1-8 all questions

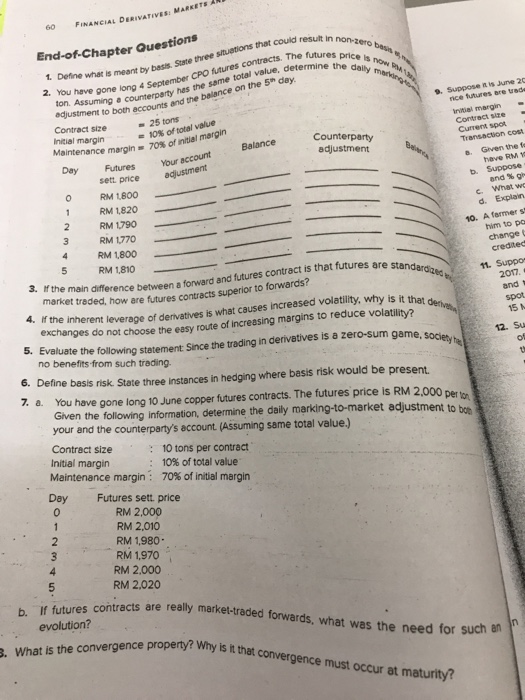

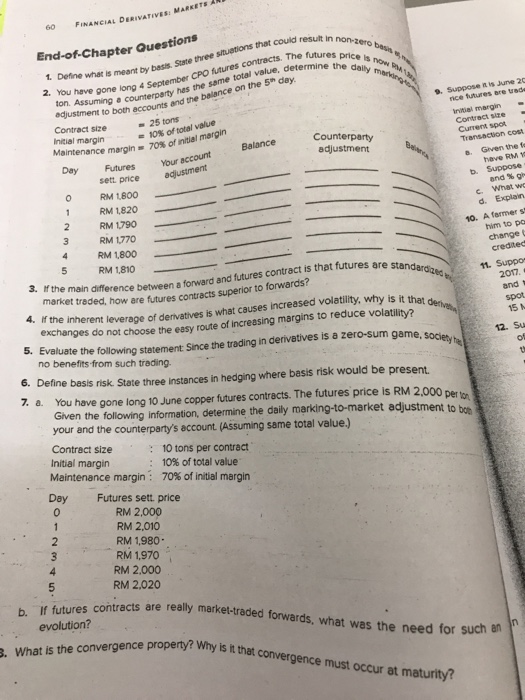

INANCIAL DERIVATIVES: MARKETS A End-of-Chapter Questions 1. Define 2. You have gone long 4 September what is meant by basis. State three situetions that could result in gone long 4 September CPO futures contrects. The futur The futures price is now counterperty hes the same total value, determine thec to both accounts and the balance on the 5h day. smng d Contract size Inzial margin 9. Suppose a is June 20 rnice futures bre uede initial mbrgin = 25 tons o% of total value aintenance margin-70% of nitial margin Day Contrect size Current spot Balance Futures Your account sett. price adjustment adjustment a. Given the fo have RM 1 Suppose and % gr b. 1 RM 1,820 2RM 1790 RM 1770 4 RM 1,800 e What w 10. A farmer s him to po 5 RM 1,810 market treded, how are futures contracts superion f the inherent leverage of denvatives is what causes increased volatility, why is it that 3. If the main difference between a forward and futures contract is that futures are 11 Suppo 2017. exchanges do not choose the easy route of increasing margins to reduce volati uate the following stetement Since the trading in derivatives is a zero-sum game no benefits from such treding. 6. Define basis risk. State three instances in hedging where besis risk would be present. a You have gone long 10 June copper futures contracts. The futures price is RM 2,000 Given the following information, determine the daily marking-to-market adjustment to your and the counterparty's account. (Assuming same total value.) Contract size Initial margin per to : 10 tons per contract Maintenance margin: Day 10% of total value 70% of initial margin Futures sett price RM 2,000 RM 2,010 RM 1,980 RM 2.000 RM 2,020 contracts are really market-traded forwards, what was the need for such n evolution? . What is the convergence property? n/? Why s t that convergence must occur at matur t th convergence must occur at maturity? INANCIAL DERIVATIVES: MARKETS A End-of-Chapter Questions 1. Define 2. You have gone long 4 September what is meant by basis. State three situetions that could result in gone long 4 September CPO futures contrects. The futur The futures price is now counterperty hes the same total value, determine thec to both accounts and the balance on the 5h day. smng d Contract size Inzial margin 9. Suppose a is June 20 rnice futures bre uede initial mbrgin = 25 tons o% of total value aintenance margin-70% of nitial margin Day Contrect size Current spot Balance Futures Your account sett. price adjustment adjustment a. Given the fo have RM 1 Suppose and % gr b. 1 RM 1,820 2RM 1790 RM 1770 4 RM 1,800 e What w 10. A farmer s him to po 5 RM 1,810 market treded, how are futures contracts superion f the inherent leverage of denvatives is what causes increased volatility, why is it that 3. If the main difference between a forward and futures contract is that futures are 11 Suppo 2017. exchanges do not choose the easy route of increasing margins to reduce volati uate the following stetement Since the trading in derivatives is a zero-sum game no benefits from such treding. 6. Define basis risk. State three instances in hedging where besis risk would be present. a You have gone long 10 June copper futures contracts. The futures price is RM 2,000 Given the following information, determine the daily marking-to-market adjustment to your and the counterparty's account. (Assuming same total value.) Contract size Initial margin per to : 10 tons per contract Maintenance margin: Day 10% of total value 70% of initial margin Futures sett price RM 2,000 RM 2,010 RM 1,980 RM 2.000 RM 2,020 contracts are really market-traded forwards, what was the need for such n evolution? . What is the convergence property? n/? Why s t that convergence must occur at matur t th convergence must occur at maturity