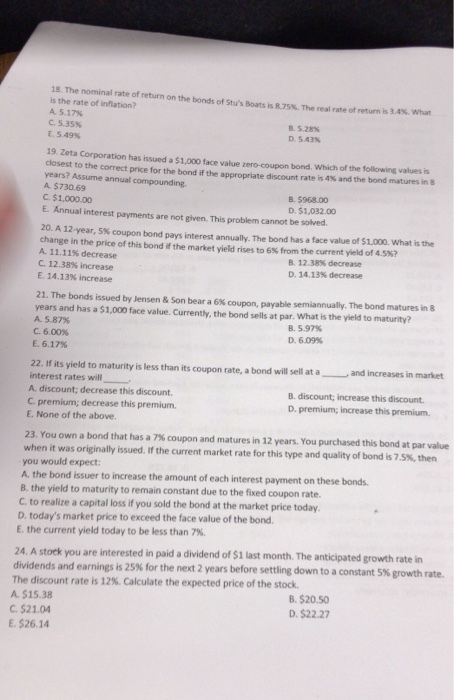

18.The nominal rate of return on the bonds of Stu's Boats is R75%The real rate of return is is the rate of inflation? 34% what 5.17% B. 5.28% D. 5.43% C. 5.35% E. 549% 19. Zeta Corporation has issued a $1,000 face value zero-coupon bond. Which of the following values is closest to the correct price for the bond if the appropriate discount rate is 4% and the bond matures in & years? Assume annual compounding. A. $730.69 B. $968.00 C. $1,000.00 D. $1,032.00 E. Annual interest payments are not given. This problem cannot be solved 20. A 12-year, 5% coupon bond pays interest annually. The bond has a face value of $1,000, what is the change in the price of this bond if the market yield rises to 6% from the current yeld of 45s? 11.11% decrease B. 12.38% decrease D. 14.13% decrease C. 12.38% increase E. 14.13% increase 21. The bonds issued by Jensen & Son bear a 6% coupon, payable semiannually. The bond matures in 8 years and has a $1,000 face value. Currently, the bond sells at par. What is the yield to maturity? A. 5.87% C. 6.00% E.6.17% B. 5.97% D, 6.09% 22. If its yield to maturity is less than its coupon rate, a bond will sell at a interest rates will A. discount; decrease this discount. C. premium; decrease this premium E. None of the above. a and increases in market B. discount, increase this discount. D. premium; increase this premium 23. You own a bond that has a 7% coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. iIf the current market rate for this type and quality of bond is 7.5%, then you would expect: A. the bond issuer to increase the amount of each interest payment on these bonds. 8. the yield to maturity to remain constant due to the fixed coupon rate. C. to realize a capital loss if you sold the bond at the market price today D. today's market price to exceed the face value of the bond E, the current yield today to be less than 7%. 24. A stoek you are interested in paid a dividend of $1 last month. The anticipated growth rate in dividends and earnings is 25% for the next 2 years before settling down to a constant 5% growth rate. The discount rate is 12%. Calculate the expected price of the stock. A $15.38 C. $21.04 E. $26.14 B. $20.50 D.$22.27