Answered step by step

Verified Expert Solution

Question

1 Approved Answer

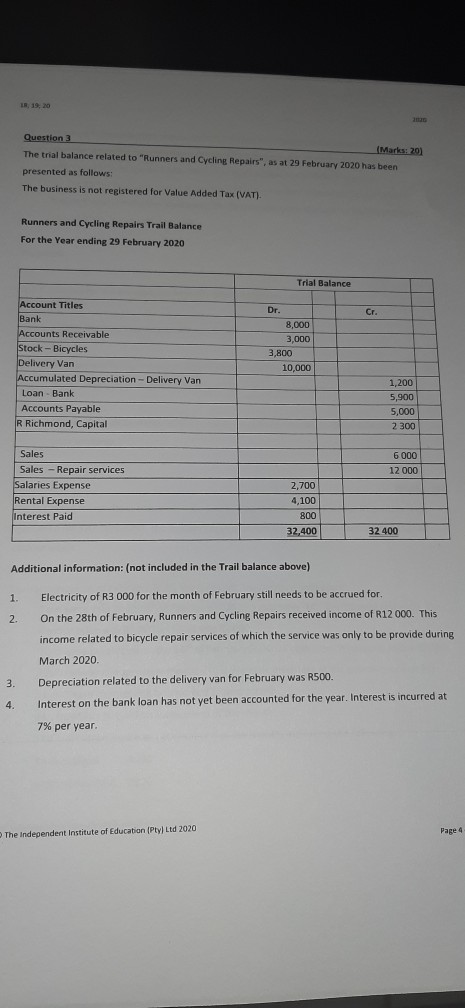

18, 19, 20 Question 3 Marks:20) The trial balance related to Runners and Cycling Repairs, as at 29 February 2020 has been presented as follows:

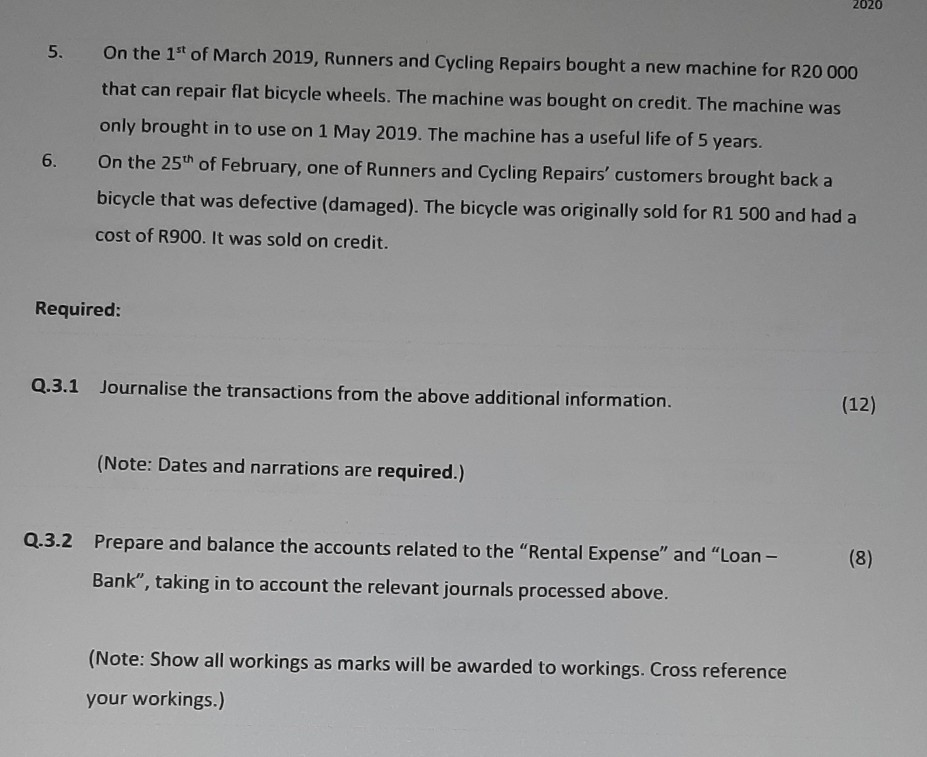

18, 19, 20 Question 3 Marks:20) The trial balance related to "Runners and Cycling Repairs", as at 29 February 2020 has been presented as follows: The business is not registered for Value Added Tax (VAT). Runners and Cycling Repairs Trail Balance For the Year ending 29 February 2020 Trial Balance Cr Account Titles Bank Accounts Receivable Stock - Bicycles Delivery Van Accumulated Depreciation - Delivery Van Loan Bank Accounts Payable R Richmond, Capital Dr. 8,000 3,000 3,800 10,000 1,200 5,900 5,000 2 300 6 000 12 000 Sales Sales - Repair services Salaries Expense Rental Expense Interest Paid 2,700 4,100 800 32,400 32 400 Additional information: (not included in the Trail balance above) 1. 2. Electricity of R3 000 for the month of February still needs to be accrued for On the 28th of February, Runners and Cycling Repairs received income of R12 000. This income related to bicycle repair services of which the service was only to be provide during March 2020 3. Depreciation related to the delivery van for February was R500. Interest on the bank loan has not yet been accounted for the year. Interest is incurred at 4. 7% per year. The Independent Institute of Education (Pty) Ltd 2020 Page 4 2020 5. On the 1st of March 2019, Runners and Cycling Repairs bought a new machine for R20 000 that can repair flat bicycle wheels. The machine was bought on credit. The machine was only brought in to use on 1 May 2019. The machine has a useful life of 5 years. On the 25th of February, one of Runners and Cycling Repairs' customers brought back a bicycle that was defective (damaged). The bicycle was originally sold for R1 500 and had a cost of R900. It was sold on credit. 6. Required: Q.3.1 Journalise the transactions from the above additional information. (12) (Note: Dates and narrations are required.) Q.3.2 Prepare and balance the accounts related to the "Rental Expense" and "Loan - Bank, taking in to account the relevant journals processed above. (8) (Note: Show all workings as marks will be awarded to workings. Cross reference your workings.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started