Answered step by step

Verified Expert Solution

Question

1 Approved Answer

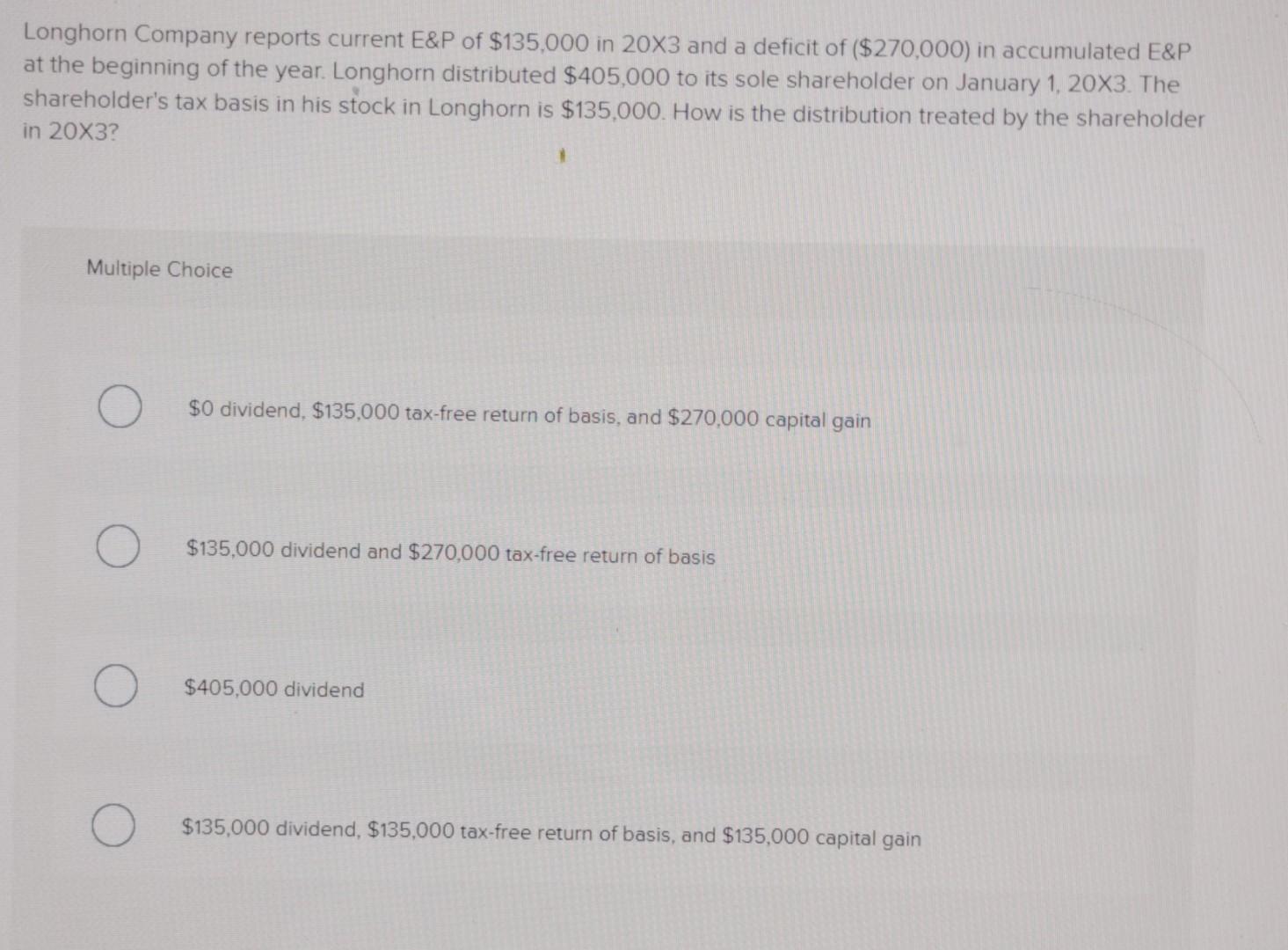

18 Longhorn Company reports current E&P of $135,000 in 203 and a deficit of ($270,000) in accumulated E&P at the beginning of the year. Longhorn

18

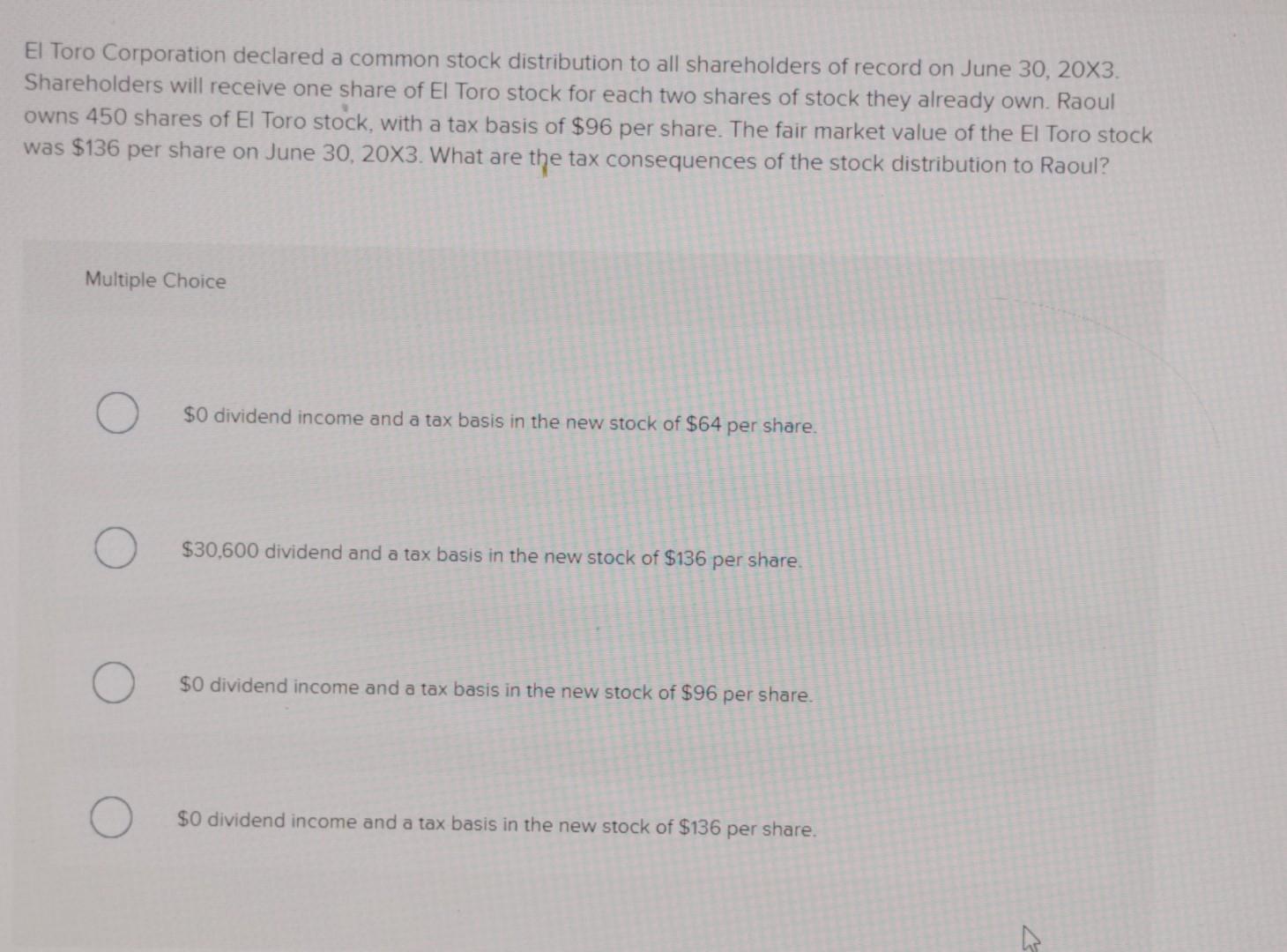

Longhorn Company reports current E\&P of $135,000 in 203 and a deficit of ($270,000) in accumulated E\&P at the beginning of the year. Longhorn distributed $405,000 to its sole shareholder on January 1,203. The shareholder's tax basis in his stock in Longhorn is $135,000. How is the distribution treated by the shareholder in 203? Multiple Choice $0 dividend, $135,000 tax-free return of basis, and $270,000 capital gain $135,000 dividend and $270,000 tax-free return of basis $405,000 dividend $135,000 dividend, $135,000 tax-free return of basis, and $135,000 capital gain El Toro Corporation declared a common stock distribution to all shareholders of record on June 30,203. Shareholders will receive one share of El Toro stock for each two shares of stock they already own. Raoul owns 450 shares of El Toro stock, with a tax basis of $96 per share. The fair market value of the EI Toro stock was $136 per share on June 30,203. What are the tax consequences of the stock distribution to Raoul? Multiple Choice $0 dividend income and a tax basis in the new stock of $64 per share. $30,600 dividend and a tax basis in the new stock of $136 per share. \$0 dividend income and a tax basis in the new stock of $96 per share. $0 dividend income and a tax basis in the new stock of $136 per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started