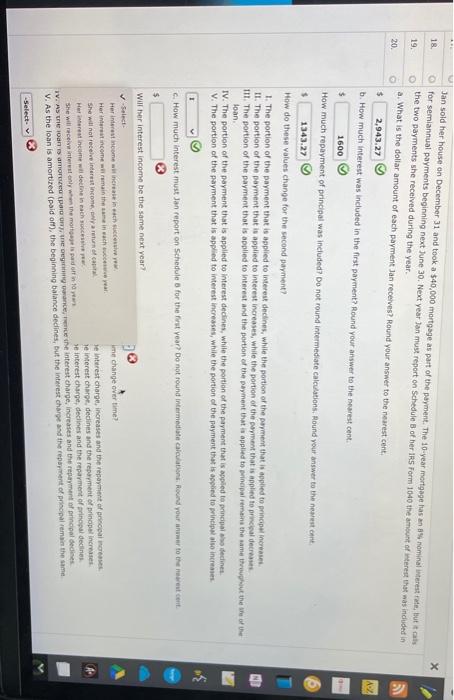

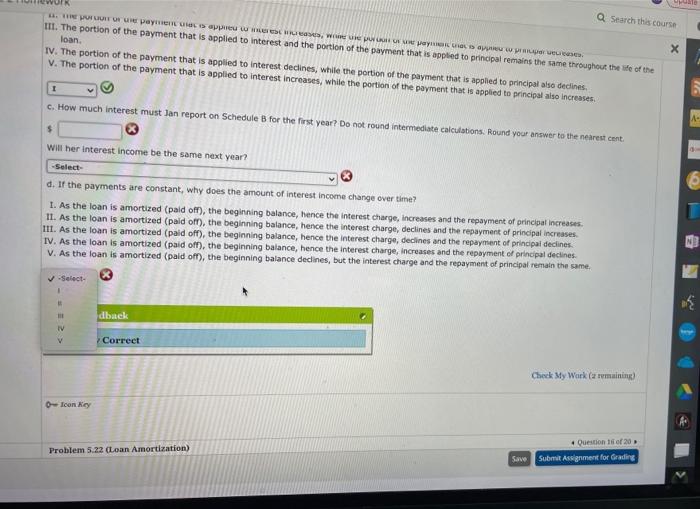

18. Jan sold her house on December 31 and took a $40,000 mortgage as part of the payment. The 10-year mortgage has an 8 nominal interest rate, but the for semiannual payments beginning next June 30. Next year lan must report on Schedule of her IRS Form 1040 the amount of interest that was included in the two payments she received during the year. a. What is the dollar amount of each payment Jan receives Round your answer to the nearest cent, 19 0 0 0 20. A. $ 2,943.27 b. How much interest was included in the first payment? Round your answer to the nearest cent. $ 1600 How much repayment of principal was included? Do not round intermediate calculations. Round your answer to the nearest $ 1343.27 How do these values change for the second payment? 1. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increase II. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal der II. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same through the theorie loan IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is appled to principal delines V. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases e 1 c. How much interest must Jan report on schedule for the first year? Do not found intermediate calculations. Round your newer to the newest cont. } $ Will her interest income be the same next year? Select Her interest income increase in successive ime change over time Herit income will remain the same in aceea She will not receive interest income a return Se interest charge, increases and the repayment of picioare Her interest income will decline in nach soccer je interest charge dedines and the repayment of principal increases She will receive interest only when the mottage is paid in 10 years se interest charge declines and the repayment of principal decine IV. As the ans amor power the interest charge, increases and the repayment of principal dedies V. As the loan is amortized (paid om), the beginning balance declines, but the interest charge and the repayment of principal remain the same Select Hae a Search this course ORTOR U pays eu TECHS, WE U OVOG PO. TIL. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same throughout the life of the loan IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal also decines. V. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases 1 c. How much interest must Jan report on Schedule B for the first year? Do not round intermediate calculations. Round your answer to the nearest cent $ Will her interest income be the same next year? -Select- d. If the payments are constant, why does the amount of interest income change over time? 1. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal increases 11. As the loan is amortized (paid of), the beginning balance, hence the interest charge, declines and the repayment of principal increases III. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal declines. IV. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal declines. V. As the loan is amortized (paid off), the beginning balance declines, but the interest charge and the repayment of principal remain the same. Select It dback v Correct Check My Work (maining) 0 Toon Key Question of 20 Problem 5.22 (Loan Amortization) Save Submit Assignment for Grading