Answered step by step

Verified Expert Solution

Question

1 Approved Answer

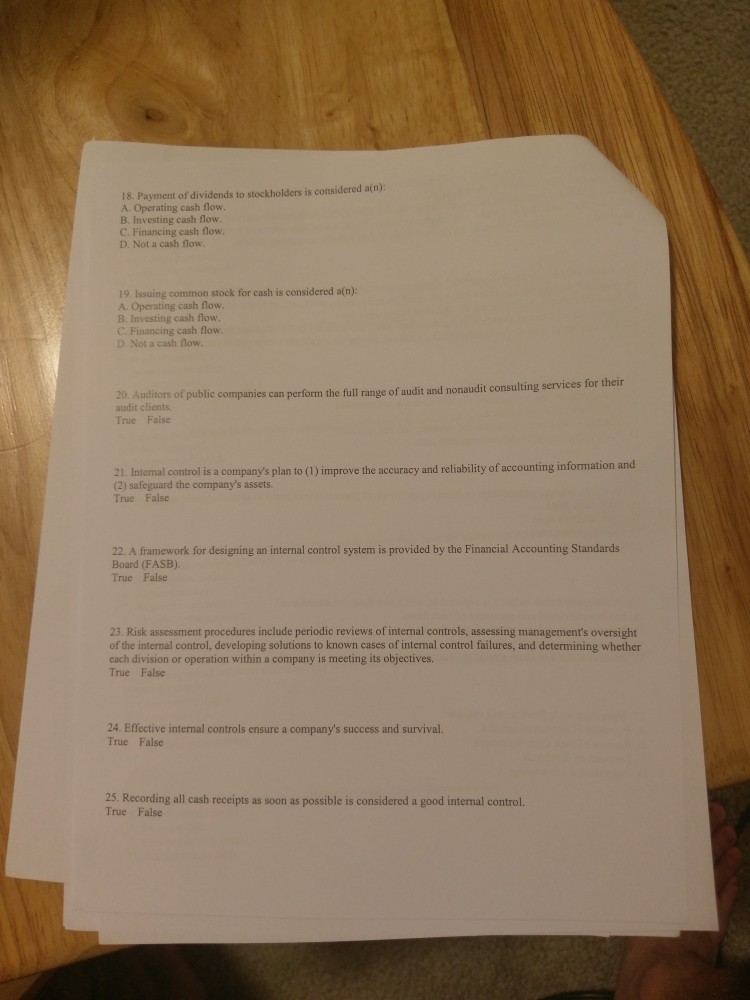

18. Payment of dividends to stockholders is considered a(n) A. Operating cash flovw B. Investing cash flow. C. Financing cash flow D. Not a cash

18. Payment of dividends to stockholders is considered a(n) A. Operating cash flovw B. Investing cash flow. C. Financing cash flow D. Not a cash flow 19. Issuing common stock for cash is considered a(n): A. Operating cash flow B. Investing cash flow C. Financing cash flow. D. Not a cash flow. 20. Auditors of publ audit clients True False ic companies can perform the full range of audit and nonaudit consulting services for their 21. Intenal control is a company's plan to (1) improve the accuracy and reliability of accounting information (2) safeguard the company's assets. True Falsc 22. A framework for designing an internal control system is provided by the Financial Accounting Standards Board (FASB). True False 23. Risk assessment procedures include periodic reviews of internal controls, assessing management's oversight of the internal control, developing solutions to known cases of internal control failures, and determining whether each division or operation within a company is meeting its objectives. True False 24. Effective internal controls ensure a company's success and survival True False 25. Recording all cash receipts as soon as possible is considered a good internal control. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started