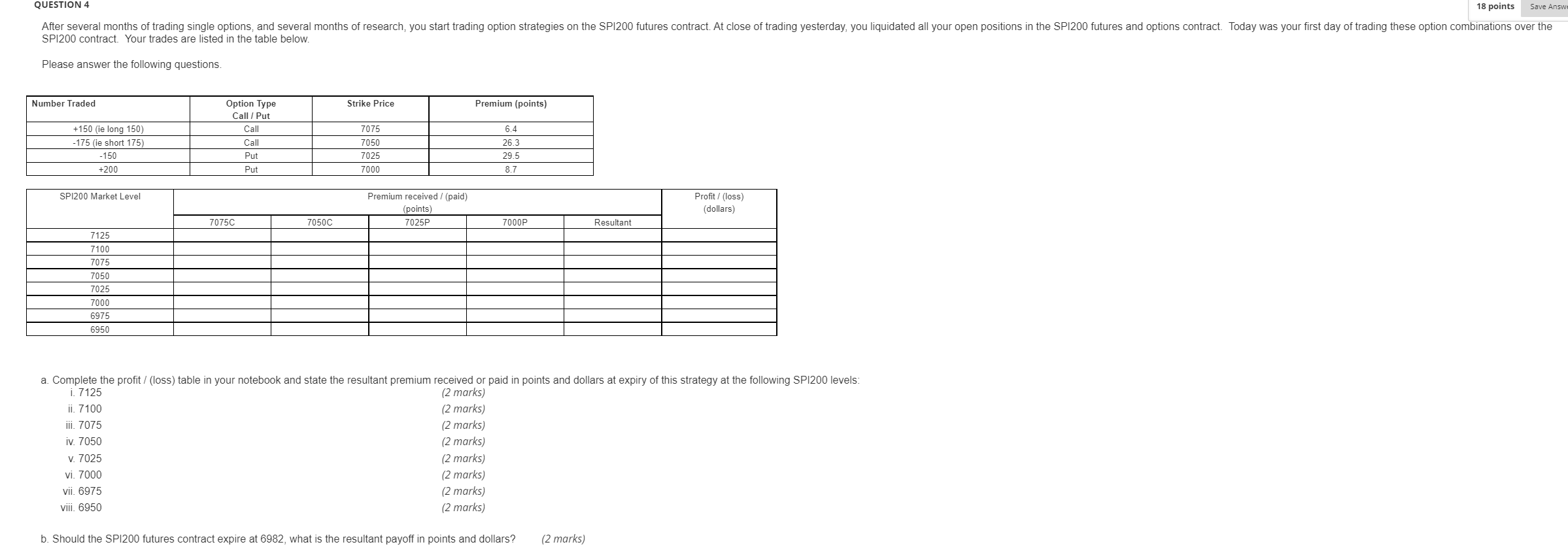

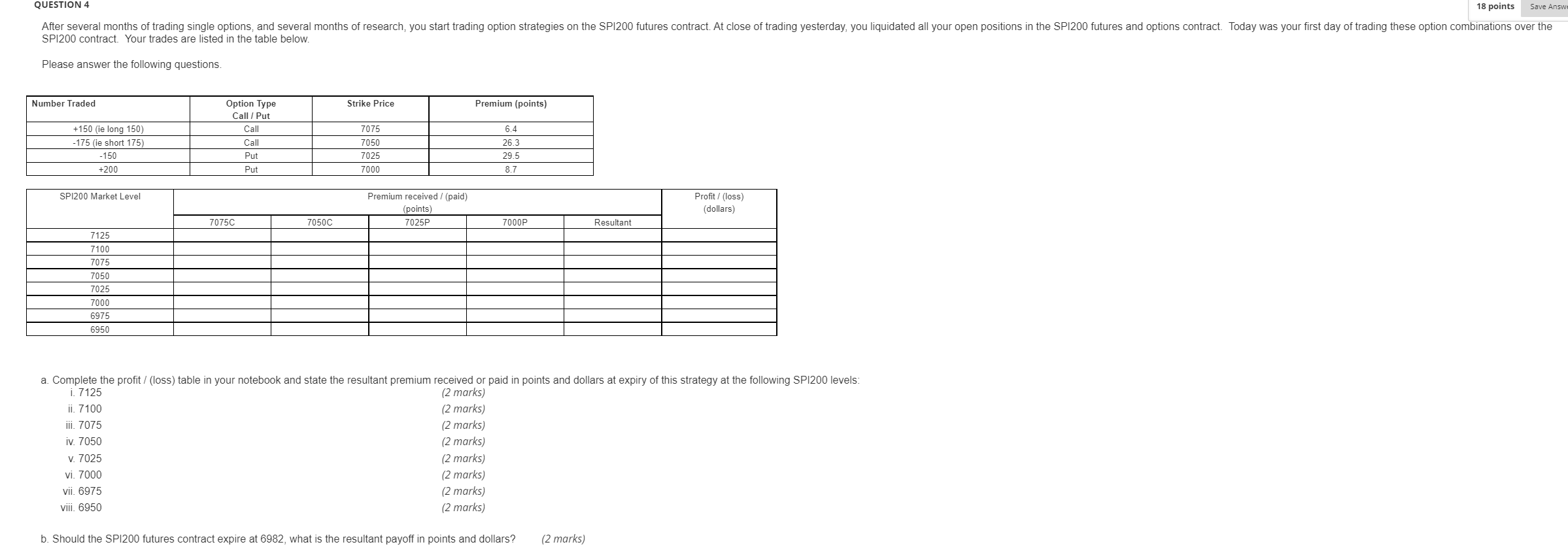

18 points Save Answe QUESTION 4 After several months of trading single options, and several months of research, you start trading option strategies on the SP1200 futures contract. At close of trading yesterday, you liquidated all your open positions in the SP1200 futures and options contract. Today was your first day of trading these option combinations over the SP1200 contract. Your trades are listed in the table below. Please answer the following questions. Number Traded Strike Price Premium (points) Option Type Call / Put +150 (ie long 150) Call 7075 7050 6.4 26.3 -175 (ie short 175) Call -150 Put 7025 29.5 +200 Put 7000 8.7 SP1200 Market Level Premium received / (paid) (points) 7025P Profit/ (loss) (dollars) Resultant 7075C 7050C 7000P 7125 7100 7075 7050 7025 7000 6975 6950 a. Complete the profit / (loss) table in your notebook and state the resultant premium received or paid in points and dollars at expiry of this strategy at the following SP1200 levels: i. 7125 (2 marks) ii. 7100 (2 marks) iii. 7075 (2 marks) iv. 7050 (2 marks) v. 7025 (2 marks) vi. 7000 (2 marks) vii. 6975 (2 marks) viii. 6950 (2 marks) b. Should the SP1200 futures contract expire at 6982, what is the resultant payoff in points and dollars? (2 marks) 18 points Save Answe QUESTION 4 After several months of trading single options, and several months of research, you start trading option strategies on the SP1200 futures contract. At close of trading yesterday, you liquidated all your open positions in the SP1200 futures and options contract. Today was your first day of trading these option combinations over the SP1200 contract. Your trades are listed in the table below. Please answer the following questions. Number Traded Strike Price Premium (points) Option Type Call / Put +150 (ie long 150) Call 7075 7050 6.4 26.3 -175 (ie short 175) Call -150 Put 7025 29.5 +200 Put 7000 8.7 SP1200 Market Level Premium received / (paid) (points) 7025P Profit/ (loss) (dollars) Resultant 7075C 7050C 7000P 7125 7100 7075 7050 7025 7000 6975 6950 a. Complete the profit / (loss) table in your notebook and state the resultant premium received or paid in points and dollars at expiry of this strategy at the following SP1200 levels: i. 7125 (2 marks) ii. 7100 (2 marks) iii. 7075 (2 marks) iv. 7050 (2 marks) v. 7025 (2 marks) vi. 7000 (2 marks) vii. 6975 (2 marks) viii. 6950 (2 marks) b. Should the SP1200 futures contract expire at 6982, what is the resultant payoff in points and dollars? (2 marks)