Answered step by step

Verified Expert Solution

Question

1 Approved Answer

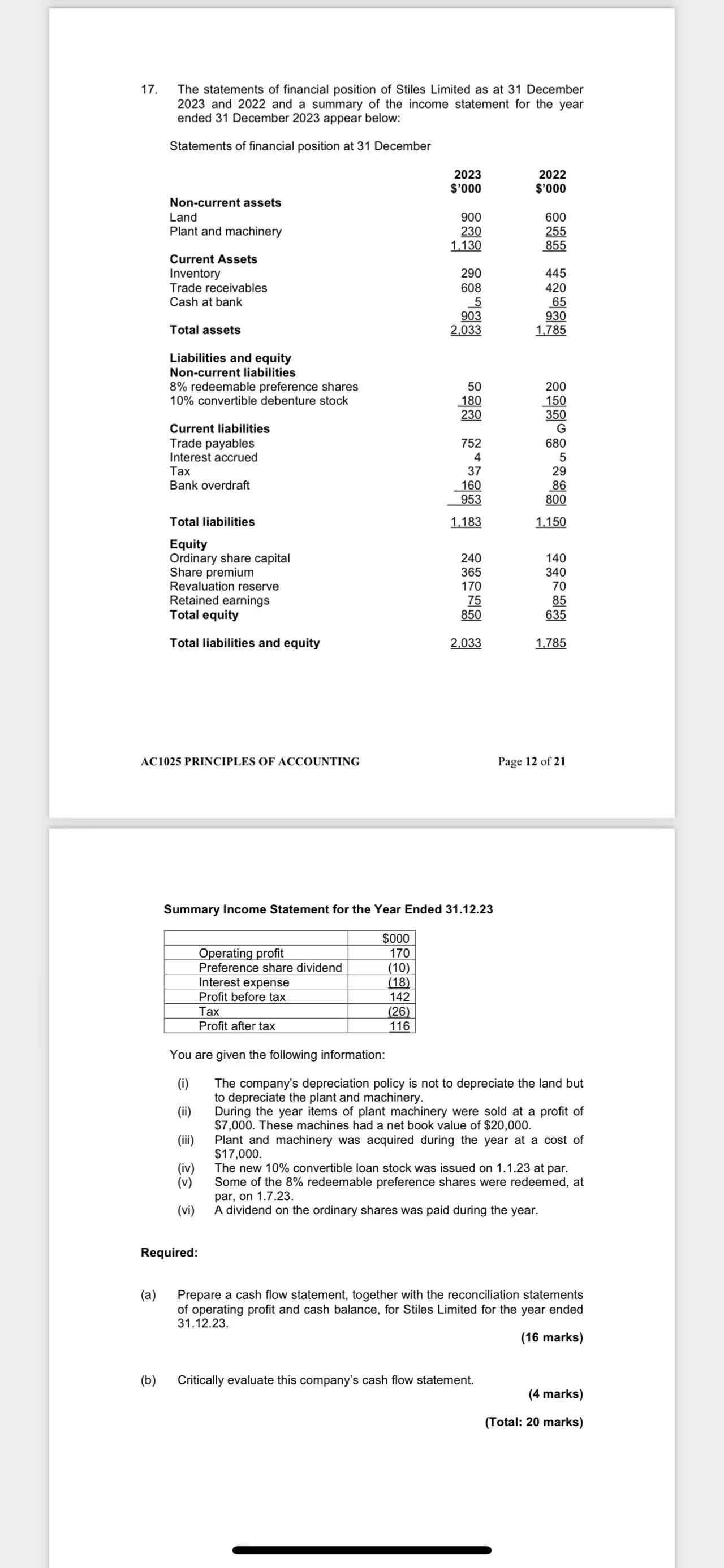

17. The statements of financial position of Stiles Limited as at 31 December 2023 and 2022 and a summary of the income statement for

17. The statements of financial position of Stiles Limited as at 31 December 2023 and 2022 and a summary of the income statement for the year ended 31 December 2023 appear below: Statements of financial position at 31 December Non-current assets Land Plant and machinery Current Assets Inventory Trade receivables 2023 2022 $'000 $'000 900 600 230 255 1.130 855 290 445 608 420 5 65 903 930 2,033 1,785 Cash at bank Total assets Liabilities and equity Non-current liabilities 8% redeemable preference shares 50 200 10% convertible debenture stock 180 230 Current liabilities Trade payables 752 Interest accrued 4 Tax 37 Bank overdraft 160 953 Total liabilities 1,183 1,150 Equity 150 350 680 29 86 800 Ordinary share capital 240 140 Share premium 365 340 Revaluation reserve 170 70 Retained earnings 75 85 Total equity 850 635 Total liabilities and equity 2,033 1.785 AC1025 PRINCIPLES OF ACCOUNTING Page 12 of 21 Summary Income Statement for the Year Ended 31.12.23 $000 Operating profit 170 Preference share dividend (10) Interest expense (18) Profit before tax 142 Tax (26) Profit after tax 116 You are given the following information: (i) (ii) (iii) (iv) (v) The company's depreciation policy is not to depreciate the land but to depreciate the plant and machinery. During the year items of plant machinery were sold at a profit of $7,000. These machines had a net book value of $20,000. Plant and machinery was acquired during the year at a cost of $17,000. The new 10% convertible loan stock was issued on 1.1.23 at par. Some of the 8% redeemable preference shares were redeemed, at par, on 1.7.23. (vi) A dividend on the ordinary shares was paid during the year. Required: (a) Prepare a cash flow statement, together with the reconciliation statements of operating profit and cash balance, for Stiles Limited for the year ended 31.12.23. (16 marks) (b) Critically evaluate this company's cash flow statement. (4 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started