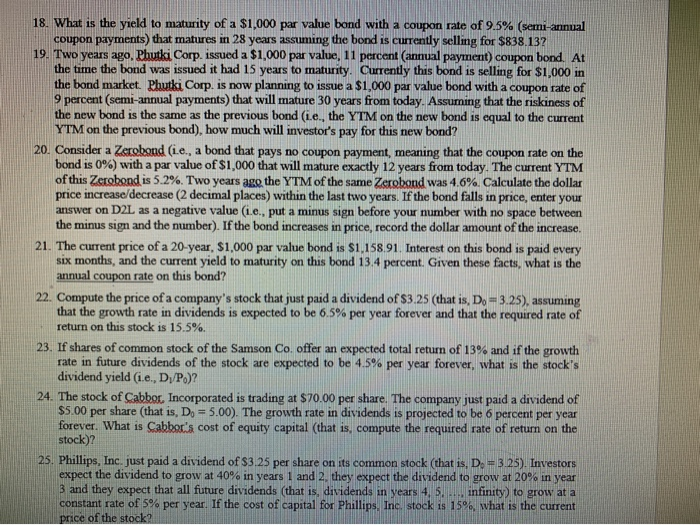

18. What is the yield to maturity of a $1,000 par value bond with a coupon rate of 9.5% (semi-annual coupon payments) that matures in 28 years assuming the bond is currently selling for $838.132 19. Two years ago, Phutki Corp. issued a $1,000 par value, 11 percent (annual payment) coupon bond. At the time the bond was issued it had 15 years to maturity. Currently this bond is selling for $1,000 in the bond market. Phutki Corp. is now planning to issue a $1,000 par value bond with a coupon rate of 9 percent (semi-annual payments) that will mature 30 years from today. Assuming that the riskiness of he same as the previous bond (ne., the YTM on the new bond is equal to the current YTM on the previous bond), how much will investor's pay for this new bond? 20. Consider a Zerobond (i.e., a bond that pays no coupon payment, meaning that the coupon rate on the bond is 0%) with a par value of $1,000 that will mature exactly 12 years from today. The current YTM of this Zerobond is 5.2%. Two years ago the YTM of the same Zerobond was 4.6%. Calculate the dollar price increase/decrease (2 decimal places) within the last two years. If the bond falls in price, enter your answer on D2L as a negative value (1.e., put a minus sign before your number w the minus sign and the number). If the bond increases in price, record the dollar amount of the increase. 21. The current price of a 20-year, $1,000 par value bond is $1,158.91. Interest on this bond is paid every six months, and the current yield to maturity on this bond 13.4 percent. Given these facts, what is the annual coupon rate on this bond? 22. Compute the price of a company's stock that just paid a dividend of $3,25 (that is, D.-3.25), assuming that the growth rate in dividends is expected to be 6,5% per year forever and that the required rate of return on this stock is 15.5%. 23. If shares of common stock of the Samson Co. offer an expected total return of 13% and if the growth rate in future dividends of the stock are expected to be 4.5% per year forever, what is the stock's dividend yield (i.e., D/P.)? 24. The stock of Cabbor, Incorporated is trading at $70.00 per share. The company just paid a dividend of $5.00 per share (that is, D, -5.00). The growth rate in dividends is projected to be 6 percent per year forever. What is Cabbons cost of equity capital (that is, compute the required rate of return on the stock)? 25. Phillips, Inc. just paid a dividend of $3.25 per share on its common stock (that is, D.-3.25). Investors expect the dividend to grow at 40% in years 1 and 2. they expect the dividend to grow at 20% in year 3 and they expect that all future dividends (that is dividends in years 4,5.... infinity) to grow at a constant rate of 5% per year. If the cost of capital for Phillips, Ine, stock is 15%, what is the current price of the stock