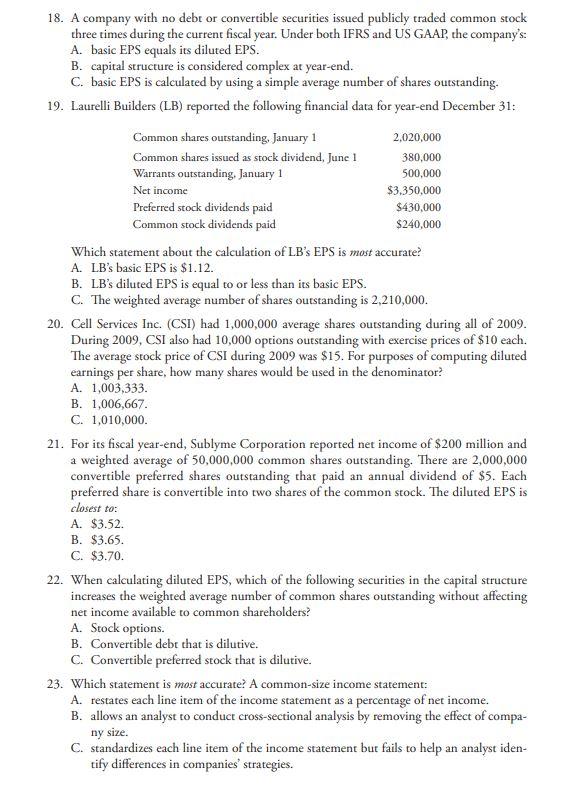

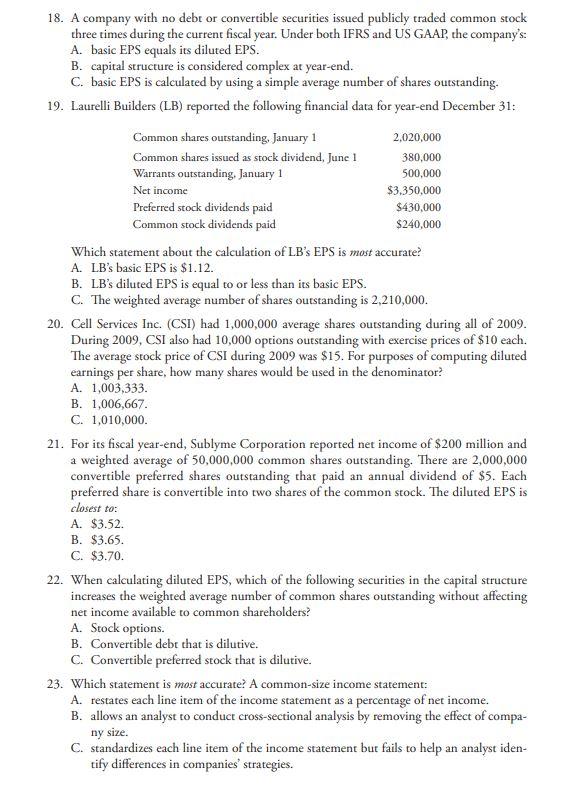

18. A company with no debt or convertible securities issued publicly traded common stock three times during the current fiscal year. Under both IFRS and US GAAP, the company's: A. basic EPS equals its diluted EPS. B. capital structure is considered complex at year-end. C. basic EPS is calculated by using a simple average number of shares outstanding. 19. Laurelli Builders (LB) reported the following financial data for year-end December 31: Common shares outstanding, January 1 2,020,000 Common shares issued as stock dividend, June 1 380,000 Warrants outstanding, January 1 500,000 Net income $3,350,000 Preferred stock dividends paid $430,000 Common stock dividends paid $240,000 Which statement about the calculation of LB's EPS is most accurate? A. LB's basic EPS is $1.12. B. LB's diluted EPS is equal to or less than its basic EPS. C. The weighted average number of shares outstanding is 2,210,000. 20. Cell Services Inc. (CSI) had 1,000,000 average shares outstanding during all of 2009. During 2009, CSI also had 10,000 options outstanding with exercise prices of $10 each. The average stock price of CSI during 2009 was $15. For purposes of computing diluted earnings per share, how many shares would be used in the denominator? A. 1,003,333. B. 1,006,667. C. 1,010,000. 21. For its fiscal year-end, Sublyme Corporation reported net income of $200 million and a weighted average of 50,000,000 common shares outstanding. There are 2,000,000 convertible preferred shares outstanding that paid an annual dividend of $5. Each preferred share is convertible into two shares of the common stock. The diluted EPS is closest to: A. $3.52 B. $3.65. C. $3.70. 22. When calculating diluted EPS, which of the following securities in the capital structure increases the weighted average number of common shares outstanding without affecting net income available to common shareholders? A. Stock options. B. Convertible debt that is dilutive. C. Convertible preferred stock that is dilutive. 23. Which statement is most accurate? A common-size income statement: A. restates each line item of the income statement as a percentage of net income. B. allows an analyst to conduct cross-sectional analysis by removing the effect of compa- ny size. C. standardizes each line item of the income statement but fails to help an analyst iden- tify differences in companies' strategies