Answered step by step

Verified Expert Solution

Question

1 Approved Answer

18. Your broker mailed you your year-end statement. You have RM25,000 invested in Maxis, RM18,000 tied up in MAS, RM36,000 in AirAsia, and RM11,000 in

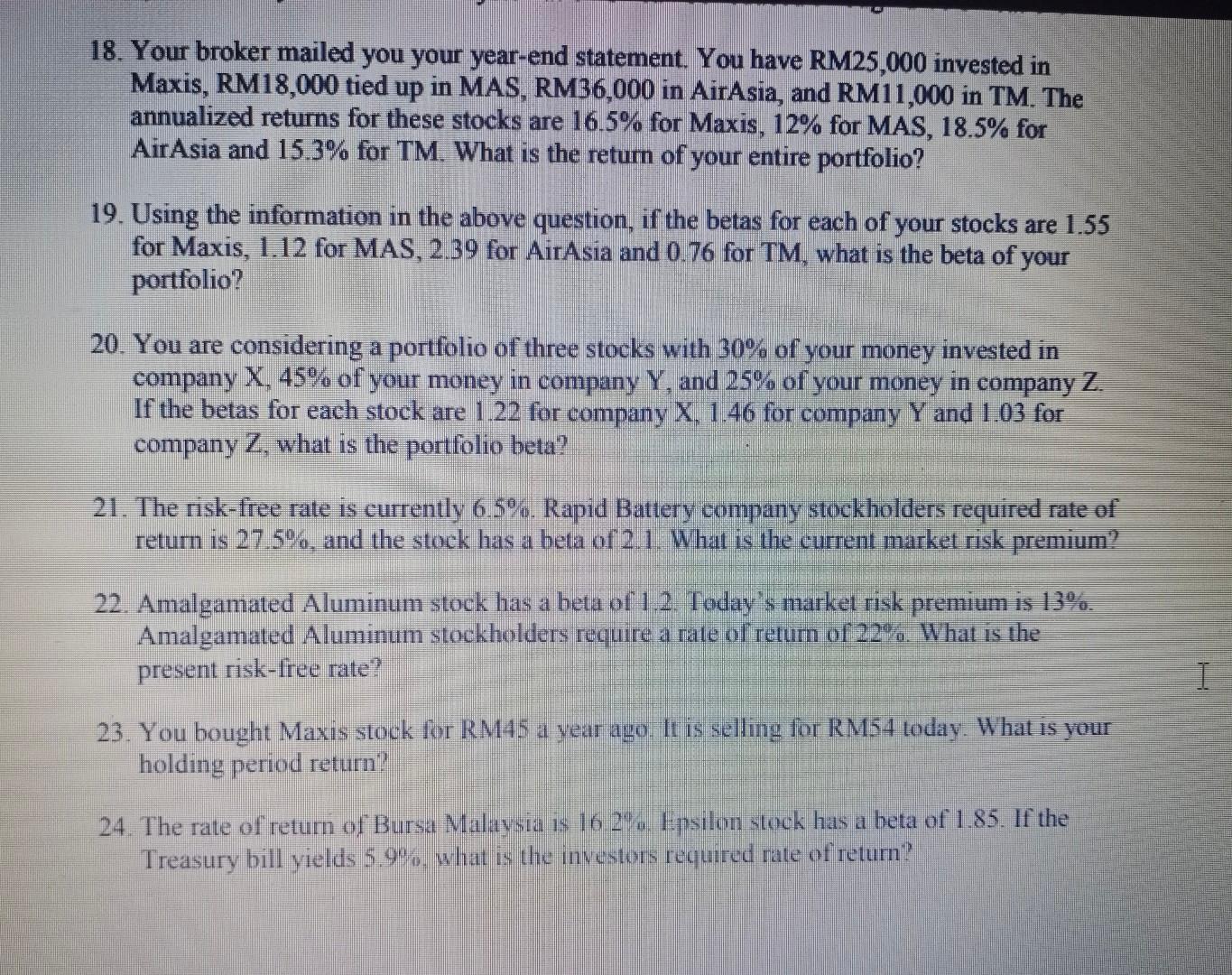

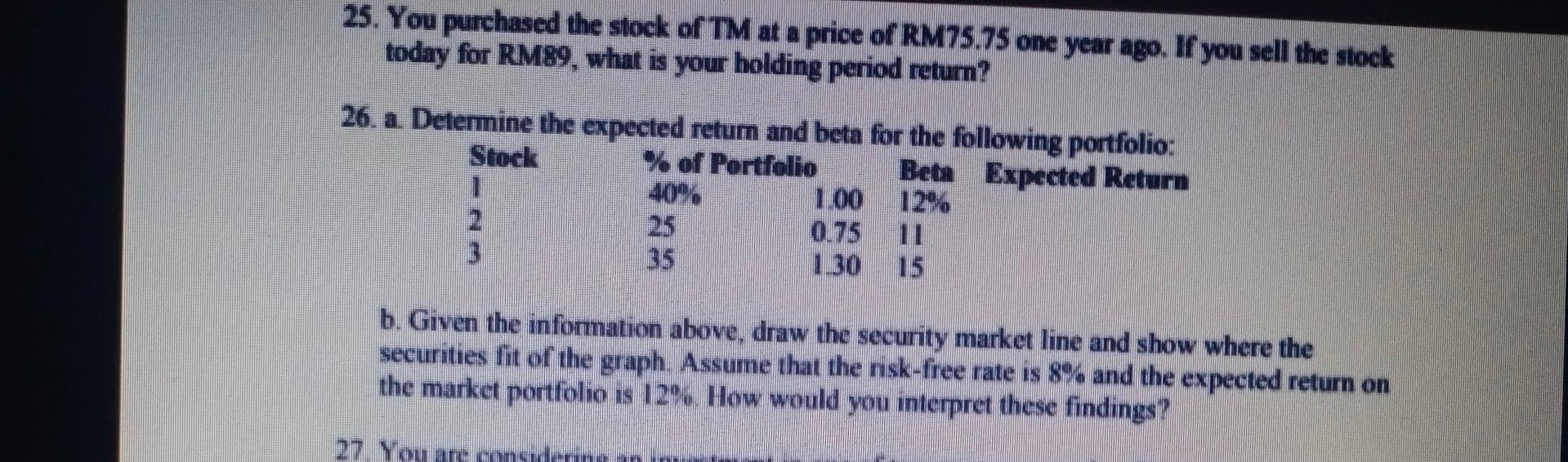

18. Your broker mailed you your year-end statement. You have RM25,000 invested in Maxis, RM18,000 tied up in MAS, RM36,000 in AirAsia, and RM11,000 in TM, The annualized returns for these stocks are 16.5% for Maxis, 12% for MAS, 18.5% for AirAsia and 15.3% for TM. What is the return of your entire portfolio? 19. Using the information in the above question, if the betas for each of your stocks are 1.55 for Maxis, 1.12 for MAS, 2.39 for AirAsia and 0.76 for TM, what is the beta of your portfolio? 20. You are considering a portfolio of three stocks with 30% of your money invested in company X, 45% of your money in company Y. and 25% of your money in company Z. If the betas for each stock are 1.22 for company X, 1.46 for company Y and 1.03 for company Z. what is the portfolio beta? 21. The risk-free rate is currently 6.5%. Rapid Battery company stockholders required rate of return is 27.5%, and the stock has a beta of 2.1. What is the current market risk premium? 22. Amalgamated Aluminum stock has a beta of 1.2. Today's market risk premium is 13%. Amalgamated Aluminum stockholders require a rate of retum of 22%. What is the present risk-free rate? 23. You bought Maxis stock for RM45 a year ago. It is selling for RM54 today. What is your holding period return? 24. The rate of return of Bursa Malaysia is 16 2%. Epsilon stock has a beta of 1.85. If the Treasury bill yields 5.9%, what is the investors required rate of return? 25. You purchased the stock of TM at a price of RM75.75 one year ago. If you sell the stock today for RM89, what is your holding period return? 26. a Determine the expected retum and beta for the following portfolio: Stock % of Portfolio Beta Expected Return 1.00 12% 0.75 11 1.30 b. Given the infomation above, draw the security market line and show where the securities fit of the graph. Assume that the nsk-free rate is 8% and the expected return on the market portfolio is 12%. How would you interpret these findings? 27. You are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started