,408) S (3,594) Non-U.S. plans with plan assets (652) (543) All other plans (1,461) (1,490) Total (5,521) S (5,627) Pension Benefits (in millions) Components of net periodic benefit cost (credit) and amounts recognized in other comprehensive income 2010 2009 2008 Net periodic benefit (credit) cost Service cost $ 207 $ 192 $ 209 Interest cost 1,262 1,270 1,286 Expected return on plan assets (1,435) (1,603) (1,932) Amortization of loss 507 278 56 Amortization of prior service cost 16 18 18 Curtailment/settlement loss Net periodic benefit (credit) cost $ 557 $ 155 $ (362) Changes in plan assets and benefit obligations recognized in other comprehensive income Net loss (gain) 634 781 6,397 Amortization of loss (507) (278) (56) Prior service costs Amortization of prior service cost (16) (18) (18) Curtailment/settlement loss Total recognized in other comprehensive income $111 $ 485 $ 6,326 Total recognized in net periodic benefit cost and other comprehensive income $ 668 $ 640 $5,964 Weighted-avg. assumptions used for net periodic benefit cost for years ended Dec. 31 2010 2009 2008 Dicsount Rate 5.80% 6.14% 6.01% Expected return on plan assets 8.64% 8.75% 8.74% Rate of compensation increase 4.24% 4.30% 4.28% The following benefit payments, which reflect future service, as appropriate, are expected to be paid: ($ millions) Pension Benefits 2011 $ 1,593 2012 1,528 2013 1,521 2014 1,527 2015 1,544 Years 2016-2020 8,002 (a) How much pension expense (revenue) does DuPont report in its 2010 income statement? DuPont reports pension expense of $ 557 million. (b) DuPont reports a $1,435 million expected return on pension plan assets as an offset to 2010 pension expense. Approximately, how is this amount computed (estimate from the numbers reported)? (Round your dollar answers to the nearest whole number.) $ 23,924 x million x 8.64 % = $ 477 x million What is DuPont's actual gain or loss realized on its 2010 pension plan assets? 236 * ($ million) gain + DuPont's pension plan is underfunded by $ 236 * million