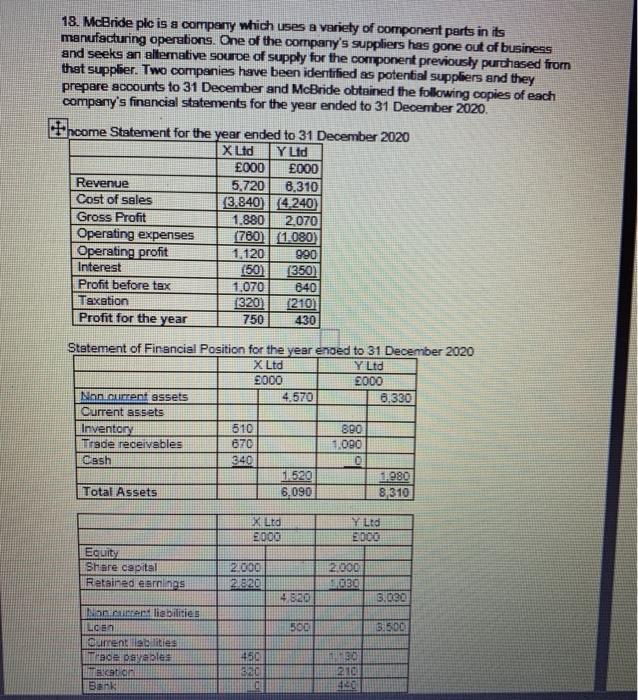

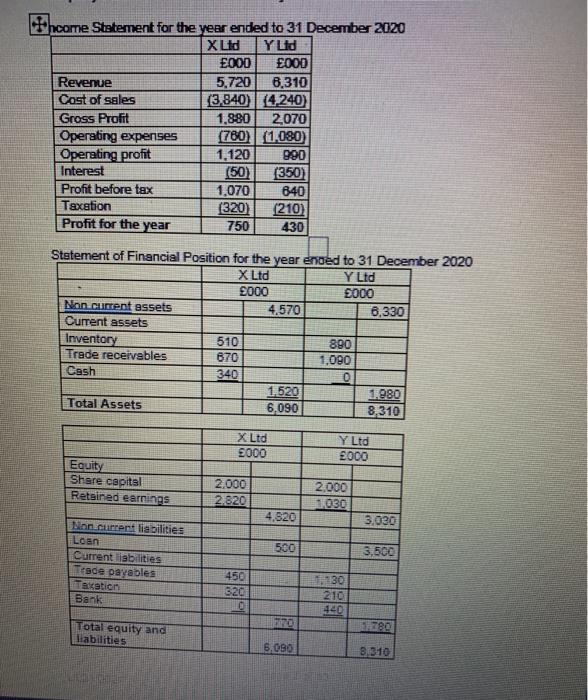

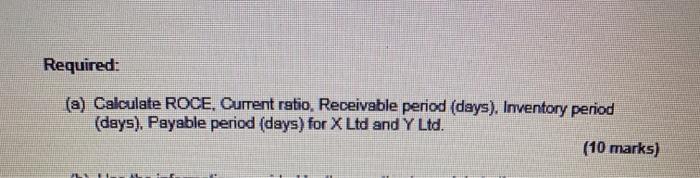

18. McBride plc is a company which uses a variety of component parts in its manufacturing operations. One of the company's suppliers has gone out of business and seeks an alterative source of supply for the component previously purchased from that supplier. Two companies have been identified as potential suppliers and they prepare accounts to 31 December and McBride obtained the following copies of each company's financial statements for the year ended to 31 December 2020. come Statement for the year ended to 31 December 2020 XLtd Y Ltd 000 E000 Revenue 5.720 6.310 Cost of sales (3.840)| (4.240 Gross Profit 1.880 2.070 Operating expenses (760) (1.080) Operating profit 1.120 990 Interest 150 (350) Profit before tax 1.070 840 Taxation 1320 (210) Profit for the year 750 430 Statement of Financial Position for the year ended to 31 December 2020 X Ltd Y Ltd 9000 5000 Non current assets 4.570 6.330 Current assets Inventory 510 890 Trade receivables 670 1.090 Cash 1.520 1.980 Total Assets 6.090 8,310 Y Ltd X Ltd E000 2000 Equity Share capital Retained earnings 2.000 2.820 2.000 BBC 4.520 3.030 500 3.500 an unted liabilities LGEN Qumentilebilities cavable Tacation Bank 450 320 30 210 420 #hcome Statement for the year ended to 31 December 2020 X Ltd Y Ltd E000 000 Revenue 5.720 6.310 Cost of sales (3,840 14240 Gross Profit 1,880 2,070 Operating expenses 780) (1.080) Operating profit 1,120 990 Interest (50) (350) Profit before tax 1,070 840 Taxation (320) (210) Profit for the year 750 430 Statement of Financial Position for the year ended to 31 December 2020 X Ltd Y Ltd 000 5000 Non current assets 4,570 6.330 Current assets Inventory 510 890 Trade receivables 670 1,080 Cash 340 O 1.520 1.980 Total Assets 6,090 8,310 X Ltd 2000 Y Ltd 2000 Equity Share capital Retained earrings 2.000 2.820 2.000 030 4,820 3.030 500 3,500 Non current liabilities Loan Current liabilities Tesce payables Tacation Bank 450 520 0 130 210 70 Total equity and liabilities 80 6,080 3,310 Required: (a) Calculate ROCE. Current ratio, Receivable period (days). Inventory period (days), Payable period (days) for X Ltd and Y Ltd. (10 marks)