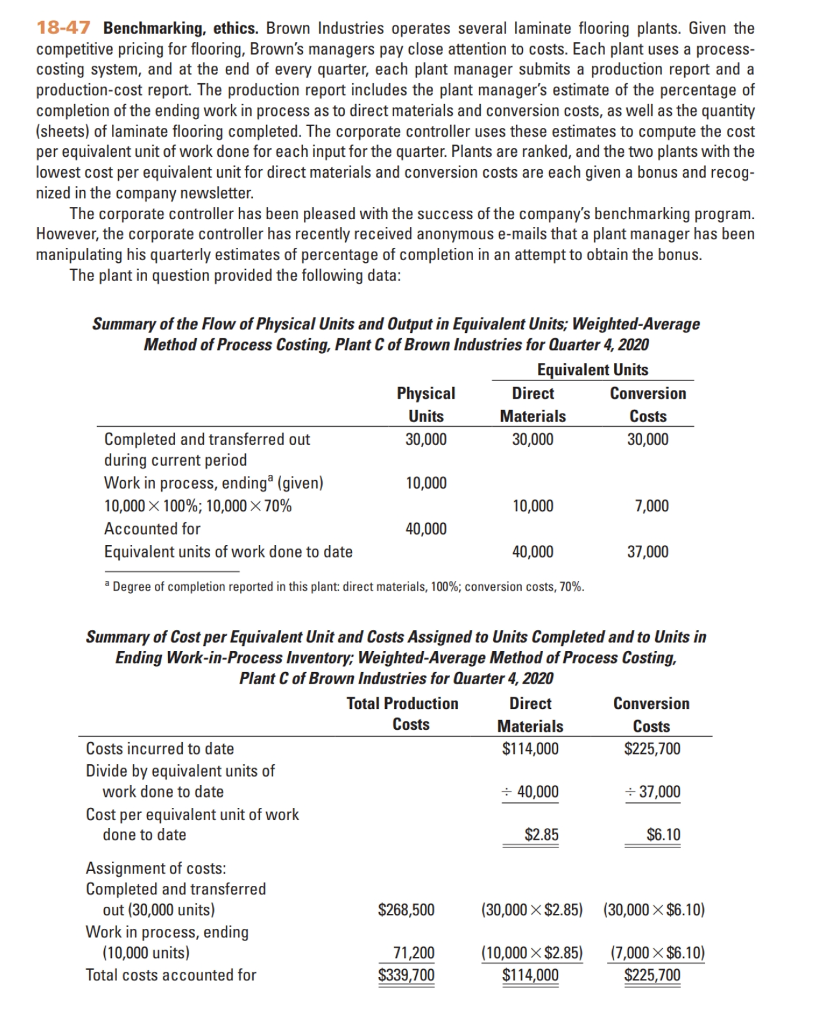

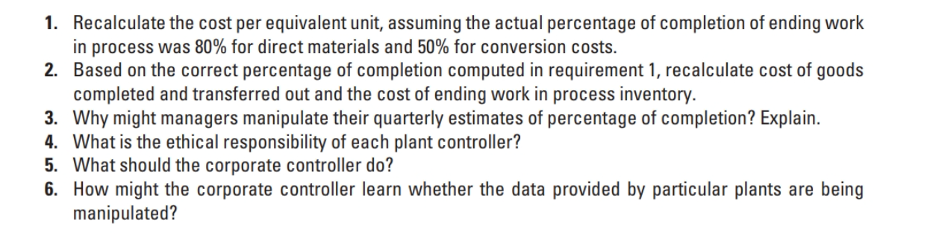

18-47 Benchmarking, ethics. Brown Industries operates several laminate flooring plants. Given the competitive pricing for flooring, Brown's managers pay close attention to costs. Each plant uses a process- costing system, and at the end of every quarter, each plant manager submits a production report and a production-cost report. The production report includes the plant manager's estimate of the percentage of completion of the ending work in process as to direct materials and conversion costs, as well as the quantity (sheets) of laminate flooring completed. The corporate controller uses these estimates to compute the cost per equivalent unit of work done for each input for the quarter. Plants are ranked, and the two plants with the lowest cost per equivalent unit for direct materials and conversion costs are each given a bonus and recog- nized in the company newsletter. The corporate controller has been pleased with the success of the company's benchmarking program. However, the corporate controller has recently received anonymous e-mails that a plant manager has been manipulating his quarterly estimates of percentage of completion in an attempt to obtain the bonus. The plant in question provided the following data: Summary of the Flow of Physical Units and Output in Equivalent Units; Weighted-Average Method of Process Costing, Plant C of Brown Industries for Quarter 4, 2020 Equivalent Units Physical Direct Conversion Units Materials Costs Completed and transferred out 30,000 30,000 30,000 during current period Work in process, ending (given) 10,000 10,000 X 100%; 10,000 X 70% 10,000 7,000 Accounted for 40,000 Equivalent units of work done to date 40,000 37,000 Degree of completion reported in this plant direct materials, 100%; conversion costs, 70%. Costs Summary of Cost per Equivalent Unit and Costs Assigned to Units Completed and to Units in Ending Work-in-Process Inventory; Weighted-Average Method of Process Costing, Plant C of Brown Industries for Quarter 4, 2020 Total Production Direct Conversion Materials Costs Costs incurred to date $114,000 $225,700 Divide by equivalent units of work done to date = 40,000 = 37,000 Cost per equivalent unit of work done to date $2.85 $6.10 $268,500 (30,000 X $2.85) (30,000 $6.10) Assignment of costs: Completed and transferred out (30,000 units) Work in process, ending (10,000 units) Total costs accounted for 71,200 $339,700 (10,000 $2.85) $114,000 (7,000 $6.10) $225,700 1. Recalculate the cost per equivalent unit, assuming the actual percentage of completion of ending work in process was 80% for direct materials and 50% for conversion costs. 2. Based on the correct percentage of completion computed in requirement 1, recalculate cost of goods completed and transferred out and the cost of ending work in process inventory. 3. Why might managers manipulate their quarterly estimates of percentage of completion? Explain. 4. What is the ethical responsibility of each plant controller? 5. What should the corporate controller do? 6. How might the corporate controller learn whether the data provided by particular plants are being manipulated