Question

18. Mike and Shannon are married filing jointly. Together they earned $168,000 in wages and $1500 in interest from a savings account. They paid

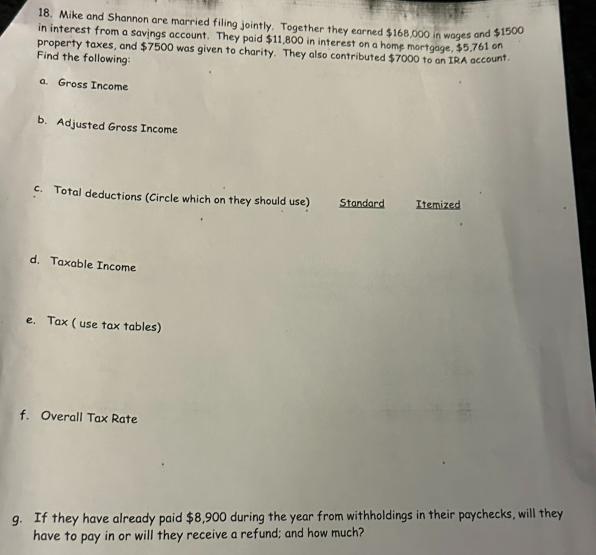

18. Mike and Shannon are married filing jointly. Together they earned $168,000 in wages and $1500 in interest from a savings account. They paid $11,800 in interest on a home mortgage, $5.761 on property taxes, and $7500 was given to charity. They also contributed $7000 to an IRA account. Find the following: a. Gross Income b. Adjusted Gross Income c. Total deductions (Circle which on they should use) Standard Itemized d. Taxable Income e. Tax (use tax tables) f. Overall Tax Rate g. If they have already paid $8,900 during the year from withholdings in their paychecks, will they have to pay in or will they receive a refund; and how much?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App