Answered step by step

Verified Expert Solution

Question

1 Approved Answer

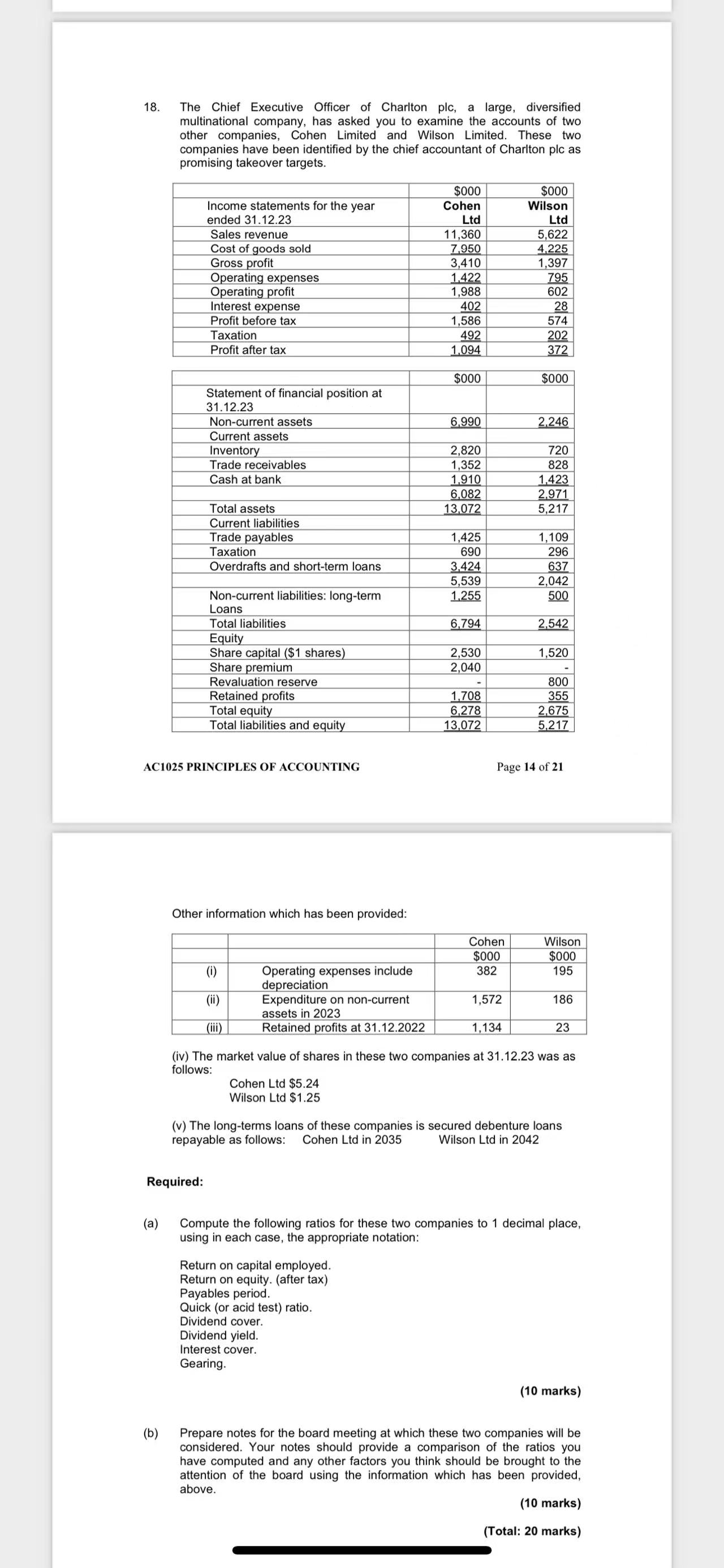

18. The Chief Executive Officer of Charlton plc, a large, diversified. multinational company, has asked you to examine the accounts of two other companies,

18. The Chief Executive Officer of Charlton plc, a large, diversified. multinational company, has asked you to examine the accounts of two other companies, Cohen Limited and Wilson Limited. These two companies have been identified by the chief accountant of Charlton plc as promising takeover targets. $000 $000 Income statements for the year Cohen Wilson ended 31.12.23 Ltd Ltd Sales revenue 11,360 5,622 Cost of goods sold 7,950 4,225 Gross profit 3,410 1,397 Operating expenses 1.422 795 Operating profit Interest expense 1,988 602 402 28 Profit before tax Taxation Profit after tax 1,586 574 492 202 1,094 372 $000 $000 Statement of financial position at 31.12.23 Non-current assets 6,990 2,246 Current assets Inventory 2,820 720 Trade receivables 1,352 828 Cash at bank Total assets 1,910 1,423 6,082 2,971 13,072 5,217 Current liabilities Trade payables 1,425 1,109 Taxation 690 296 Overdrafts and short-term loans 3.424 637 5,539 2,042 Non-current liabilities: long-term 1,255 500 Loans Total liabilities 6,794 2,542 Equity Share capital ($1 shares) 2,530 1,520 Share premium 2,040 Revaluation reserve 800 Retained profits 1,708 355 Total equity 6,278 2,675 Total liabilities and equity 13,072 5,217 AC1025 PRINCIPLES OF ACCOUNTING Other information which has been provided: Page 14 of 21 Cohen $000 Wilson $000 (i) Operating expenses include 382 195 depreciation (ii) Expenditure on non-current 1,572 186 assets in 2023 (iii) Retained profits at 31.12.2022 1,134 23 (iv) The market value of shares in these two companies at 31.12.23 was as follows: Cohen Ltd $5.24 Wilson Ltd $1.25 (v) The long-terms loans of these companies is secured debenture loans repayable as follows: Cohen Ltd in 2035 Wilson Ltd in 2042 Required: (a) (b) Compute the following ratios for these two companies to 1 decimal place, using in each case, the appropriate notation: Return on capital employed. Return on equity. (after tax) Payables period. Quick (or acid test) ratio. Dividend cover. Dividend yield. Interest cover. Gearing. (10 marks) Prepare notes for the board meeting at which these two companies will be considered. Your notes should provide a comparison of the ratios you have computed and any other factors you think should be brought to the attention of the board using the information which has been provided, above. (10 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started