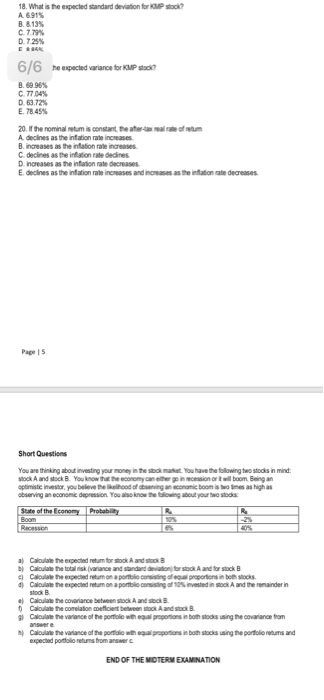

18. What is the expected standard deviation for KMP stock? A 691% B.813 % C. 7.79% D. 7.25 % E 885% 6/6 he expected variance for KMP stock B.6996% C. 7704 % D. 63.72 % E. 7845 % 20.f the nominal etum is constant the aterax eal rae of etum A decines as the infation rate increases B. increases as the infation rate increases C. decines as the infation rate dedines D. increases as the infation rate decreases E. declines as the infation rate increases and increases as the infation rate decreases Page | 5 Short Questions You are thinking about investing your money in the sibck market You have the following two stocks in mind stock A and stock B. You know that the economy can ether go in mcession or it wil boom Being an optimistic investor, you beleve the lkehood of dbsenving an econamic boom is two tmes as high as observing an economic depression You also know the falowing about your two stocks State of the Economy Boom Recession Probability 10% 40% Caloulate the expected retum for stodk A and stock B a) Caloulae the total isk (variance and standard deviaton for stock A and for stock B Caloulate the expected retum on a portblio consisting of equal proportions in both stocks d Caloulate the expected retun on a portblio consisting of 10% invested in stock A and the remainder in stock B e) Caloulate the comelation coefficient between stack A and stock B Caloulate the variance of the portiolio wh equal proportions in both stocks using the covariance from Caloulate the covariance between stock A and sibck B answer e hCaloulate the variance of the portaio with equal proportions expected portolio retuns from answer in both stocks using the portiolio retums and END OF THE MOTERM EXAMINATION 18. What is the expected standard deviation for KMP stock? A 691% B.813 % C. 7.79% D. 7.25 % E 885% 6/6 he expected variance for KMP stock B.6996% C. 7704 % D. 63.72 % E. 7845 % 20.f the nominal etum is constant the aterax eal rae of etum A decines as the infation rate increases B. increases as the infation rate increases C. decines as the infation rate dedines D. increases as the infation rate decreases E. declines as the infation rate increases and increases as the infation rate decreases Page | 5 Short Questions You are thinking about investing your money in the sibck market You have the following two stocks in mind stock A and stock B. You know that the economy can ether go in mcession or it wil boom Being an optimistic investor, you beleve the lkehood of dbsenving an econamic boom is two tmes as high as observing an economic depression You also know the falowing about your two stocks State of the Economy Boom Recession Probability 10% 40% Caloulate the expected retum for stodk A and stock B a) Caloulae the total isk (variance and standard deviaton for stock A and for stock B Caloulate the expected retum on a portblio consisting of equal proportions in both stocks d Caloulate the expected retun on a portblio consisting of 10% invested in stock A and the remainder in stock B e) Caloulate the comelation coefficient between stack A and stock B Caloulate the variance of the portiolio wh equal proportions in both stocks using the covariance from Caloulate the covariance between stock A and sibck B answer e hCaloulate the variance of the portaio with equal proportions expected portolio retuns from answer in both stocks using the portiolio retums and END OF THE MOTERM EXAMINATION