Answered step by step

Verified Expert Solution

Question

1 Approved Answer

18. An investor identifies an arbitraging opportunity on the shares of Tristan Group [buying in market A and selling in market B]. The investor can

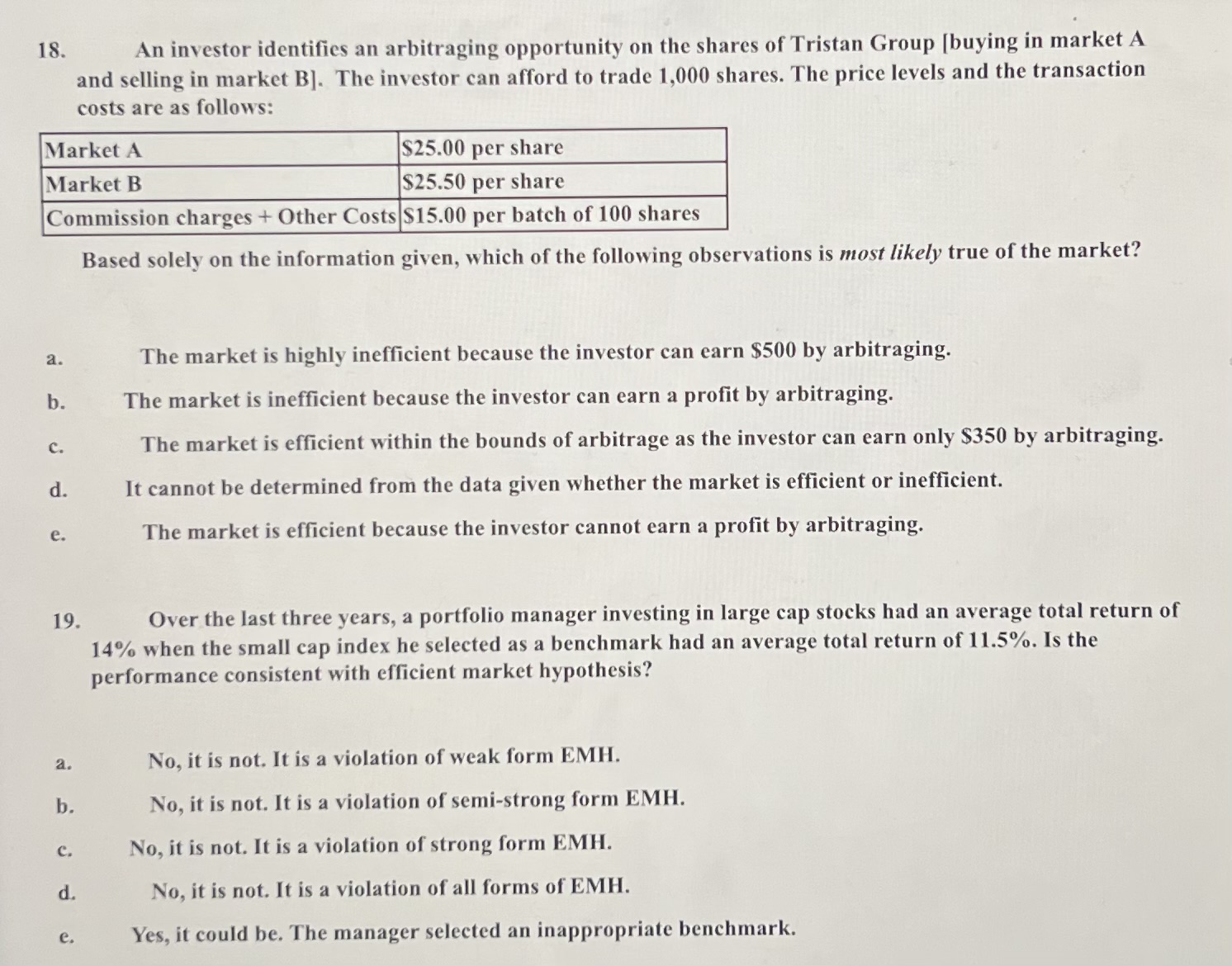

18. An investor identifies an arbitraging opportunity on the shares of Tristan Group [buying in market A and selling in market B]. The investor can afford to trade 1,000 shares. The price levels and the transaction costs are as follows: Based solely on the information given, which of the following observations is most likely true of the market? a. The market is highly inefficient because the investor can earn $500 by arbitraging. b. The market is inefficient because the investor can earn a profit by arbitraging. c. The market is efficient within the bounds of arbitrage as the investor can earn only $350 by arbitraging. d. It cannot be determined from the data given whether the market is efficient or inefficient. e. The market is efficient because the investor cannot earn a profit by arbitraging. 19. Over the last three years, a portfolio manager investing in large cap stocks had an average total return of 14% when the small cap index he selected as a benchmark had an average total return of 11.5%. Is the performance consistent with efficient market hypothesis? a. No, it is not. It is a violation of weak form EMH. b. No, it is not. It is a violation of semi-strong form EMH. c. No, it is not. It is a violation of strong form EMH. d. No, it is not. It is a violation of all forms of EMH. e. Yes, it could be. The manager selected an inappropriate benchmark

18. An investor identifies an arbitraging opportunity on the shares of Tristan Group [buying in market A and selling in market B]. The investor can afford to trade 1,000 shares. The price levels and the transaction costs are as follows: Based solely on the information given, which of the following observations is most likely true of the market? a. The market is highly inefficient because the investor can earn $500 by arbitraging. b. The market is inefficient because the investor can earn a profit by arbitraging. c. The market is efficient within the bounds of arbitrage as the investor can earn only $350 by arbitraging. d. It cannot be determined from the data given whether the market is efficient or inefficient. e. The market is efficient because the investor cannot earn a profit by arbitraging. 19. Over the last three years, a portfolio manager investing in large cap stocks had an average total return of 14% when the small cap index he selected as a benchmark had an average total return of 11.5%. Is the performance consistent with efficient market hypothesis? a. No, it is not. It is a violation of weak form EMH. b. No, it is not. It is a violation of semi-strong form EMH. c. No, it is not. It is a violation of strong form EMH. d. No, it is not. It is a violation of all forms of EMH. e. Yes, it could be. The manager selected an inappropriate benchmark Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started