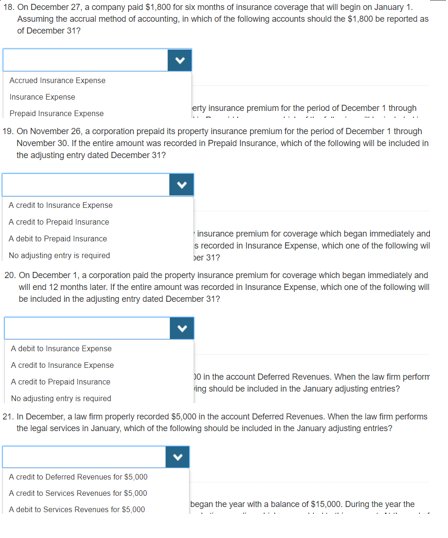

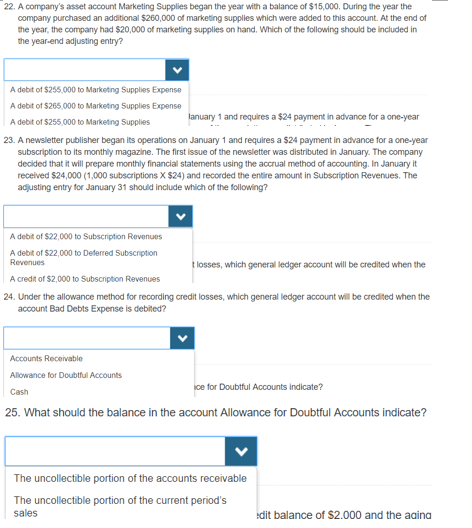

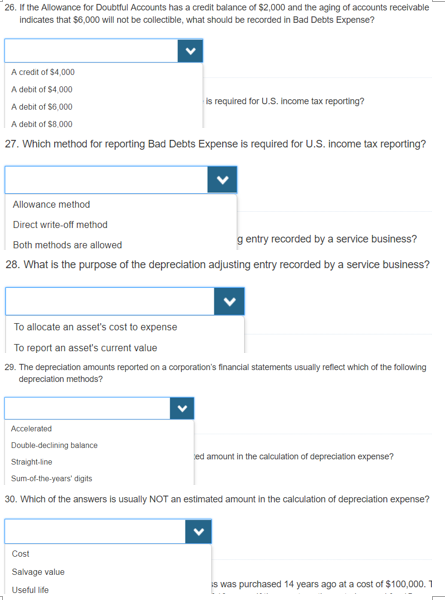

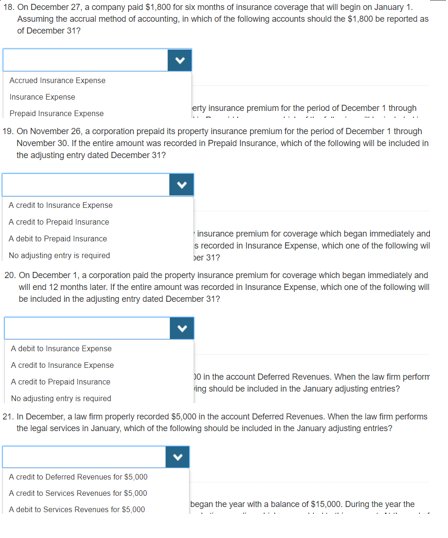

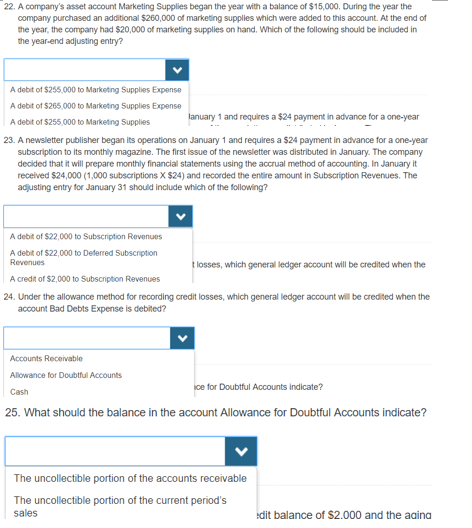

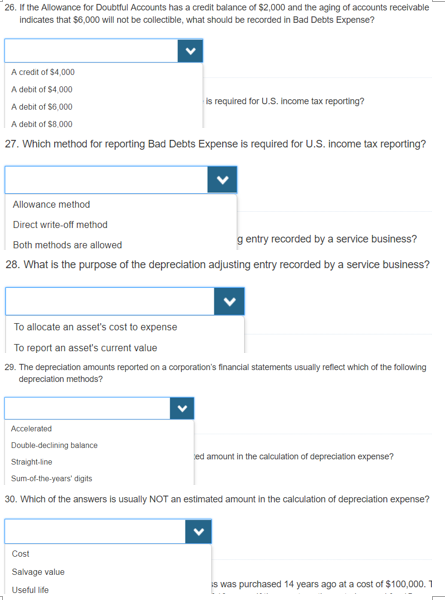

18. On December 27, a company paid $1,800 for six months of insurance coverage that will begin on January 1 Assuming the accrual method of accounting, in which of the following accounts should the $1,800 be reported as of December 31? Accrued Insurance Expense Insurance Expense Prepaid Insurance Expense erty insurance premium for the period of December 1 through 19. On Nowember 26, a corporation prepaid its property insurance premium for the period of December 1 through November 30. the entire amount was recorded in Prepaid insurance, which of the following will be included in the adjusting entry dated December 31? A credt to Insurance Expense A credt to Prepaid Insurance A debit to Prepaid Insurance No adjusting entry is required insurance premium for coverage which began immediately and s recorded in Insurance Expense, which one of the following wi er 31? 20. On December 1, a corporation paid the property insurance premium for coverage which began immediately and will end 12 months later. If the entire amount was recorded in Insurance Expense, which one of the following wil be included in the adjusting entry dated December 31? A debit to Insurance Expense A credt to Insurance Expense A credt to Prepaid Insurance No adjusting entry is required in the account Deferred Revenues. When the law firm perform ing should be included in the January adjusting entries? 21. In December, a law firm properly recorded $5,000 in the account Deferred Revenues. When the law firm performs the legal services in January, which of the following should be included in the January adjusting entries? A credit to Deferred Revenues for $5.000 A credit to Services Revenues for $5,000 A debit to Services Revenues for $5,000 the year with a balance of $15,000. During the year the 22. A company's asset account Marketing Supplies began the year with a balance of $15,000. During the year the company purchased an additional $260,000 of marketing supplies which were added to this account. At the end of the year, the company had $20,000 of marketing supplies on hand. Which of the following should be included in the year-end adjusting entry? A debit of $255,000 to Marketing Supplies Expense A debit of $265,000 to Marketing Supplies Expense A debit of $255,000 to Marketing Supplies lanuary 1 and requires a $24 payment in advance for a one-year 23. A newsleter publisher began its operations on January 1 and requires a $24 payment in advance for a one-year subscription to its monthly magazine. The first issue of the newsletter was distributed in January. The company decided that it will prepare monthly financial statements using the accrual method of accounting. In January it received $24,000 (1,000 subsariptions X $24) and recorded the entire amount in Subscription Revenues. The adjusting entry for January 31 should include which of the following? A debit of $22,000 to Subscription Revenues A debit of $22,000 to Deterred Subscription Revenues t losses, which general ledger account will be credited when the A credt of $2,000 to Subscription Revenues 24. Under the allowance method for recording credit losses, which general ledger account will be credited when the account Bad Debts Expense is debited? Accounts Receivable Allowance for Doubtful Accounts Cash for Doubtful Accounts indicate? 25. What should the balance in the account Allowance for Doubtful Accounts indicate? The uncollectible portion of the accounts receivable The uncollectible portion of the current period's sales dit balance of $2.000 and the aging 26. If the Allowance for Doubtful Accounts has a credit balance of s2,000 and the aging of accounts receivable indicates that $6,000 will not be collectible, what should be recorded in Bad Debts Expense? A credit of $4,000 A debit of $4,000 A debit of $6,000 A debit of $8,000 s required for U.S. income tax reporting? 27. Which method for reporting Bad Debts Expense is required for U.S. income tax reporting? Allowance method Direct write-off method Both methods are allowed g entry recorded by a service business? 28. What is the purpose of the depreciation adjusting entry recorded by a service business? To allocate an asset's cost to expense To report an asset's current value 29. The depreciation amounts reported on a corporation's financial statements usually reflect which of the following depreclation methods? Double-declining balance amount in the calculation of depreciation expense? Sum-of-the-years' digits 30. Which of the answers is usually NOT an estimated amount in the calculation of depreciation expense? Cost Salvage value Useful life is was purchased 14 years ago at a cost of $100,000.1