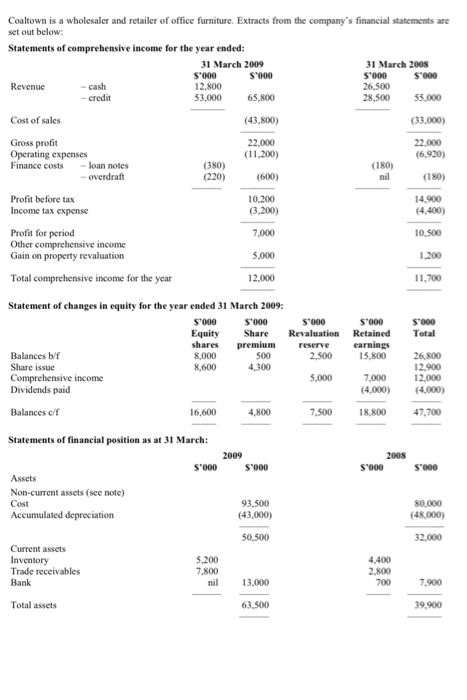

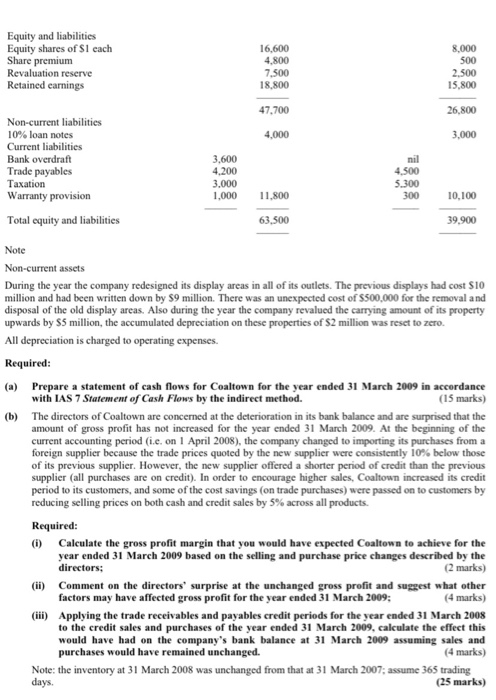

(180) Coaltown is a wholesaler and retailer of office furniture. Extracts from the company's financial statements are set out below: Statements of comprehensive income for the year ended: 31 March 2009 31 March 2008 S'000 S'000 S'000 S'000 Revenue - cash 12.800 26,500 credit 53,000 65,800 28,500 55,000 Cost of sales (43,800) (33,000) Gross profit 22.000 22.000 Operating expenses (11,200) (6.920) Finance costs - loan notes (380) (180) - overdraft (220) (600) nil Profit before tax 10.200 14.900 Income tax expense (3,200) Profit for period 7.000 10.500 Other comprehensive income Gain on property revaluation 5.000 1.200 Total comprehensive income for the year 12,000 11,700 Statement of changes in equity for the year ended 31 March 2009: S'000 S'000 S'000 $'000 Equity Share Revaluation Retained Total shares premium reserve earnings Balances br 8,000 500 2.500 15,800 26,800 Share issue 8,600 12.900 Comprehensive income 5,000 7,000 12,000 Dividends paid (4,000) (4,000) Balances of 16,600 4.800 7.500 18,800 47,700 Statements of financial position as at 31 March: 2009 2008 S'000 S'000 S'000 S'000 Assets Non-current assets (see note) Cost 93,500 80,000 Accumulated depreciation (43,000) (48,000) 50,500 32,000 Current assets Inventory 5.200 4,400 Trade receivables 7.800 2.800 Bank nil 13,000 700 7.900 Total assets 63,500 39.900 S'000 4.300 Equity and liabilities Equity shares of S1 cach Share premium Revaluation reserve Retained earnings 16,600 4.800 7,500 18.800 47,700 8,000 500 2.500 15,800 26.800 4,000 3,000 Non-current liabilities 10% loan notes Current liabilities Bank overdraft Trade payables Taxation Warranty provision Total equity and liabilities 3,600 4.200 3.000 1,000 nil 4,500 5.300 300 11.800 10,100 63,500 39.900 Note Non-current assets During the year the company redesigned its display areas in all of its outlets. The previous displays had cost $10 million and had been written down by S9 million. There was an unexpected cost of $500,000 for the removal and disposal of the old display areas. Also during the year the company revalued the carrying amount of its property upwards by S5 million, the accumulated depreciation on these properties of S2 million was reset to zero. All depreciation is charged to operating expenses. Required: (a) Prepare a statement of cash flows for Coaltown for the year ended 31 March 2009 in accordance with IAS 7 Statement of Cash Flows by the indirect method. (15 marks) (6) The directors of Coaltown are concerned at the deterioration in its bank balance and are surprised that the amount of gross profit has not increased for the year ended 31 March 2009. At the beginning of the current accounting period (i.c. on 1 April 2008), the company changed to importing its purchases from a foreign supplier because the trade prices quoted by the new supplier were consistently 10% below those of its previous supplier. However, the new supplier offered a shorter period of credit than the previous supplier (all purchases are on credit). In order to encourage higher sales, Coaltown increased its credit period to its customers, and some of the cost savings (on trade purchases) were passed on to customers by reducing selling prices on both cash and credit sales by 5% across all products. Required: (1) Calculate the gross profit margin that you would have expected Coaltown to achieve for the year ended 31 March 2009 based on the selling and purchase price changes described by the directors: (2 marks) (ii) Comment on the directors' surprise at the unchanged gross profit and suggest what other factors may have affected gross profit for the year ended 31 March 2009; (4 marks) (ii) Applying the trade receivables and payables credit periods for the year ended 31 March 2008 to the credit sales and purchases of the year ended 31 March 2009, calculate the effect this would have had on the company's bank balance at 31 March 2009 assuming sales and purchases would have remained unchanged. (4 marks) Note: the inventory at 31 March 2008 was unchanged from that at 31 March 2007; assume 365 trading days. (25 marks)