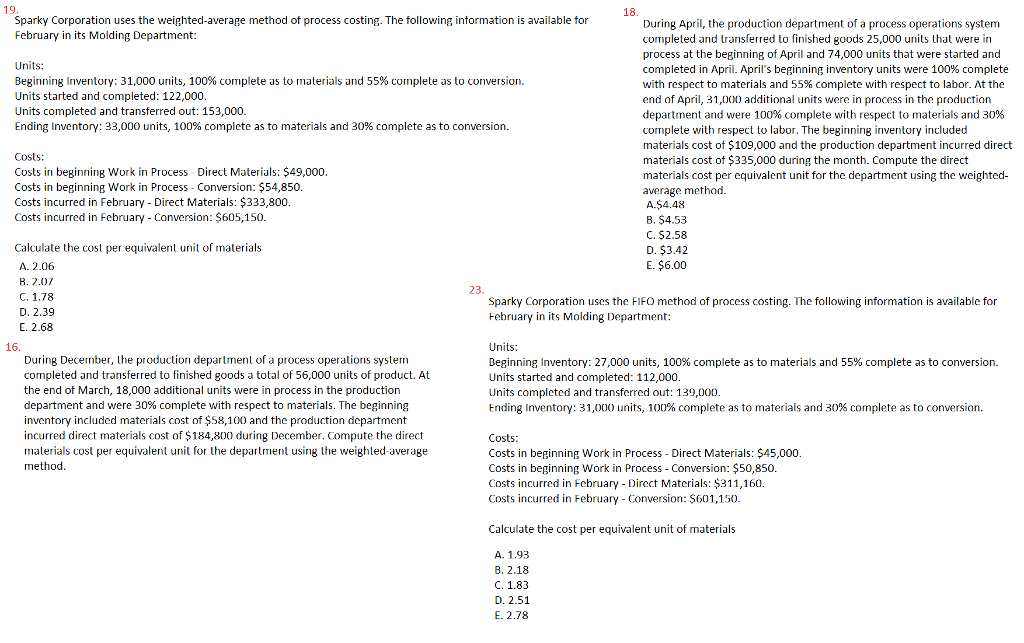

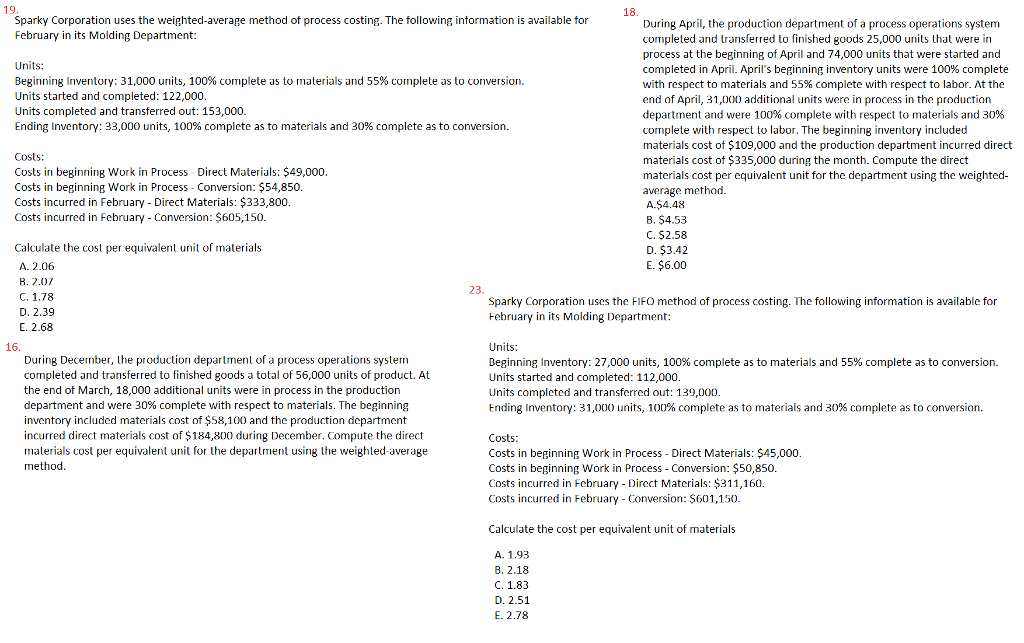

19 18 Sparky Corporation uses the weighted-average method of process costing. The following intormation is available for February in its Molding Department: During Apr, the production department of a process operations system completed and transferred to finished goods 25,000 units that were in process at the beginning of Apad 74,000 units that were started and completed in April. April's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to labor. At the end of April, 31,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to labor. The beginning inventory included materials cost of $109,000 and the production department incurred direct materials cost of $335,000 during the month. Compute the direct materials cost per equivalent unit for the department using the weighted- average method. A.$4.48 B. $4.53 C. $2.58 D. $3.42 E. $6.00 Units: Beginning inventory: 31,000 units, 100% complete as to materials and 55% complete as to conversion. Units started and completed: 122,000 Units completed and transferred out: 153,000 Ending inventory: 33,000 units, 100% complete as to materials and 30% complete as to conversion. Costs Costs in beginning Work in Process Direct Materials: $49,000 Costs in beginning Work in Process Conversion: $54,850. Costs incurred in February - Direct Materials: $333,800 Costs incurred in February - Conversion: $605,150 Calculate the cost per equivalent unit of materials A. 2.06 B. 2.07 C. 1.78 D. 2.39 E. 2.68 23 Sparky Corporation uses the FIFO method of process costing. The following information is aable for February in its Molding Department: 16 During December, the production department of a process operations system completed and transferred to finished goods a total of 56,000 units of product. At the end of March, 18,000 additional units were in process in the production department and were 30% complete with respect to materials. The beginning inventory included materials cost of $58,100 and the production department incurred direct materials cost of $184,800 during December. Compute the direct malerials cost per equivalent uni for the department using the weighted-average method. Units: Beginning inventory: 27,000 units, 100% complete as to materials and 55% complete as to conversion. Units started and completed: 112,000 Units completed and transferred out: 139,000 Ending inventory: 31,000 units, 100% complete as to materials and 30% complete as to conversion. Costs: Costs in beginning Work in Process - Direct Materials: $45,000 Costs in beginning Work in Process - Conversion: $50,850. Costs incurred in February Direct Materials: $311,160. Costs incured in February Conversion: $601,150 Calculate the cost per equivalent unit of materials A. 1.93 B, 2.18 C. 1.83 D. 2.51 E. 2.78